Certifying Pool-to-Security Differences

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

When the security balance differs from the sum of the scheduled balances for all the mortgage loans in a pool, you use eServicing to identify and certify the reason for the difference. Fannie Mae calculates monthly pool-to-security differences after MBS activity and loan balance reporting are complete and makes the data available on eServicing after the 20th of the month. Follow the steps below to complete your certification, which is due by the end of the month.

-

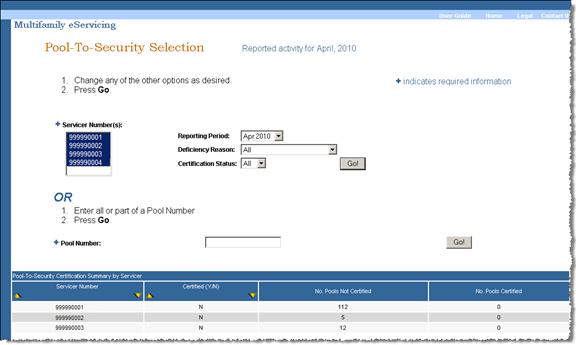

From the Investor Reporting Menu, select Pool-To-Security Reconciliation under the Mortgage Backed Securities (MBS) heading.

The Pool-to-Security Selection screen appears.

Note: Use the Pool-to-Security Certification Summary by Servicer, located at the bottom of the screen to track your progress. The summary may be blank if you do not have any differences to certify.

-

Select the servicer number(s) you want to certify. To select more than one number, hold down the Ctrl key while you make your selections.

-

Select a reporting period from the drop-down box. If you do not make a selection, eServicing defaults to the latest month available.

-

If you want to further limit your search, select a deficiency reason and/or a certification status from the drop-down boxes. The following options are available.

Deficiency Reason

- All

- None

- Rounding Assumed

- Security Balance Correct

- Security Balance Too High

- Security Balance Too Low

Certification Status

- All

- Yes

- No

-

Click Go.

Note: If you wish to research only a specific pool number, enter the number in the Pool Number field and then click Go.

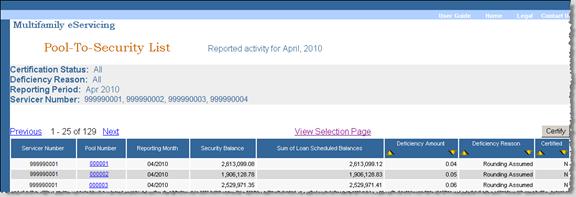

The Pool-to-Security List screen appears.

The list displays the Security Balance, the Sum of Loan Scheduled Balances, the Deficiency Amount, and the certification status for pools matching the criteria you selected. eServicing also populates the Deficiency Reason, if it is Rounding Assumed.

-

Click the Pool Number link to each pool with a deficiency.

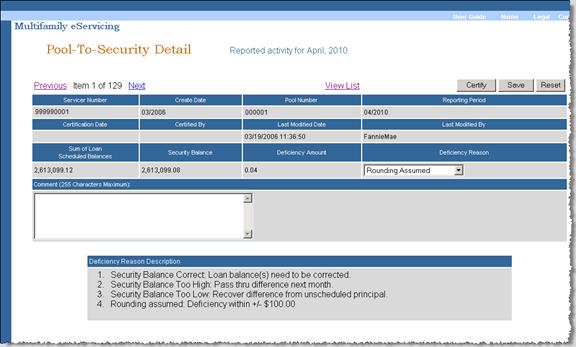

The Pool-to-Security Detail screen appears.

-

Select the deficiency reason from the drop-down box.

Select If Security Balance Correct The loan balance(s) needs to be corrected. Report the correct mortgage loan balance the next time you report your loan-level activity to Fannie Mae. Make sure your servicing system also reflects the correct mortgage loan balance.

Security Balance Too High The security balance is higher than the sum of the scheduled balances for the mortgage loans in the pool. Example: After rolling up your loan-level data to the pool level, you entered a payoff or a principal curtailment at the loan-level. You did not perform a new rollup and the curtailment was not reflected in the security balance.

Pass through the difference in pool principal next month.

Caution: Keep in mind that the interest due is based on the beginning security balance and not the sum of the beginning mortgage loan balances. Failure to reduce a security balance timely, could result in additional interest due in subsequent months that you may not collect from the borrower.

Security Balance Too Low The security balance is lower than the sum of the scheduled balances for the mortgage loans in the pool. Example: A loan was scheduled to pay off at month end and you reported the anticipated payoff as unscheduled principal. The borrower failed to pay off the mortgage loan as expected.

Recover difference from unscheduled principal for the pool.

Caution: It is very important to verify that a payoff has actually occurred before you report it. Once you report unscheduled principal, you cannot recover the funds except from unscheduled principal you later collect on mortgage loans in the same pool.

Rounding Assumed The deficiency is within /- $100. Fannie Mae defaults to Rounding Assumed if the deficiency is within $100. Usually, no action is required unless you determine that the discrepancy is the result of an error, in which case you can change the deficiency reason in eServicing and take the appropriate action, as described above.

-

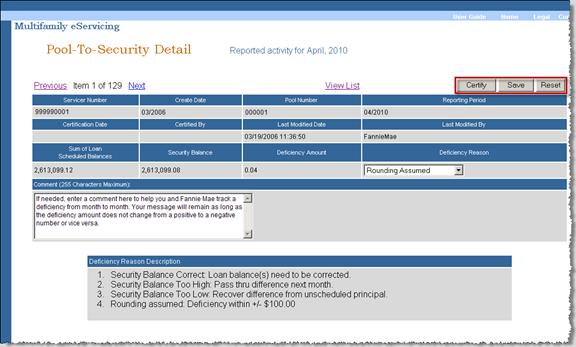

If applicable, enter additional information in the Comment box to help you and Fannie Mae track this deficiency through successive months.

-

Click Save.

You see the following message: “Your changes were saved successfully.”

-

Click the Certify button.

You see the following message: “Deficiency has been certified.”

Note: You also can certify the entire servicer number from the Pool-to-Security List screen after you enter the Deficiency Reason for each of the pools listed on the screen.

Viewing Fannie Mae Data by Servicer Number

Before the end of the month, you should verify that you have certified all your pools.

- From the Investor Reporting Menu, select Pool-to Security Reconciliation under the Mortgage Backed Securities (MBS) heading.

The Pool-to-Security Selection screen appears.

- Select all servicer numbers for which you are responsible. To select more than one number, hold down the Ctrl key while you make your selections.

-

Select No as the Certification Status.

-

Click Go.

The Pool-to-Security List appears. It displays only those pools that you have not yet certified.

© 2010 Fannie Mae. Trademarks of Fannie Mae.