Uploading a Loan-Level Data File to eServicing

Multifamily Investor Reporting

-

Requesting Access to the Investor Reporting Application

-

Logging on to Investor Reporting

-

Opening Your CSV File in Excel

-

Viewing and Downloading Loan-Level Data

-

Uploading a Loan-Level Data File to eServicing

-

Understanding the Loan Balance Detail Screen

-

Entering Loan-Level Data Manually

-

Verifying and Updating Loan-Level Data

-

Reporting Loan-Level Activity

-

Rolling Up Loan-Level Data and Reporting MBS Activity

-

Certifying Pool-to-Security Differences

-

List of MBS Edits

-

Reviewing, Updating, and Reporting Loan-Level ARM Rate and Payment Changes

-

Viewing and Downloading ARM Rate and Payment Changes

Beginning on the 25th of each month through the 2nd business day of the following month, you can upload loan-level transactions data for all mortgage loans serviced through the eServicing system. The upload function accommodates two methods for uploading your data to Fannie Mae.

- Reporting loan-level data at the time you upload your file

- Uploading loan-level data without reporting it so that you can review the data before reporting it to Fannie Mae.

The process varies slightly depending on the option you choose.

-

From the Investor Reporting Menu, select File Upload.

The File Upload Status screen appears.

-

Click New File Upload.

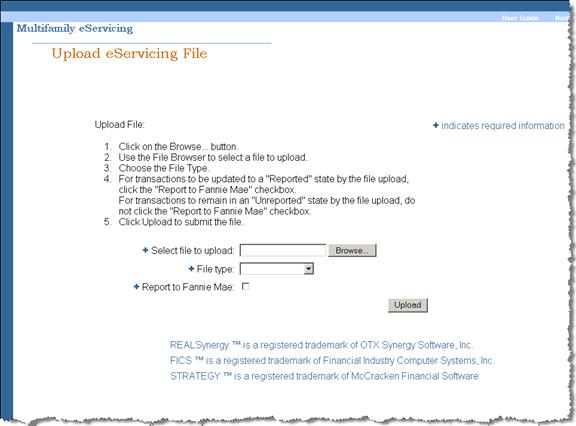

The Upload eServicing File screen appears.

-

Click Browse and navigate to the applicable file on your own system.

-

Select the file and click Open.

-

Select the File type from the drop-down box. Fannie Mae accepts four file formats:

- FICS®

- Fannie Mae LAR

- REALSynergy™

- Strategy™ PLRS1

-

Click the Report to Fannie Mae box if you want to report your data to Fannie Mae when you upload it. If you want more time to review, and possibly update, your data, leave the box blank.

-

Click Upload.

You first see an hour glass and a message that your file is being uploaded. When the upload is complete, the Upload eServicing File screen appears. It displays a message similar to the following:

“File 00001lardownload.txt has been successfully uploaded. Your tracking identifier for this file is 00001. Your file has been queued for processing. Use the File Upload screen to track the status of your file.”

-

Click the File Upload link embedded in the message.

The File Upload Status screen appears. It displays the following information:

- Tracking number

- Upload date

- File name

- Processing status – Received, Processing, Processing Complete, or Processing Failure

- Number of loan records processed

- Number of loan records rejected

- User ID of the person who uploaded the file

Depending upon the size of your file, processing may take several minutes and may still be underway when the File Upload Status screen opens. If so, click the Refresh Page link at the top right of the screen to monitor the status of your upload. When processing is complete, the Status field will display Processing Complete or Processing Failure.

Note: If all of your data records are processed successfully, the tracking number will be static. If any data records are rejected, the tracking number becomes a hyperlink to a File Upload Errors screen.

-

Review the File Upload Status screen to determine your next step.

- If the Processing Status is Processing Failure or if the Processing Status is Processing Complete and the No. Rejected is greater than “0,” go to Step 10.

- If the Processing Status is Processing Complete and the number rejected is “0,” see the Note following Step 12.

-

Click the Tracking No. hyperlink for each file you need to review.

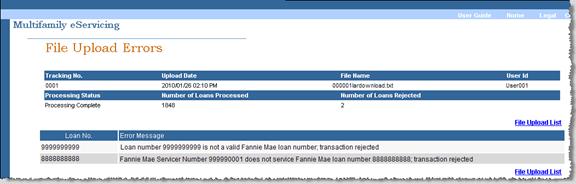

The File Upload Errors screen appears. It displays an error message for each data record that was rejected.

-

Review the reason listed for each rejected transaction (for example, “Fannie Mae Servicer Number 999990001 does not service Fannie Mae loan number 8888888888; transaction rejected.”)

-

Correct the data using one of these three options.

- Create and upload a new file for all the mortgage loans under the applicable servicer number

- Create and upload a new file for just the mortgage loans that generated errors

- Update the data manually for each mortgage loan that generated an error.

No action is necessary if the rejected transaction should not have been included in your upload.

|

Note: After you successfully upload your loan-level data file(s), you are ready to proceed to the next phase of the investor reporting process, which includes:

|

© 2010 Fannie Mae. Trademarks of Fannie Mae.