Forty-nine million Americans are credit invisible (not having a credit record) or credit unscorable, which puts them at a disadvantage and limits their access to credit cards, auto loans, mortgages, and the ability to build wealth. In September 2022, Fannie Mae launched the Positive Rent Payment pilot with the goal of helping renters with low or no credit build their credit scores. We quickly learned that the pilot uncovered a "win-win" that benefits renters and multifamily property owners alike.

The pilot was aimed at increasing the number of multifamily property owners offering rent reporting. As an incentive, Fannie Mae covered the cost of the reporting services with one of our three approved pilot vendors, Esusu, Jetty or Entrata, for 12 months. Through the pilot vendor network, positive rent payments were reported to the three major credit bureaus for inclusion in each renter's credit profile.

The pilot ended June 30, 2025.

There are numerous benefits to building and maintaining good credit. Renters with good credit may qualify for better rental property lease terms or reduced security deposits. But building and maintaining good credit can be difficult for many, especially renters. For most households, rent is the largest monthly expense, and we learned that about 90 percent of renters pay their rent on time. However, on-time rent payments are not typically reported to credit bureaus like mortgage or auto payments. This puts renters at a disadvantage, especially if they are trying to establish or raise their credit scores.

By renting from a property owner that offers positive rent reporting, renters benefit by having their on-time payments factored into their credit profile. Additionally, this program is specifically designed for positive-only rental reporting, meaning missed or late rent payments are not reported to the credit bureaus, minimizing unintended consequences for the end consumer.

Here’s how renters can benefit from rent reporting

Establish a credit score

to build credit history

Improve low credit scores

with consistent, on-time rent payment

Create opportunities

for building wealth and/or homeownership with improved credit scores

Unlock more favorable interest rates

for auto, business, and education loans with improved credit scores

A win-win for all participants

While supporting residents, property owners can also benefit from offering rent reporting. Here's how:

- Encourages on-time rent payments

- Offering rent reporting provides a competitive advantage and helps differentiate the property from others

- Increases resident satisfaction

- Could improve renter retention

Results speak for themselves

Units reporting rent payments*

Number of renters who established credit scores*

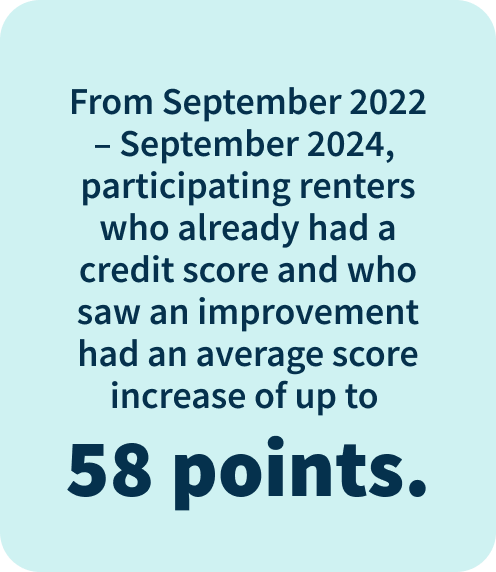

Credit score improvements*

Increase in credit scores*

Number of property owners participating across properties*

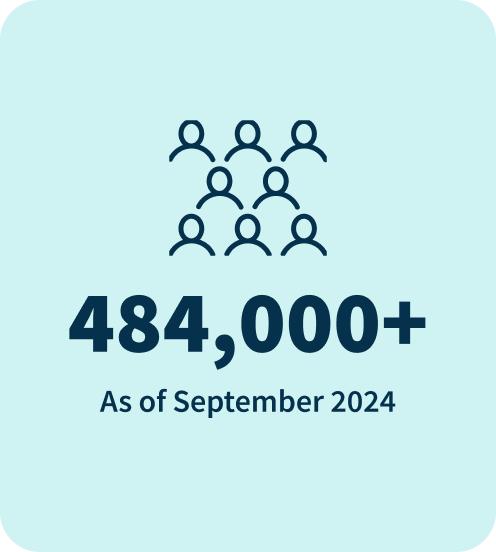

Number of renters having their on-time rent payments reported*

*Data according to our vendors from September 2022 to September 2024. Rent reporting is one component that can contribute to a consumer's credit score. Positive Rent Payment reporting does not guarantee an increase in credit score.