Verifying and Updating Loan-Level Data

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

After your monthly loan-level activity is loaded to eServicing, you must review and update, if necessary, any mortgage loan records with a status of Servicing Exception or Unreconciled. This applies whether you enter data manually, upload a file from your servicing system, or have a service bureau report on your behalf. If you check the Report to Fannie Mae box when you perform your file upload, or if a service bureau reports your data, you also need to verify that all your Fannie Mae mortgage loans have been reported. This topic includes the following sections.

- Reviewing Loan Records with Servicing Exception Status

- Reviewing Loan Records with Unreconciled Status

- Verifying that all Mortgage Loans Have Been Reported

Reviewing Loan Records with Servicing Exception Status

Servicing exceptions occur when a mortgage loan matures or is liquidated due to a payoff or foreclosure, or if any fees are due to Fannie Mae or another investor. Follow the steps below to identify loan records with a status of Servicing Exception.

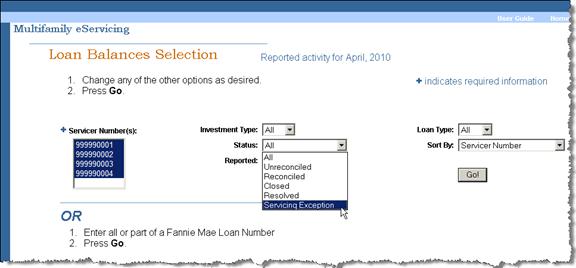

- Select Manage under the Loan Balances heading on the Investor Reporting Menu.

The Loan Balances Selection screen appears.

- Select the servicer number(s) you want to review. To select more than one number, hold down the Ctrl key while you make your selections.

-

From the Status drop-down box, select Servicing Exception.

Note: You can limit your search to a segment of your portfolio (for example, MBS) by selecting the applicable filters from the drop-down boxes for Investment Type and Loan Type. Otherwise, leave the filters set to the default value – All.

- Select a sort criteria, if desired.

- Click Go.

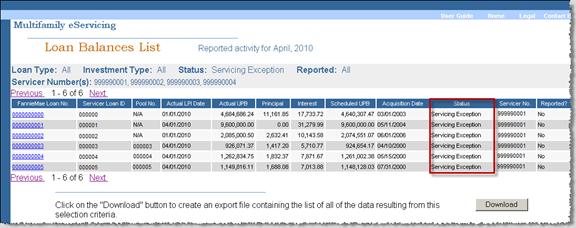

The Loan Balances List appears. It displays only loan records with a status of Servicing Exception.

-

Click the Fannie Mae Loan No. link for the loan record you want to review.

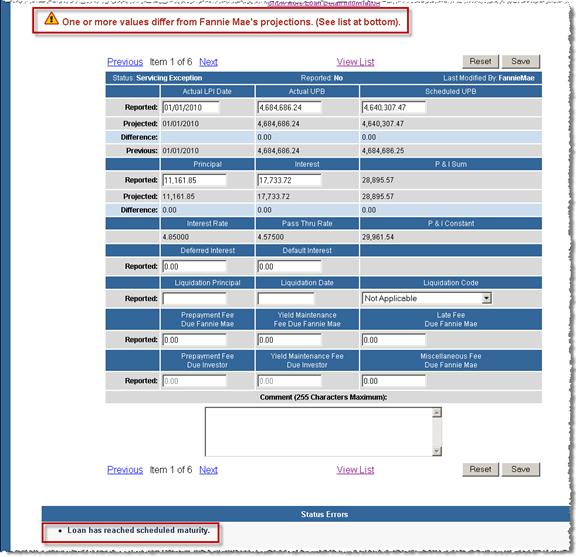

The Loan Balance Detail screen appears.

-

Review the Status Error message(s) listed at the bottom of the screen and verify the following.

Maturing Loans

- The borrower paid off the loan as scheduled and you have reported the payoff.

- The borrower did not pay off the loan (maturity default). Make sure that you have notified the appropriate parties and taken the required action. Include a comment in the Comment box. Be aware that the Comment box does not automatically notify the analyst.

Payoffs

- All loans reported as paid-off have been paid in full.

- All payoffs have been reported.

- Any yield maintenance or prepayment premiums, and any applicable fees have been reported.

Mortgage Loans with Reported Fees

- Any amounts reported as deferred interest, default interest, late or miscellaneous fees are accurate.

-

Update the data, if necessary. (See Understanding the Loan Balance Detail Screen for a description of each field.)

If you believe that your data is correct, do not change it. Your Fannie Mae servicing analyst also reviews the data and may contact you if further information is needed. It is helpful to the analyst if you include a message in the Comment box stating why you believe your data is correct.

Note: Clicking the Reset button returns all data to previously saved values.

-

Click Save.

eServicing tests your data to validate that it is in the correct format and that all the required fields are complete. If the validation test returns any errors, an error message appears at the top of the Loan Balance Detail screen indicating that your data changes cannot be saved until the error is corrected. A more specific error message describing the required change appears below each data field that has an error.

- Correct validation errors, if any, and click Save again.

When validation is successful, you see a message indicating that your data has been saved.

Note: Depending on the changes you make, the status of the loan record may change to Reconciled or Unreconciled. You may continue to see Status Error messages. Review the messages one last time to be sure that you have addressed each one.

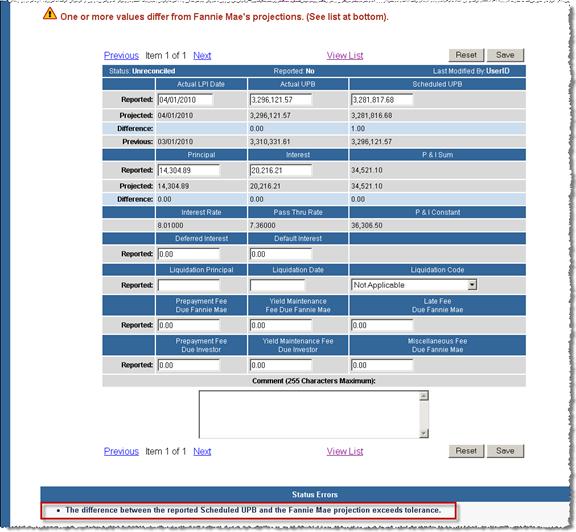

Reviewing Loan Records with Unreconciled Status

You see a status of Unreconciled if the data you entered or uploaded does not match Fannie Mae projections. Follow the steps below to identify and review loan records with a status of Unreconciled.

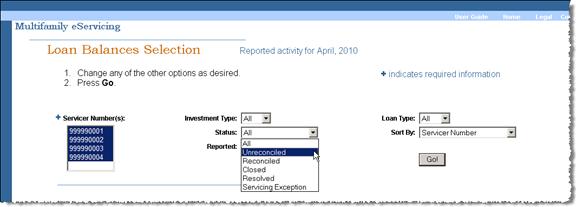

- Select Manage under the Loan Balances heading on the Investor Reporting Menu.

The Loan Balances Selection screen appears.

- Select the servicer number(s) you want to review. To select more than one number, hold down the Ctrl key while you make your selections.

- From the Status drop-down box, select Unreconciled.

Note: You can limit your search to a segment of your portfolio (for example, MBS) by selecting the applicable filters from the drop-down boxes for Investment Type and Loan Type. Otherwise, leave the filters set to the default value – All.

- Select a sort criteria, if desired.

- Click Go.

The Loan Balances List appears. It displays only loan records with a status of Unreconciled.

-

Click the Fannie Mae Loan No. link for the loan record you want to review.

The Loan Balance Detail screen appears.

- Review the Status Error message(s) listed at the bottom of the screen.

- Correct data errors, if any. (See Understanding the Loan Balance Detail Screen for a description of each field.)

If you believe that your data is correct, do not change it. Your Fannie Mae servicing analyst also reviews the data and may contact you if further information is needed. It is helpful to the analyst if you include a message in the Comment box stating why you believe your data is correct. Be aware that the Comment box does not automatically notify the analyst.

Note: Clicking the Reset button returns all data to previously saved values.

-

Click Save.

eServicing tests your data to validate that it is in the correct format and that all the required fields are complete. If the validation test returns any errors, an error message appears at the top of the Loan Balance Detail screen indicating that your data changes cannot be saved until the error is corrected. A more specific error message describing the required change appears below each data field that has an error.

- Correct validation errors, if any, and click Save again.

When validation is successful, you see a message indicating that your data has been saved.

Note: Depending on the changes you make, the status of the loan record may change. You may continue to see Status Error messages. Review the messages one last time to be sure that you have addressed each one.

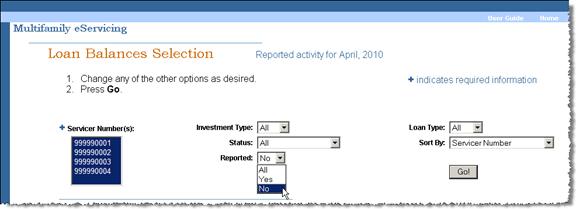

Verifying that all Mortgage Loans Have Been Reported

If you report with a file upload or if a service bureau reports on your behalf, your loan-level activity report may not pick up activity for one or more mortgage loans. This may occur, for example, if you deliver a newly originated mortgage loan to Fannie Mae and it is not added to your servicing system in time for the reporting period. Follow the steps below to identify any mortgage loans that were not reported.

- Select Manage under the Loan Balances heading on the Investor Reporting Menu.

The Loan Balances Selection screen appears.

- Select the servicer number(s) you want to review. To select more than one number, hold down the Ctrl key while you make your selections.

- From the Reported drop-down box, select No.

Note: You can limit your search to a segment of your portfolio (for example, MBS) by selecting the applicable filters from the drop-down boxes for Investment Type and/or Loan Type. Otherwise, leave the filters set to the default value – All.

- Select a sort criteria, if desired.

- Click Go.

The Loan Balances List appears. It displays only loan records that have not yet been reported.

- Click the Fannie Mae Loan No. link for the loan record you want to review.

The Loan Balance Detail screen appears.

- Review the Fannie Mae projected data for accuracy.

- Edit the data, if required, and click Save.

- Report your data manually following the step-by-step instructions in Reporting Loan-Level Activity.

Note: After you update any mortgage loans that are unreported, make sure you save your data and check for any mortgage loans with a status of Servicing Exception or Unreconciled and update the data, as needed.

Once you are satisfied that the data is accurate, report your loan-level data if you have not already done so. See Reporting Loan-Level Activity for step-by-step instructions. If you have already reported loan-level data for a mortgage loan, you do not need to report it again. When you click Save, eServicing reports your loan-level changes for you.

© 2010 Fannie Mae. Trademarks of Fannie Mae.