Understanding the Loan Balance Detail Screen

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

You use the Loan Balance Detail screen to review and update monthly loan-level activity data for specific mortgage loans, regardless of your reporting method. This topic includes the following sections.

Note: The data you see and your ability to change it depend on where you are in the monthly reporting cycle. You cannot update loan-level activity between the 16th and 24th calendar days of the month or if the status is Closed.

Accessing the Loan Balance Detail Screen

Follow the steps below to access your data.

-

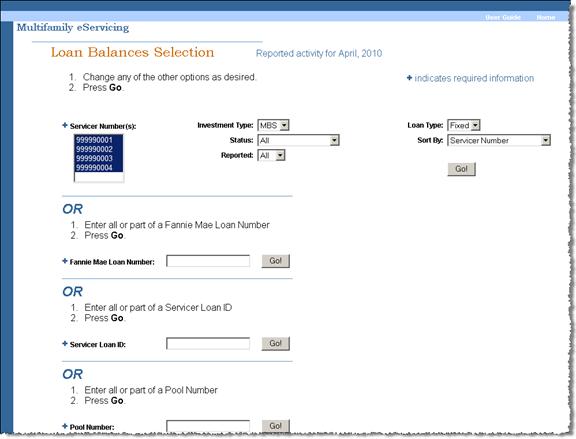

Select Manage under the Loan Balances heading on the Investor Reporting Menu.

The Loan Balances Selection screen appears.

-

Enter your search criteria and click Go.

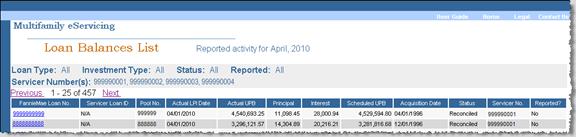

The Loan Balances List appears.

-

Click the Fannie Mae Loan No. link for the loan record you want to review and/or update.

The Loan Balance Detail screen appears.

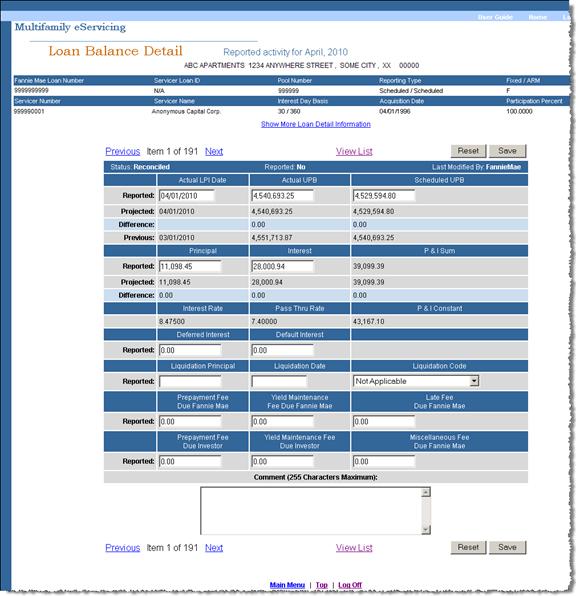

Understanding the Loan Balance Detail Screen

The Loan Balance Detail screen features three major elements.

- Identifying information for the mortgage loan

- A data table

- A Comment box

Identifying Information

The data at the top of the screen identifies the mortgage loan by property name and address, Fannie Mae loan number, your own servicer loan ID, and pool number, if applicable. It also provides some basic information about the mortgage loan.

Show More Loan Detail Information allows you to view curtailment eligibility, servicing and guaranty fees, maturity date, and ARM characteristics, if applicable.

Data Table

Further down the screen you see a data table that features three types of information: tracking information, monthly loan-level activity, and servicing exception activity, plus a Comment box.

Following is a description of each data type.

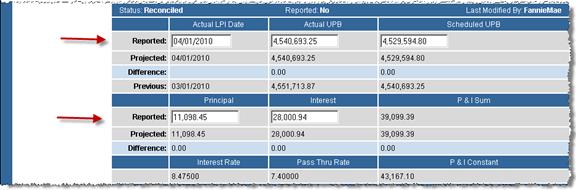

Tracking Information

The top line of the table tracks the mortgage loan’s position in the monthly reporting cycle.

- Status: Is the data Unreconciled, Reconciled, Closed, Resolved, or Servicing Exception?

- Reported: Has the data been reported to Fannie Mae?

- Last Modified By: Was the data populated by Fannie Mae, via file Upload, or by someone within your organization (indicated by a user ID)?

Monthly Loan-Level Activity

The next several rows track monthly payment activity. At the beginning of each reporting period, the fields in the rows labeled Reported default to Fannie Mae projections. You can overwrite our projections in either of two ways.

- File upload – if any data in your upload file differs from Fannie Mae projections, the reported values change to the values in your file.

- Data entry – if you disagree with Fannie Mae projections, you can key in the correct data.

Fannie Mae projections continue to display in the rows labeled Projected, followed by any differences between your values and ours.

Note: After the 15th calendar day of the month or when the status changes to Closed, the data in the Reported rows becomes read-only. Contact your Fannie Mae servicing analyst if you later discover a discrepancy.

| In this Field | Enter or Select the Following |

| Actual LPI Date | The due date of the last monthly payment you received during the activity month. eServicing does not edit this field, except for format, because you have the best information about recent payments.

Note: The reporting month is the month following the activity month. In our examples, April is the activity month, and your loan-level activity reporting is due by 5:00 p.m. eastern time the second business day in May, which is the reporting month. Examples:

|

| Actual UPB | The UPB after application of the last installment received from the borrower up to and including the activity month.

Scheduled/Scheduled remittance – eServicing does not edit this field, except for format, because you have the best information about the borrower’s recent payments. Actual/Actual remittance – you receive an error message if the value in the Reported row varies from Fannie Mae projections by more than /- $0.05. |

| Scheduled UPB | UPB after application of the payment due on the first of the month following the activity month. Continuing our example, this would be the UPB after application of the payment due May 1, whether or not you receive it.

You receive an error message if the value in the Reported row varies from Fannie Mae projections by more than /- $0.05. |

| Principal | Scheduled/Scheduled remittance – scheduled principal, in this example, the portion of the May 1st payment that is to be applied to principal.

Actual/Actual remittance – principal you actually received during the activity month, in this example, April. You receive an error message if the value in the Reported row varies from Fannie Mae projections by more than /- $0.03. |

| Interest | Scheduled/Scheduled remittance – scheduled interest, the portion of the May 1st payment that is to be applied to interest.

Actual/Actual remittance – interest you actually received during the activity month, in this example, April. You receive an error message if the value in the Reported row varies from Fannie Mae projections by more than /- $0.03. |

| P&I Sum | The sum of the entries in the principal and interest fields. eServicing calculates this value for you.

You receive an error message if the value in the Reported row varies from Fannie Mae projections by more than $0.01. |

Note: For questions on reporting activity on mortgage loans with odd due dates, contact your Fannie Mae servicing analyst.

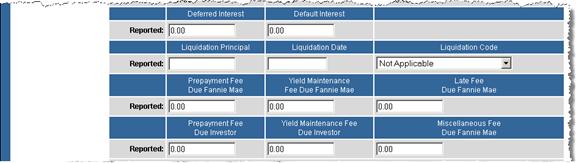

Servicing Exception Data

The remaining editable fields apply to what we call “servicing exceptions” – that is, activity other than that resulting from regular monthly payments. Servicing exceptions occur when a mortgage loan matures or is liquidated due to a payoff or foreclosure, or if any fees are due to Fannie Mae or another investor.

The following table describes each field and the data you would enter for various servicing exceptions.

|

In this Field |

Enter or Select the Following |

|

Deferred Interest |

Any deferred interest amount that you collect and that is due to Fannie Mae. |

|

Default Interest |

Fannie Mae’s share of an interest fee collected from the borrower when a mortgage loan becomes delinquent – does not include regular interest paid by the borrower. |

|

Liquidation Principal |

Scheduled/Scheduled remittance – the reporting month’s ending scheduled UPB as if the mortgage loan had not paid off. Actual/Actual remittance – the outstanding UPB after the last payment received from the borrower. |

|

Liquidation Date |

The date one of the following events occurred

|

|

Liquidation Code |

The reason for the liquidation selected from the following options listed in the drop-down box

|

|

Prepayment Fee Due Fannie Mae |

Fannie Mae’s portion of the prepayment premium/declining premium due on a payoff or curtailment. |

|

Yield Maintenance Fee Due Fannie Mae |

Fannie Mae’s portion of a yield maintenance premium due on a payoff or curtailment. |

|

Late Fee Due Fannie Mae |

Fannie Mae’s portion of a late fee collected on a mortgage loan. |

|

Prepayment Fee Due Investor |

Any investor’s portion of a prepayment/declining premium due on a payoff or curtailment. Funds are drafted by Fannie Mae and passed through to the investor(s). |

|

Yield Maintenance Fee Due Investor |

Any investor’s portion of a yield maintenance premium due on a payoff or curtailment. Funds are drafted by Fannie Mae and passed through to the investor(s). |

|

Miscellaneous Fee Due Fannie Mae |

Any fee not captured in other fields on the transaction. |

Comment Box

Finally, you see a Comment box where you can provide more detail about mortgage loans with a status of Unreconciled or Servicing Exception. This can be helpful to the Fannie Mae servicing analyst who reviews your reported monthly loan-level activity. Be aware, however, that the Comment box does not automatically alert the analyst. For critical issues, you should contact the analyst directly.

© 2010 Fannie Mae. Trademarks of Fannie Mae.