Credit Facility

Learn about the Credit Facility execution that allows borrowers to arrange flexible financing terms for a portfolio of properties.

Fannie Mae’s Credit Facility is a flexible financing tool that allows Borrowers to manage debt across their entire multifamily portfolio. Credit Facilities permit a combination of variable- and fixed-rate debt with laddered maturities and flexible post-closing features, so borrowers can manage complex and changing business strategies to achieve their long-term goals.

Core Features

All structuring options/features subject to the terms of the Master Credit Facility Agreement.

- Must be cross-collateralized and cross-defaulted.

- Add, release, or substitute collateral.

- Borrow-up availability to access trapped equity.

- Unlimited expansion capabilities.

- No hidden costs or annual re-balancing.

Benefits

- Tranche debt to optimize strategy

- Ladder maturities and customize prepayment

- Buy and sell assets on your schedule

- Grow portfolio with quick and easy expansions and pre-negotiated loan documents

- Retain favorable interest rates and reduce prepayment premiums with property substitutions

- Recognize portfolio improvements with first lien borrow-ups

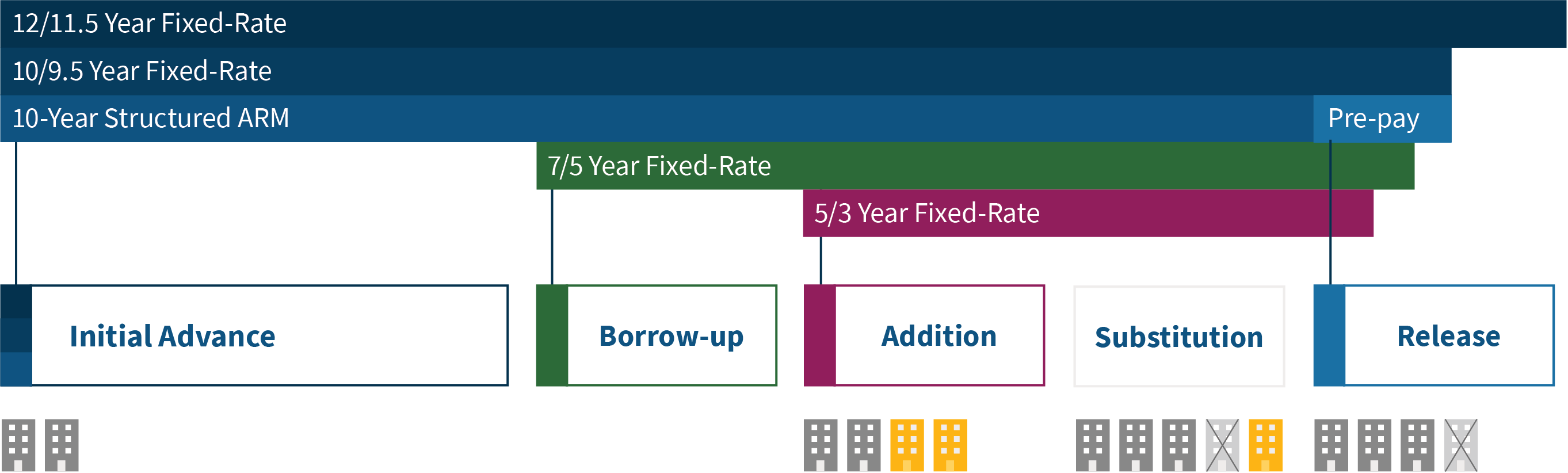

Life Cycle of a Credit Facility

- The collateral pool is identified for the initial closing of the Credit Facility

- The governing loan documents are tailored to the specific transaction and sponsor

- Debt tranches for the initial advance are determined based on borrower’s strategy

- Minimum $100 million funding for the initial closing

Eligibility

- New or repeat Fannie Mae Borrowers

- Available for all Asset Classes

Credit Facility Size

Minimum initial advance of $100 million with unlimited expansion capacity.

Core Features

All structuring options/features subject to the terms of the Master Credit Facility Agreement.

- Must be cross-collateralized and cross-defaulted.

- Add, release, or substitute collateral.

- Borrow-up availability to access trapped equity.

- Unlimited expansion capabilities.

- No hidden costs or annual re-balancing.

Term

Minimum 5-year loan term and a maximum loan term of:

- 15 years for fixed-rate advances; and

- 10 years for variable-rate advances.

The Facility terminates upon its full repayment of the Latest Facility Termination Date (typically 15 years from initial closing date or 5 years beyond the loan term of the initial advance).

Interest Rate

Fixed, variable, or a combination of fixed and variable tranches. Variable rate advances may be converted to fixed rate.

An Interest Rate Cap or other Interest Rate Hedge is generally required for variable rate advances.

Amortization

Interest-only and amortizing available, based upon property and pool performance.

Maximum Facility LTV

Up to 75%, depending upon asset class and product type.

Credit Facilities that only include Multifamily Affordable Housing Properties may go up to 80%.

Minimum Facility DSCR

Generally starting at 1.25x depending upon asset class and product type. Multifamily Affordable Housing Properties may start at 1.20x.

Prepayment Availability

Flexible prepayment options available, including partially pre-payable debt, yield maintenance, and declining prepayment premium.

Borrower Entity

A single purpose, bankruptcy-remote entity is required for each Borrower and any general partner, managing member, or sole member that is an entity. Borrowers must have common ownership and control across the Credit Facility.

Rate Lock

30- to 180-day commitments.

Timing of Rate Lock and Closing

The timeframes for Rate Lock and closing are subject to the number of Properties, property-specific issues, locations, complexity of ownership issues, complexity of closing or execution requirements, and the level of document negotiation.

The minimum closing timeframe for a new Credit Facility is 60 days from signed term sheet/ loan application. For collateral additions and substitutions, the closing timeframe is 30 days from signed application.

Recourse

Non-recourse execution with standard recourse carve-outs for “bad acts”, such as fraud and bankruptcy.

Escrows

Replacement Reserve, tax, and insurance escrows are typically required, but may be waived based on the strength of the transaction.

Third-Party Reports

Standard third-party reports required, including Appraisal, Phase I Environmental Site Assessment, and Property Condition Assessment.

Assumption

Assumption of the entire Credit Facility is permitted upon satisfaction of the requirements of the Master Credit Facility Agreement.

Origination Fees

The Lender’s Origination Fee must be approved by Fannie Mae and is determined on a case-by-case basis prior to application based on the size and make-up of the Collateral Pool for the Initial Advance.

Fannie Mae charges a structuring fee of 10 basis points on each advance.

Other fees (e.g. due diligence, substitution, release, assumption, and review) will apply.

Property Considerations

Financial and operating covenants and geographic diversity requirements determined on a case-by-case basis.