Reporting Loan-Level Activity

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

You must report loan-level activity by 5:00 p.m., eastern time on the second business day of the month. You have four options for reporting monthly loan-level activity, as described below.

- With a file upload

You upload your loan-level activity using eServicing’s file upload function and select the option that allows you to report your loan-level activity at the same time. In most cases, this is your most efficient option. - After a file upload

You upload your loan-level activity using eServicing’s file upload function and report manually after you have had the opportunity to review your uploaded data. - By service bureau

A service bureau reports loan-level activity on your behalf. If so, we process the data as soon as we receive it. You still need to check for any mortgage loans that may not have been reported, or that have a status of Unreconciled or Servicing Exception. - Manually

You report loan-level activity manually, usually in the following cases: you service only a few mortgage loans for Fannie Mae and enter any updates manually, or you reported loan-level activity using one of the other methods, but later discovered that one or more mortgage loans went unreported.

If you report after a file upload or manually, follow the steps below.

Note: If you report with a file upload, see Uploading a Loan-Level Data File to eServicing and Verifying and Updating Loan-Level Data for step-by-step instructions. If a service bureau reports for you, see Verifying and Updating Loan-Level Data for step-by-step instructions.

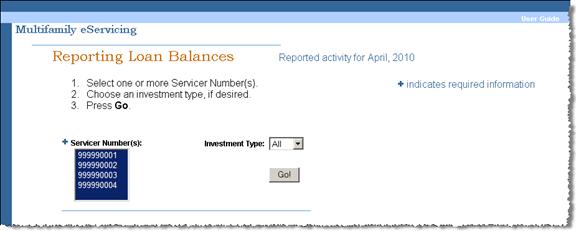

- Select Reporting under the Loan Balances heading on the Investor Reporting Menu.

The first Reporting Loan Balances screen appears.

-

Select the Servicer Number(s) for the loan data you want to view. To select more than one servicer number, hold down the Ctrl key while you make your selection.

Note: You can view data at one time for as many servicer numbers as you want. You also can report for multiple servicer numbers at the same time, but the first five digits of the servicer number must be the same.

- Select the Investment Type (All, Cash, MBS), if desired.

- Click Go.

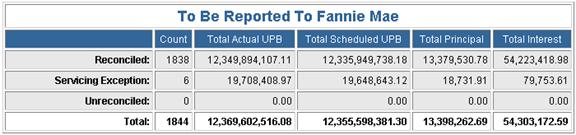

A more detailed Reporting Loan Balances screen appears. The screen displays loan reporting information in the following three tables.

To Be Reported to Fannie Mae

The To Be Reported to Fannie Mae table summarizes your workspace by reporting status, and displays loan count, total UPB, total principal and total interest for data not yet reported to Fannie Mae.

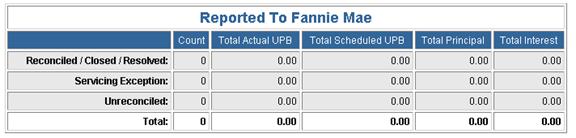

Reported to Fannie Mae

The Reported to Fannie Mae table displays similar data that has already been reported to Fannie Mae.

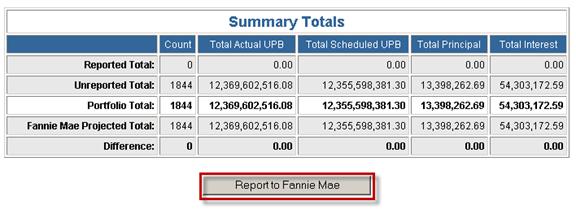

Summary Totals

The Summary Totals table displays any differences between the data you entered or uploaded, whether reported or unreported, and Fannie Mae projected data.

- Click Report to Fannie Mae at the bottom of the screen to report the selected portfolio information.

You see the following message: “You are about to report the listed loan balances to Fannie Mae. Click OK to Continue.”

- Click OK if you are ready to report.

You see the following message: “You have successfully reported to Fannie Mae.”

Note: Click Cancel if you need to make additional changes.

© 2010 Fannie Mae. Trademarks of Fannie Mae.