Rolling Up Loan-Level Data and Reporting MBS Activity

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

If you service Fannie Mae Multifamily Mortgage-Backed Securities (MBS), you must roll up your loan-level activity to the pool level and report your MBS activity by the close of business the second business day of each month. This topic includes the following sections.

- Performing a Rollup for One or More Servicer Numbers

- Verifying and/or Updating ARM MBS Pool Pass-Through Rates

- Reporting MBS Activity

- Updating Data after MBS Reporting

Pre-condition: You must have reported your loan-level activity and resolved any data discrepancies before you begin this process. Then follow this sequence for your monthly MBS activity reporting:

- Roll up loan-level activity for all pools under the servicer number(s) for which you are responsible.

- Review the pool-level data for each nine-digit servicer number for accuracy, paying particular attention to pools that generate error status messages.

- If you discover that an error was caused by a discrepancy at the loan-level, correct the loan-level data first and perform a second rollup for only the affected pools.

- Correct errors that occurred at the pool level, if needed.

- If you service adjustable-rate mortgage (ARM) MBS, verify and update, if necessary, the pool pass-through rate.

- Report your pool-level data at the servicer number level.

- Conduct a final review of any pools that generate an error message.

Performing a Rollup for One or More Servicer Numbers

Follow these steps to roll up your loan-level data to the pool level.

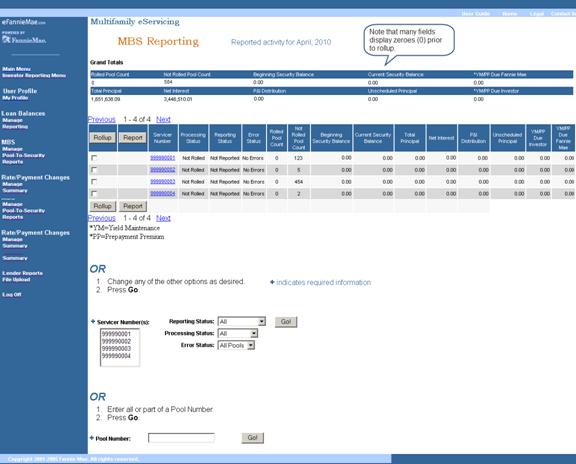

- Select Manage under the Mortgage Backed Securities (MBS) heading on the Investor Reporting Menu.

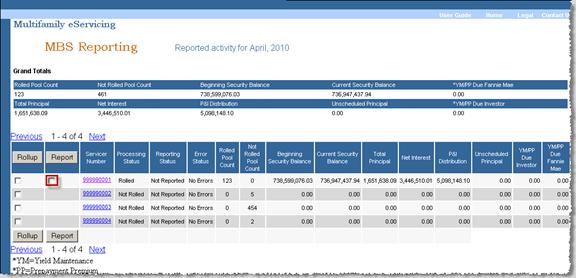

The MBS Reporting screen appears.

The screen includes the following sections.

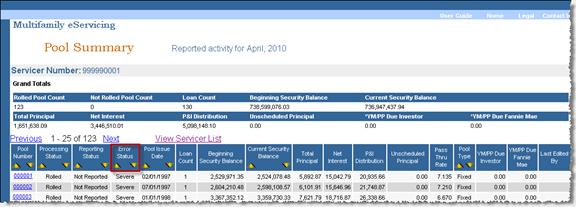

Grand Totals

The top section summarizes your monthly MBS activity and tells you how many pools have been rolled up.Rollup and Report Table

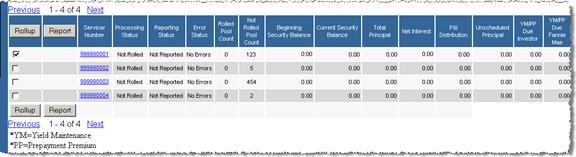

The Rollup and Report table displays data by servicer number. In later steps, we explain how you use this table to rollup and report your data. Take note of the columns labeled Processing Status, Reporting Status, and Error Status. The information in these columns will be helpful in tracking the progress of your pools as you move through the reporting process. You may see the following values.Processing Status Not Rolled This is the initial state. Your MBS pool data has not been rolled up from the loan level. Rolled The MBS pool data has been rolled up from the loan level. Edited Some values have been modified at the MBS pool level. Caution: If you change data at the pool level and later change data at the loan level, your loan-level changes will not be reflected in the reported MBS pool-level fields, even if you perform another rollup. You would need to correct both the loan-level and the pool-level data manually.

Various Different MBS pools under this servicer number have different processing statuses. Reporting Status Not Reported Your MBS activity has not yet been reported to Fannie Mae, although your loan-level activity may have been. Or, you may have made changes to a previously reported pool. If so, you will need to report the pool again. Reported Your MBS activity has been reported. Various At least one pool under this servicer number has not been reported. Error Status No Errors If you see this status after you perform your rollup, eServicing did not detect any errors, but you must still review your data to ensure its accuracy before reporting to Fannie Mae. Warning Review the pool data before reporting. Warnings often appear when a pool pays off or if there is a significant reduction in the security balance. Severe Review the pool data for accuracy and make any necessary corrections. Fatal You must resolve the error before reporting. If you believe your data is correct, contact your Fannie Mae servicing analyst for assistance. Caution: If you discover that an error was caused by a discrepancy at the loan-level, correct the loan-level data first and perform a second rollup for only the affected pools.

Search functions

Search functions located at the bottom of the screen allow you to search for pools by reporting, processing, or error status or by a specific pool number. We explain more about using this function to research and resolve errors in the section titled Updating Data after MBS Reporting. - Beginning on the 25th of the month, a checkbox appears in the Rollup column next to each servicer number. Click the Rollup checkbox next to the servicer number(s) that you want to roll up. To deselect a box, click it a second time.

- Click Rollup at the top or bottom of the table to roll up your loan-level data to the pool level.

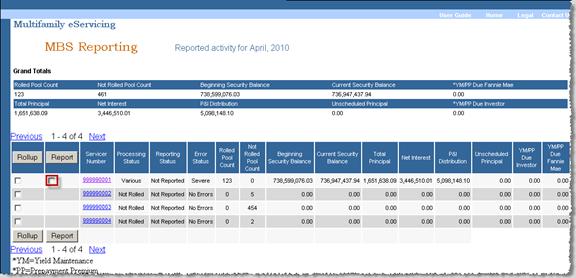

When your rollup is complete, you see the message: “You have successfully performed a loan-level rollup.” An empty check box appears under the Report column for each servicer number you rolled up. The Processing Status changes from Not Rolled to Rolled. The Error Status changes only if there are errors.

- Review the pool-level data for each servicer number that you rolled up. Begin by clicking the nine-digit Servicer Number link for the data that you want to review.

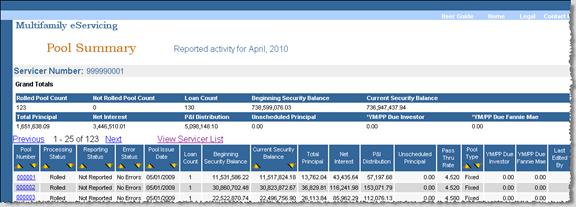

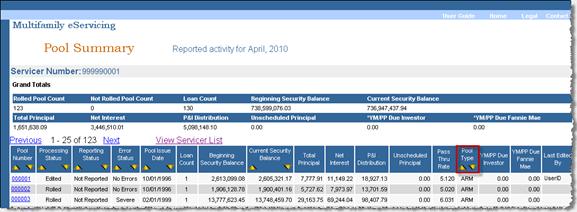

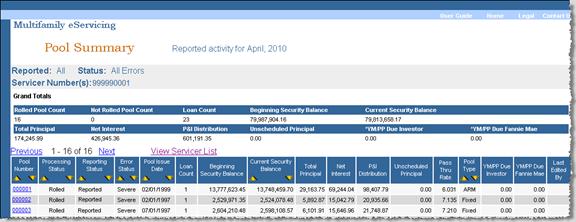

The Pool Summary screen appears.

- Under Grand Totals, review the following totals to make sure they agree with your own servicing data.

- Current Security Balance

- Total Principal

- Net Interest

- Unscheduled Principal

- YM/PP (yield maintenance/prepayment premium) Due Investor

- YM/PP Due Fannie Mae

Note: You can download the data on the Pool Summary screen for ease in comparison with your own data.

- Sort your data by Error Status by clicking the arrows in the Error Status column.

- Click the Pool Number link for any pool that disagrees with your own servicing data or that has an Error Status of Fatal, Severe, or Warning. You should address fatal errors first, then severe, then warnings, and finally review any pools that do not have errors.

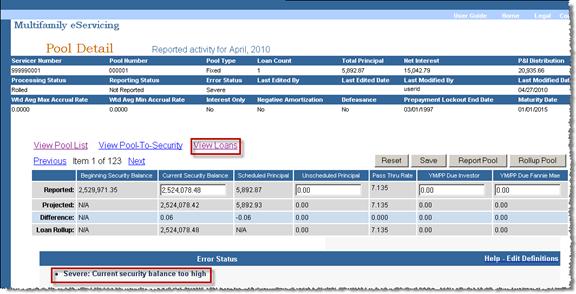

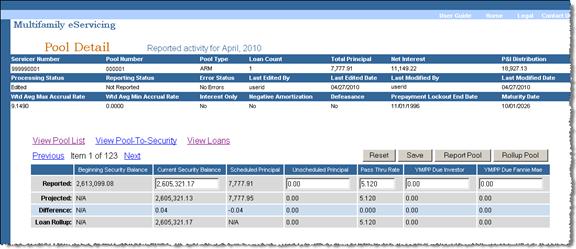

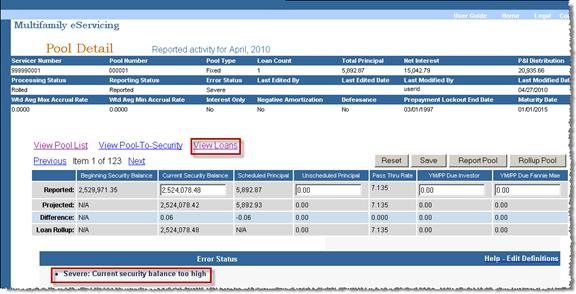

The Pool Detail screen appears. It displays the following information:

- A table showing your reported values, Fannie Mae’s projected values and any differences between the two

- An Error Status section with more specific information about the error(s), if applicable.

- Check the data for accuracy.

- If you think that the error is related to loan-level data, click the View Loans link.

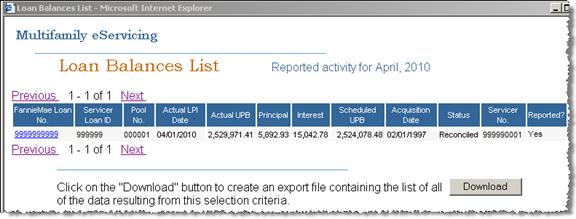

The Loan Balances List appears.

- Click the Fannie Mae Loan No. link for each mortgage loan you want to review.

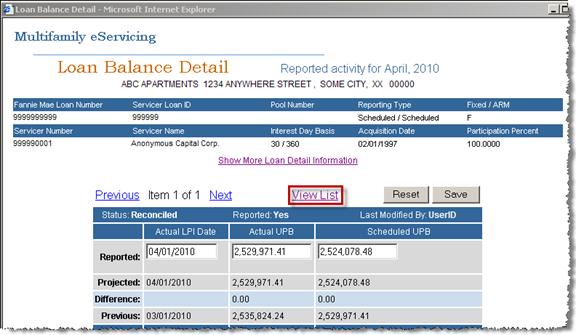

The Loan Balance Detail screen appears.

- Review the data on the Loan Balance Detail screen.

- Update the data, if necessary.

- Click Save.

- If there are other loans in the pool, click View List to return to the Loan Balances List to check, and correct if necessary, data for any other mortgage loans in the pool.

- When you have completed your review and saved any corrections at the loan-level, return to the Pool Detail screen, which remains open in the background.

Caution: Except in rare circumstances, you should edit your data at the loan level and then roll up the data to the pool level. If you change any data on the Pool Detail screen, any subsequent changes to the loan-level data will not be reflected in the reported MBS pool-level fields, even if you perform another rollup.

- Click Rollup Pool to capture any changes you made at the loan level.

You see the message: “You have successfully performed a loan-level rollup.”

- Click View Pool List to return to the Pool Summary screen. Or, click Next or Previous to move among pools.

Repeat Steps 7 through 17 to research and correct, if necessary, any other data discrepancies under the servicer number you are reviewing. Pay particular attention to pools with an Error Status of Fatal, Severe, or Warning.

- If you service ARM MBS under the servicer number you are reviewing, you should next verify and, if necessary, update your pool pass-through rates as described in the section below.

If you do not service ARM MBS, click View Servicer List to return to the MBS Reporting screen. Skip to the Reporting MBS Activity section for next steps.

Verifying and/or Updating ARM MBS Pool Pass-Through Rates

- On the Pool Summary screen, click the Down Arrow under the Pool Type column heading to sort the pool list by pool type: ARM or Fixed.

ARM pools, if any, now appear at the top of the pool list.

Note: Click the Up Arrow if you want to restore Fixed Rate mortgage loans to the top of the list.

- Verify that the values displayed under the pool Pass Thru Rate agree with your servicing records.

- Click the Pool Number link for each pool that has an incorrect pass-through rate.

The Pool Detail screen appears.

- Update the value in the Pass Thru Rate field.

- Click Save.

You see the message: “Your changes were saved successfully.”

Caution: If you change the pass-through rate on the Pool Detail screen, any subsequent changes to the loan-level data will not be reflected in the reported MBS pool-level fields, even if you perform another rollup. You should perform this step after you have verified all other loan- and pool-level data and are ready to report MBS activity.

-

Click View Pool List to return to the Pool Summary screen.

Repeat Steps 3 through 6 to update the pass-through rates for any other pools that have incorrect pass-through rates.

- When you are finished updating your pool pass-through rates, click View Servicer List to return to the MBS Reporting screen.

Reporting MBS Activity

When you are sure that your data is accurate, you are ready to report your MBS activity.

- On the MBS Reporting screen, click the Report box next to the servicer number(s) that you want to report.

- Click Report at the top or bottom of the Report column.

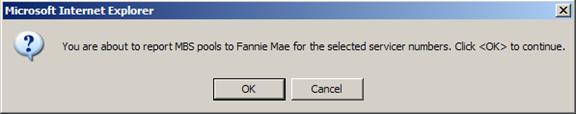

eServicing displays a dialog box asking you to confirm that you are ready to report your MBS pools.

- Click OK if you are ready to report. Click Cancel if you need to make additional changes.

If you click OK, the MBS Reporting Screen displays the message: “You have successfully reported.”

Note: Sometime between your initial reporting and the second business day of the month, you should return to the MBS Reporting Screen to make sure that there are no remaining issues and that you have captured and reported any intervening activity. For example, you may not have captured a loan that paid off. Make sure that all your pools have a status of reported.

Updating Data after MBS Reporting

You may need to update pool-level data after reporting. Follow the steps below to research and resolve remaining MBS reporting issues.

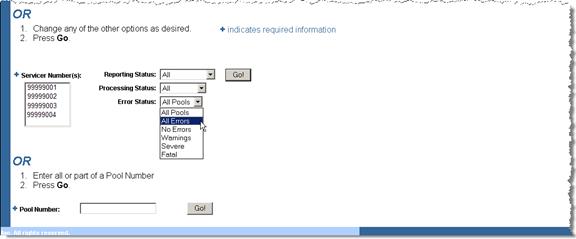

- Beginning on the MBS Reporting screen, select one or more servicer numbers from the Servicer Number(s) box that appears below the table.

- From the Error Status drop-down box, select the type of error you want to research as shown in the following screen shot and click Go.

Note: If you identify an issue with a specific pool, you can enter its number in the Pool Number field and click Go to access the data for just that pool.

The Pool Summary screen appears.

- For each pool that you need update, click the Pool Number link.

The Pool Detail screen appears.

Note: Click Help - Edit Definitions on the Pool Error Status bar to view a complete list of error messages, their definitions, and troubleshooting. You can also view the List of MBS Edits.

If you had a pool-to-security reconciliation difference in the prior month, click the View Pool-to-Security link to review the previous difference and any comments you may have entered. This information may help you resolve issues with the current month’s reporting.

- Click the View Loans link.

A list of all loans in the pool appears.

- Click the Fannie Mae Loan No. link to access the record for the mortgage loan that you want to review and/or update.

The Loan Balance Detail screen appears.

- Review the data on the Loan Balance Detail screen.

- Update the data, if necessary.

- Click Save.

- Return to the Pool Detail screen, which remains open in the background while you are viewing and/or updating your loan-level activity data.

Caution: Except in rare circumstances, you should edit your data at the loan level and then roll up the data to the pool level. If you change any data on the Pool Detail screen, any subsequent changes to the loan-level data will not be reflected in the reported MBS pool-level fields, even if you perform another rollup.

-

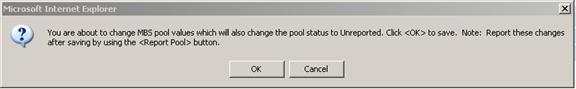

Click Rollup Pool.

eServicing displays a dialog box advising you that you are about to make changes that will change your pool status to Unreported.

-

Click OK if you are sure your data is correct. Click Cancel if you want to stop and verify your data.

If you click OK, eServicing displays the message: “You have successfully performed a loan-level rollup.”

-

Click Report Pool.

eServicing displays the message: “You have successfully reported.”

Remember if you make any changes to a reported pool, or if you roll up data from the loan-level after you report pool-level data, you need to report the pool again or your changes will not be reported to Fannie Mae.

-

Click Manage under the MBS heading on the left navigation bar to return to the MBS Reporting screen.

-

Verify that the Reporting Status is Reported.

© 2010 Fannie Mae. Trademarks of Fannie Mae.