Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

eServicing populates projected interest rate and payment changes for adjustable-rate mortgage loans the business day after the mortgage loan’s rate review date, also called the lookback date. Before an ARM reaches the effective date for an interest rate/payment change, you must review, update, if necessary, and report data related to the pending change.

Follow the steps below to review, update, and report data on your ARM interest rate/payment changes.

-

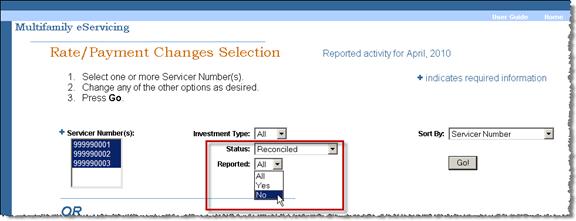

Select Manage under the Rate/Payment Changes heading on the Investor Reporting Menu.

The Rate/Payment Changes Selection screen appears.

-

Select one or more servicer numbers.

-

From the Status drop-down box, select Reconciled.

-

From the Reported drop-down box select No.

-

Click Go.

The Rate/Payment Changes List appears. It will display only those mortgage loans with interest rate and/or payment changes that you have not yet reported.

-

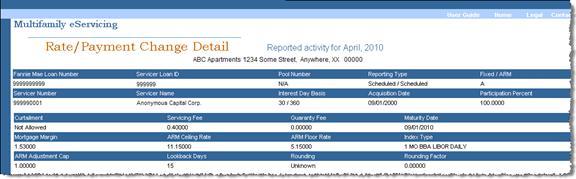

Click the Fannie Mae Loan No. link for the loan record you want to review and/or update.

The Rate/Payment Change Detail screen appears. It summarizes rate and payment information in table format. Take note of the following major sections.

Identifying Information

At the top of the screen you see general identifying information including the property name and address, Fannie Mae loan number, your own servicer loan ID, and the pool number, if applicable. To see more detail about the mortgage loan, including ARM characteristics, click the Show More Loan Detail Information, as we have done below.

Tracking Information

The top line of the table tracks the data’s position in the reporting cycle.- Status: Your data status may appear as Reconciled, Unreconciled, Servicing Exception, Resolved, or Closed. Initially, the status appears as Reconciled because all data reflects Fannie Mae projections. If you enter and save any changes, the status may change to Unreconciled or Servicing Exception.

- Reported: This field displays as No until you report your data to Fannie Mae.

- Last Modified By: Initially, this field displays as Fannie Mae, because the data is projected by Fannie Mae. After you enter and save any changes, your user ID appears.

Interest Rate, Pass Thru Rate, Index Value, Payment

The business day following the interest rate review date, Fannie Mae populates the interest rate, pass-through rate, index value, and payment. The fields in the row labeled Reported default to Fannie Mae projections. If you disagree with Fannie Mae projections, you can key in the correct data.Rate Review Date, Rate Effective Date, Payment Effective Date

Below the rate and payment information, you see the relevant dates for both the upcoming and previous rate and payment changes.Other Amounts

The remaining editable fields apply if the mortgage loan has been modified to extend the term or if the borrower chooses to exercise an option to convert the mortgage loan to a fixed rate.

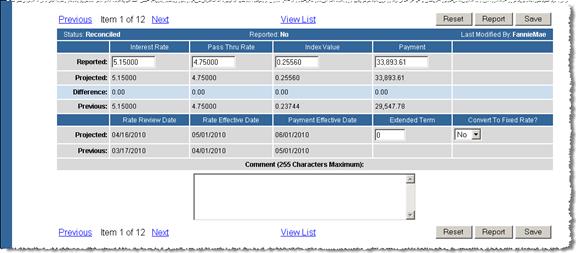

- Review Fannie Mae projected data.

- Update any data that you believe to be incorrect.

If there are differences between your reported data and Fannie Mae projected data, it is helpful to your Fannie Mae servicing analyst if you include a message in the Comment box stating why you believe your data is correct. Be aware that the Comment box does not automatically notify the analyst.

Note: Click the Reset button if you want to return all data to previously saved values.

-

Complete the Extended Term and Convert to Fixed Rate fields only if you have extended the term of the ARM or if you have converted an ARM to a fixed-rate mortgage loan. If you complete these fields, include a message in the Comment box stating why you believe your data is correct or contact your Fannie Mae servicing analyst directly.

-

Click Save.

Caution: You must save any changes you make before reporting them to Fannie Mae.

eServicing tests your data to validate that it is in the correct format and that all the required fields are complete. If the validation test returns any errors, an error message appears at the top of the Rate/Payment Change Detail screen indicating that your data changes cannot be saved until the error is corrected. A more specific error message describing the required change appears below each data field with an error.

-

Correct validation errors, if any, and click Save again.

When validation is successful and your data is saved, you see the following message: “Your changes were saved successfully.”

eServicing then performs a reconciliation test. The status changes to Unreconciled if you entered data that differs from Fannie Mae projections. The status changes to Servicing Exception if you entered data in the Extended Term or Convert to Fixed Rate fields.

In either case, you see a message advising you that one or more values differ from Fannie Mae projections and referring you to a list of Status Error messages at the bottom of the screen for more specifics.

-

Review Status Error messages, if any, and double check your data to make sure it is correct.

-

Correct errors, if any.

Note: If you believe your data is correct, do not change it. Your Fannie Mae servicing analyst also reviews the data and may contact you if further information is needed.

-

If you changed any data, click Save.

-

Once you are sure your data is correct, click Report.

The Reported indicator changes to Yes and you see the following message: “You have successfully reported.” Your user ID appears in the Last Modified By field.

If you have any unreconciled data, you may see a status of Resolved, which means that the Fannie Mae servicing analyst has accepted the values you reported, although your values differ from ours. The status will change to Closed the next business day.

Note: You can only report ARM rate and payment changes at the loan level. Be sure to report your data as soon as you complete your work on each loan record, so that you do not need to return to it a second time. You can update data multiple times up to and including the Rate Effective Date, as long as Fannie Mae has not yet accepted your data and changed the status to Closed. Once you report ARM interest rate/payment changes to Fannie Mae, eServicing captures subsequent changes as long as you click Save.You do not need to report again. After the Rate Effective Date, you need to contact your Fannie Mae servicing analyst if you discover a discrepancy.

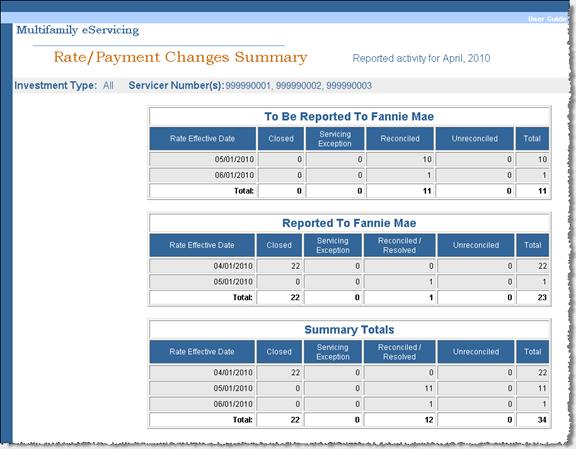

Reviewing the Rate/Payment Changes Summary

The Rate/Payment Changes Summary is a helpful tool for tracking your ARM reporting process. Although the frequency of your review will depend on the interest rate change schedule for your ARM portfolio, you should plan to review the Summary periodically to see if you have pending interest rate/payment changes to report.

-

Click Summary under the Rate/Payment Changes heading on the Investor Reporting Menu.

The Rate/Payment Changes Summary screen appears. For each rate effective date, the Summary displays the number of ARMs that have yet to be reported to Fannie Mae, those that have been reported, and summary totals. The report also identifies the number of ARMs with a reporting status of Closed, Servicing Exception, Reconciled/Resolved, and Unreconciled.

-

If items appear in the To Be Reported To Fannie Mae table, initiate the review and reporting process described earlier.

© 2010 Fannie Mae. Trademarks of Fannie Mae.