Creating a Payoff Quote - CMT

Payoff Calculator Job Aids

Creating a Yield Maintenance Payoff Quote: Constant Maturity Treasury (CMT)

To create a payoff quote for a mortgage loan that includes a yield maintenance provision linked to the Constant Maturity Treasury (CMT) index, follow the steps below. You need information from the following sources to complete the payoff quote:

- Your organization’s servicing system

- The mortgage loan documents

- The borrower’s written notice of intent to prepay

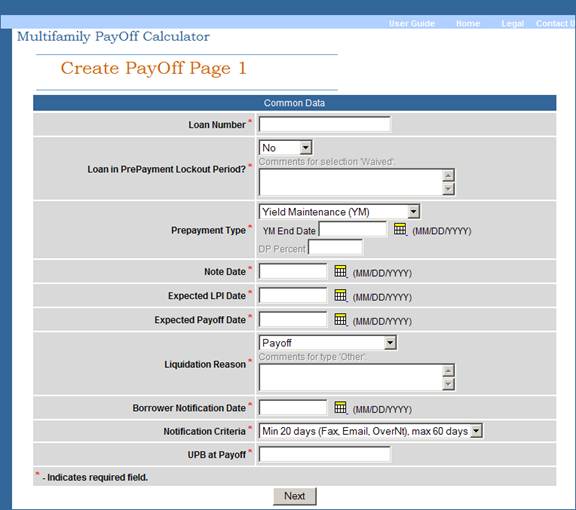

Completing Create PayOff Page 1

To complete Create PayOff Page 1, follow these steps:

-

On the PayOff Quote screen, click Create.

The Create PayOff Page 1 appears.

-

Enter the Fannie Mae Loan Number.

Note: The Payoff Calculator generates quotes only for mortgage loans in Fannie Mae’s eServicing system. If the mortgage loan is not in eServicing, contact your Fannie Mae servicing analyst for assistance.

-

Select Yes, No, or Waived from the drop-down box to indicate whether the mortgage loan is still in its prepayment lockout period. If you select Waived, you must also enter a comment indicating the reason for the waiver.

-

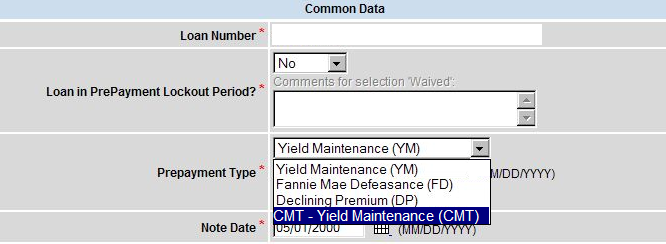

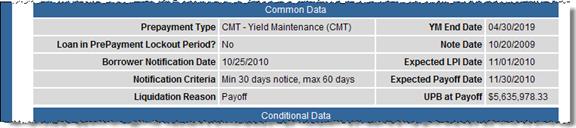

Select CMT - Yield Maintenance (CMT) from the Prepayment Type drop-down box. You must complete this and the following step even if the borrower no longer has a prepayment obligation.

-

Enter the YM End Date as stated in the loan documents in MM/DD/YYYY format.

-

Complete the remaining fields on Create PayOff Page 1 as follows:

Note Date

Enter the Note Date drawn from the mortgage loan documents.

Expected LPI Date

Enter the Expected LPI Date as of the expected payoff date.

Expected Payoff Date

Enter the Expected Payoff Date based on the borrower’s notice of intent to prepay.

Liquidation Reason

Select the reason from the drop-down box. If the reason is not listed, choose “Other” and enter a description in the Comments box.

Borrower Notification Date

Enter the date that the borrower provides you, as the servicer, with written notice of intent to prepay.

Notification Criteria

Select the applicable Notification Criteria from the drop-down box.

The Multifamily Note specifies the number of days’ written notice that a borrower must provide of intent to prepay.

UPB at Payoff

Enter the UPB at Payoff based on the expected payoff date and the expected LPI date. -

Click Next.

Note: The system may display edits at the top of the screen if you leave any required fields blank or enter data in the wrong format. If so, correct the data and click Next again.

The Create PayOff Page 2 appears.

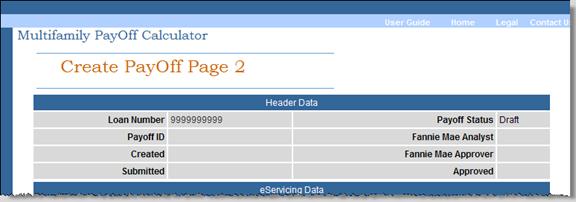

Completing Create PayOff Page 2

Create PayOff Page 2 is divided into the four sections described below. The screenshots illustrate the payoff calculation for a sample mortgage loan assuming that it was originated in 2009, delivered to Fannie Mae under an MBS execution, and paid off one year later.

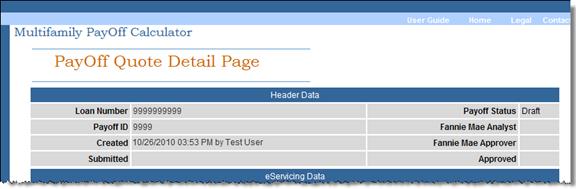

Header Data

The system populates the fields in this section at different points in the process. At this point, the screen displays the Fannie Mae Loan Number and the Payoff Status of “Draft.”

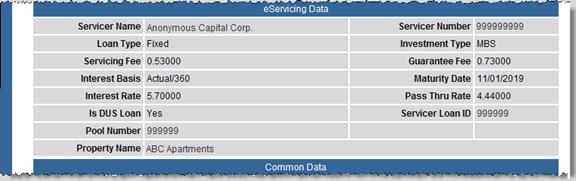

eServicing Data

The system displays the eServicing system data for this Fannie Mae loan number. The data includes the servicer name and number, the servicer’s loan ID, property name, mortgage loan maturity date, and data related to the cash flow on the mortgage loan. You should check this data for accuracy and notify your Fannie Mae servicing analyst if you notice any discrepancies.

Common Data

The system populates this section with the data you entered on Page 1.

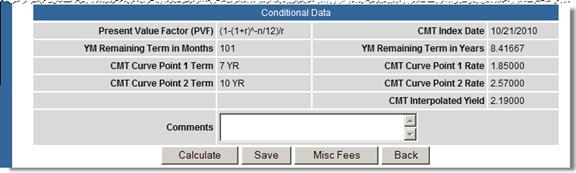

Conditional Data

The data in this section is based on the prepayment provisions for your mortgage loan. The Payoff Calculator populates most of the Conditional Data for you, based on the information you entered on Page 1. Often, only the Comments field is active.

The following table describes the fields in the Conditional Data section. In some cases, we included data drawn from the sample payoff calculation illustrated in the screenshots above.

| Data in this Field. . . | Comes from this Source. . . |

| Present Value Factor (PVF) | The mortgage loan documents |

| CMT Index Date | Treasury constant maturities as published in the Federal Reserve Statistical Release, available at www.federalreserve.gov/Releases/H15/update. Select Weekly Release Dates. See the index release date immediately preceding the lookback date specified in the mortgage loan documents. Typically the lookback date is 25 business days prior to the intended payoff date. |

| YM (Yield Maintenance) Remaining Term in Months | Automatically calculated for you – for our sample mortgage loan – 101 months |

| YM Remaining Term in Years | Derived by the Payoff Calculator – for our sample mortgage loan – 8.41667 years |

| CMT Curve Point 1 Term | The immediately shorter term CMT. Since the remaining yield maintenance term for our sample mortgage loan is 8.4 years, the immediately shorter term CMT is 7 years. When the remaining yield maintenance term falls between two CMT terms, the Payoff Calculator interpolates a yield based on the immediately shorter and longer term CMT yields. |

| CMT Curve Point 1 Rate | The index value for the 7-year CMT – for our sample mortgage loan – 1.85000 |

| CMT Curve Point 2 Term | The immediately longer term CMT – for our sample mortgage loan – 10 years |

| CMT Curve Point 2 Rate | The index value for the 10-year CMT – for our sample mortgage loan – 2.57000 |

| CMT Interpolated Yield | Derived by the Payoff Calculator – for our sample mortgage loan – 2.19000 |

If you chose “Refinance with FNMA” as the Liquidation Reason on Page 1, a Refinance Waiver prompt appears in the Conditional Data section. You may waive all or part of the prepayment premium under the following conditions:

- The mortgage loan is out of yield maintenance, but in the 1 percent period.

- The mortgage loan is still in yield maintenance, but the calculated yield maintenance amount is less than 1 percent of the outstanding UPB.

Follow these steps to complete Create PayOff Page 2:

-

If you selected Yes from the Loan in Prepayment Lockout period? drop-down menu on the Create PayOff Page 1 screen because of a refinance waiver, enter the Fannie Mae commitment number and complete the Comments field.

-

Complete other fields, if required.

-

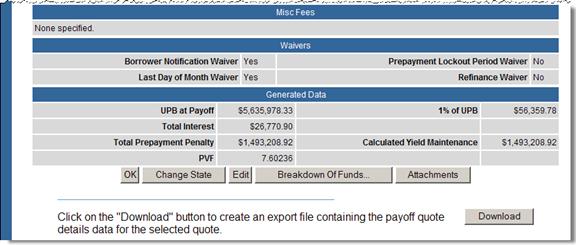

If other fees are due on the mortgage loan, click Misc Fees and enter the applicable data.

-

When you are finished entering data, click Calculate.

Note: If you wish to pause in your work before completing data entry, click Save instead.

The PayOff Quote Detail Page appears.

-

Attach the required documents, which vary with the age of the note.

- For mortgage loans originated on Fannie Mae loan documents before June 1, 2011, the required documents typically include the mortgage note with Schedule A, which is referenced in the note and describes the prepayment provisions, as well as the borrower’s written notice of intent to prepay.

- For mortgage loans originated on Fannie Mae loan documents on or after June 1, 2011, the required documents include the mortgage note, the loan agreement with all attached schedules, as well as the borrower’s written notice of intent to prepay.

Checking Your Data

The system establishes a Payoff ID, which appears under the Header Data on the Payoff Quote Detail Page along with a date stamp and your name as the creator of the quote. The Payoff Status displays as Draft. The system saves your data and generates the UPB at Payoff, Total Interest, and Total Prepayment Penalty.

Follow these steps to check your data:

-

Review the data on the PayOff Quote Detail Page for accuracy.

-

Click Breakdown of Funds to view a printable pop-up window that shows the calculated values and how they are to be split. These values include UPB; pass-through interest or interest due to Fannie Mae; the servicing fee due to your organization; our guaranty fee, if applicable; the yield maintenance due to you as the lender, Fannie Mae, and investors; and miscellaneous fees, if any.

Note: After Fannie Mae approves your quote, this page will display as a Confirmation Page stamped with the date and time your quote was approved by Fannie Mae.

-

Close the window to return to the PayOff Quote Detail Page.

Note: If you find an error in any of your entries, click Edit at the bottom of the screen. Correct any errors and click Calculate to update the data. If you believe that Fannie Mae’s data is incorrect, contact your Fannie Mae servicing analyst for assistance.

-

Review the Waivers section to see if any waivers are required with the payoff quote. If so, contact your Fannie Mae servicing analyst for further instruction. Following is a list of potential waivers.

- Borrower notification

- Last day of month

- Prepayment lockout

- Refinance

-

Click Download if you would like to create an export file containing the payoff quote data for the quote you are working on.

Note: If you are running Microsoft® Office 2003, your CSV file may open in your browser rather than in Microsoft Excel®.

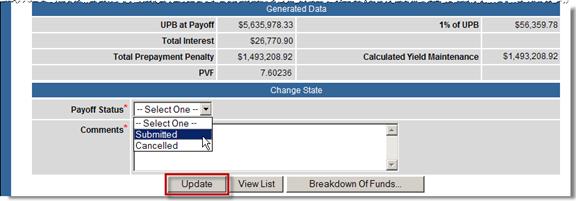

Submitting Your Payoff Quote to Fannie Mae

-

When you are ready to submit your payoff quote to Fannie Mae, click Change State.

The Change Payoff State Page appears.

-

Select Submitted from the Payoff Status drop-down box and complete the Comments field.

-

Click Update to complete your submission.

The following message appears: “You are about to submit a payoff quote to Fannie Mae. Do you wish to proceed?” -

Click OK if you want to proceed. Click Cancel if you want to return to the Payoff Calculator to verify or edit your quote.

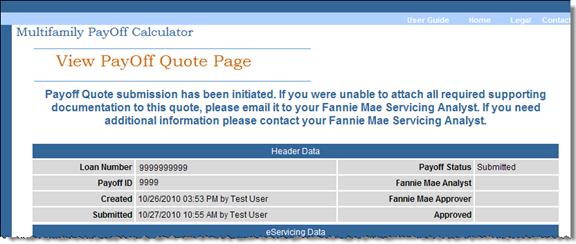

If you click OK, the View PayOff Quote Page appears and the Payoff Status changes to Submitted. The Payoff Calculator notifies the Fannie Mae servicing team that a payoff quote has been submitted.

You receive an e-mail notification from Fannie Mae when the payoff quote status changes to submitted, assigned, servicer rework, pending approval, approved, or cancelled. -

When you receive notification that your payoff quote has been approved, return to the Payoff Calculator to download the final Breakdown of Funds/Confirmation Page. You can print the Breakdown of Funds or save it as an Excel spreadsheet or a PDF.

Note: You can return to the Payoff Calculator at any time to check the status of the quote you submitted.

© 2011 Fannie Mae. Trademarks of Fannie Mae.