The multifamily sector was negatively impacted in 2020 from rising vacancy, declining rents, and higher concession rates due to the economic dislocation resulting from the COVID-19 pandemic. We expect a similar trend in 2021, with stabilization anticipated to commence starting in the latter part of the year. It is important to note that although the national trend is expected to remain subdued for most of the year, multifamily fundamentals and trends are also expected to vary by metro, submarket, and, in some cases, neighborhood.

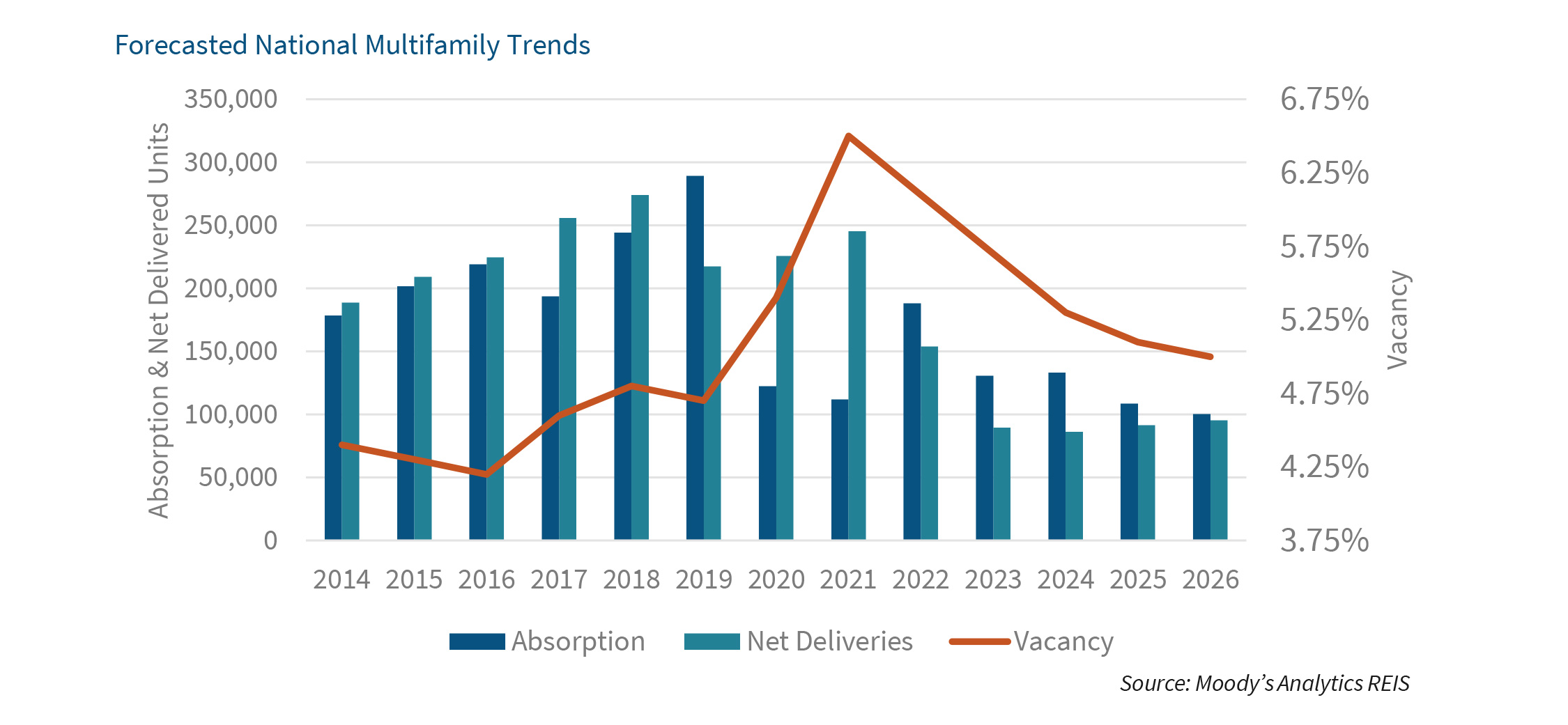

The national multifamily vacancy rate is expected to peak in 2021, at around 6.5 percent, as illustrated in the chart below from Moody’s Analytics REIS, and then begin to trend downward starting in 2022. The pace of absorption is expected to remain sluggish due to the increased number of new units expected to deliver over the next 12 months. In addition, we expect that concession levels will continue to rise in the first few months of the year, as the first quarter tends to experience a slower pace of apartment unit lease-ups and renewals.

Positive-but-Subdued Absorption Expected in 2021

Demand for multifamily rental units remained stable in 2020, according to data from CoStar Portfolio Strategy, which estimates that net absorption totaled 326,874 units last year, compared to an estimated 320,976 in 2019. In contrast, CoStar anticipates a significant slowdown in multifamily net absorption this coming year, with only 113,178 units of net absorption expected in 2021.

Vacancy Expected to Increase

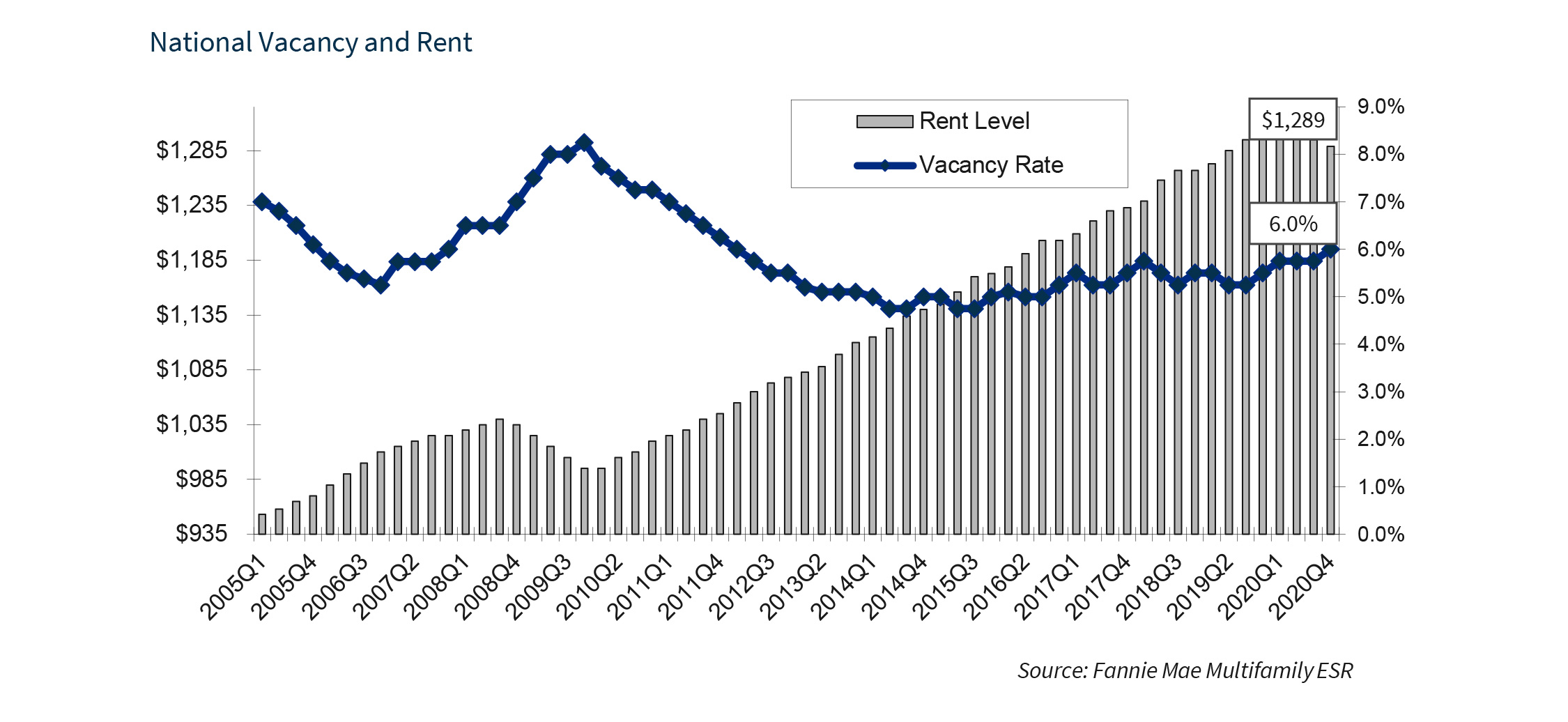

The national multifamily vacancy rate is expected to increase in 2020, primarily due to the amount of new supply expected to deliver this year, coupled with the effects of improving economic conditions. Since much of this new supply is expected to consist of more expensive, Class A units concentrated in a limited number of submarkets, particularly in urban core neighborhood locations, it is expected that supply could continue outpacing demand in some places this year. As a result, the national vacancy rate is expected to climb throughout most of the year, within a range of between 6.0 percent and 6.5 percent. Nevertheless, it is important to note that this range is well below the most recent estimated vacancy peak of 8.25 percent that occurred in fourth quarter 2009, as seen in the chart below.

Rent Growth Expected to Remain Weak

We believe that national rent growth turned negative in 2020, ending the year at an estimated negative 0.75 percent. That is in comparison to 2019’s estimated rent growth of 2.5 percent. From 2011 to 2019, rent growth was above historical averages, as illustrated in the chart above. Assuming 2020 has negative national rent growth, this would mark the first time that annualized rent growth was negative since 2009.

The current expectation for 2021 is more of the same, at least in the first half of the year. We anticipate that rent growth will not turn positive until the second half of the year. Nevertheless, we are currently projecting that rent growth will end 2021 at break-even or just slightly positive levels, assuming widespread COVID-19 vaccinations and a sustained economic recovery. We expect rent growth to be within a range of 0.0 to 0.5 percent by year-end 2021.

Differentiation by Class in Rent Growth...

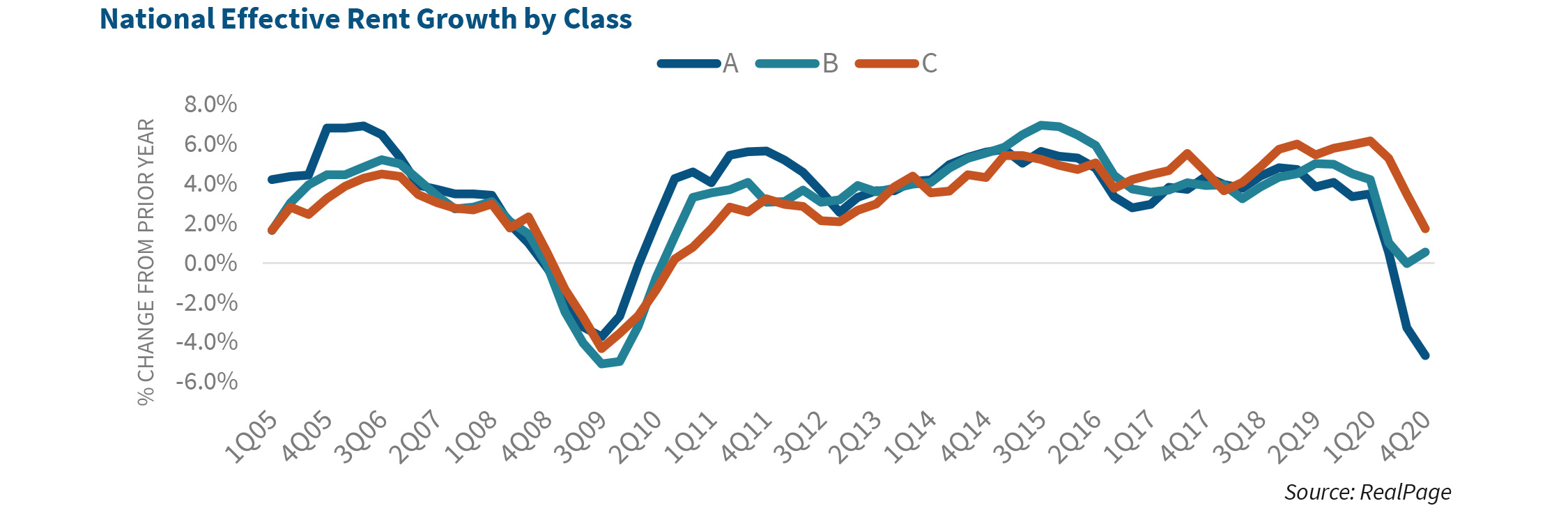

There was a substantial difference in rent growth by class of multifamily property in 2020, as illustrated below. According to data from RealPage, Inc., year-over-year national Class A rents declined by more than 4.0 percent as of fourth quarter 2020. In comparison, Class B and C rents ended the year down but still positive, at 0.55 percent and 1.72 percent, respectively. It appears that although less expensive units remained in demand, that demand has been softening since last summer. Interestingly, Class B rents saw a slight uptick in fourth quarter 2020 after experiencing a similar decline in demand, which may suggest that some Class C renters are moving up to Class B and taking advantage of lower rent levels.

There was a substantial difference in rent growth by class of multifamily property in 2020, as illustrated below. According to data from RealPage, Inc., year-over-year national Class A rents declined by more than 4.0 percent as of fourth quarter 2020. In comparison, Class B and C rents ended the year down but still positive, at 0.55 percent and 1.72 percent, respectively. It appears that although less expensive units remained in demand, that demand has been softening since last summer. Interestingly, Class B rents saw a slight uptick in fourth quarter 2020 after experiencing a similar decline in demand, which may suggest that some Class C renters are moving up to Class B and taking advantage of lower rent levels.

... and in Concessions

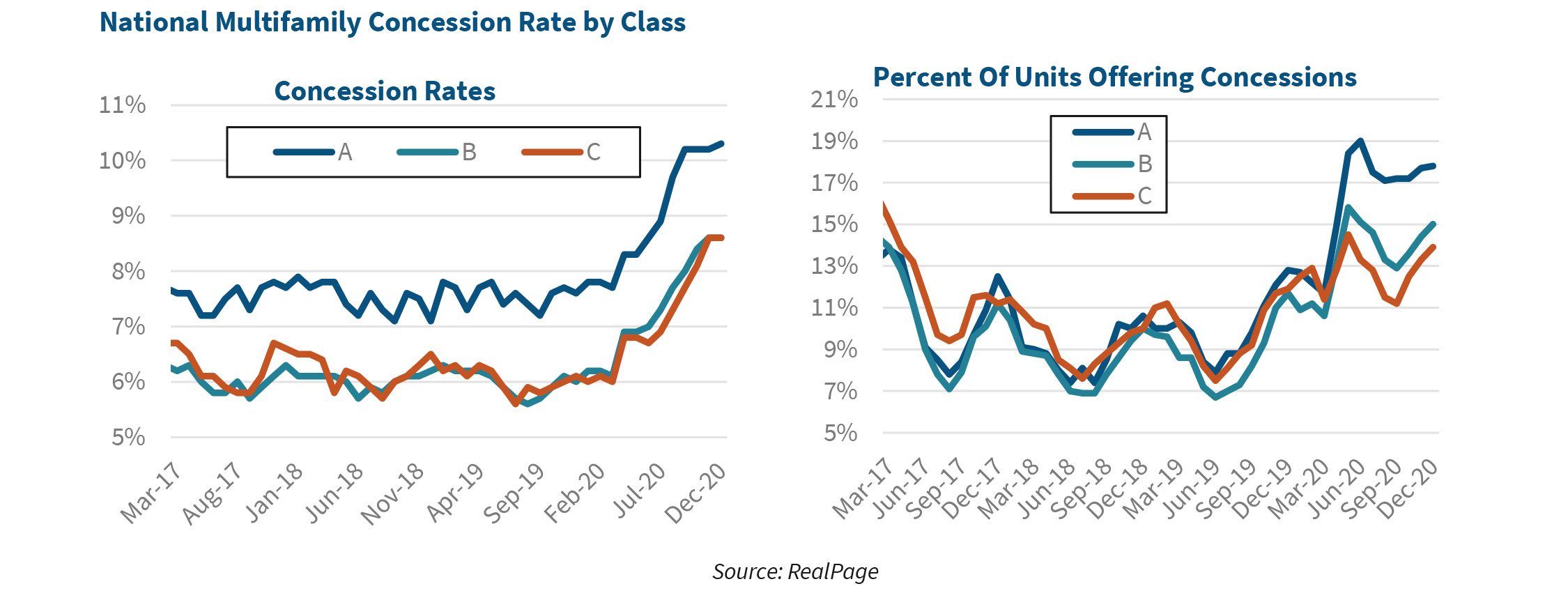

National multifamily concession rates for all property classes, and the number of units offering concessions, climbed steadily throughout 2020, as seen in the charts below. Nearly 23 percent of all multifamily units offered concessions, up from a low of just 14 percent of all units in second quarter 2019. Class A concession levels have far outpaced concessions for Class B and C units, with Class A units at nearly 10 percent as of year-end 2020. In contrast, Class B and C units are now both at 8.1 percent, meaning they are offering nearly one month’s free rent on average.

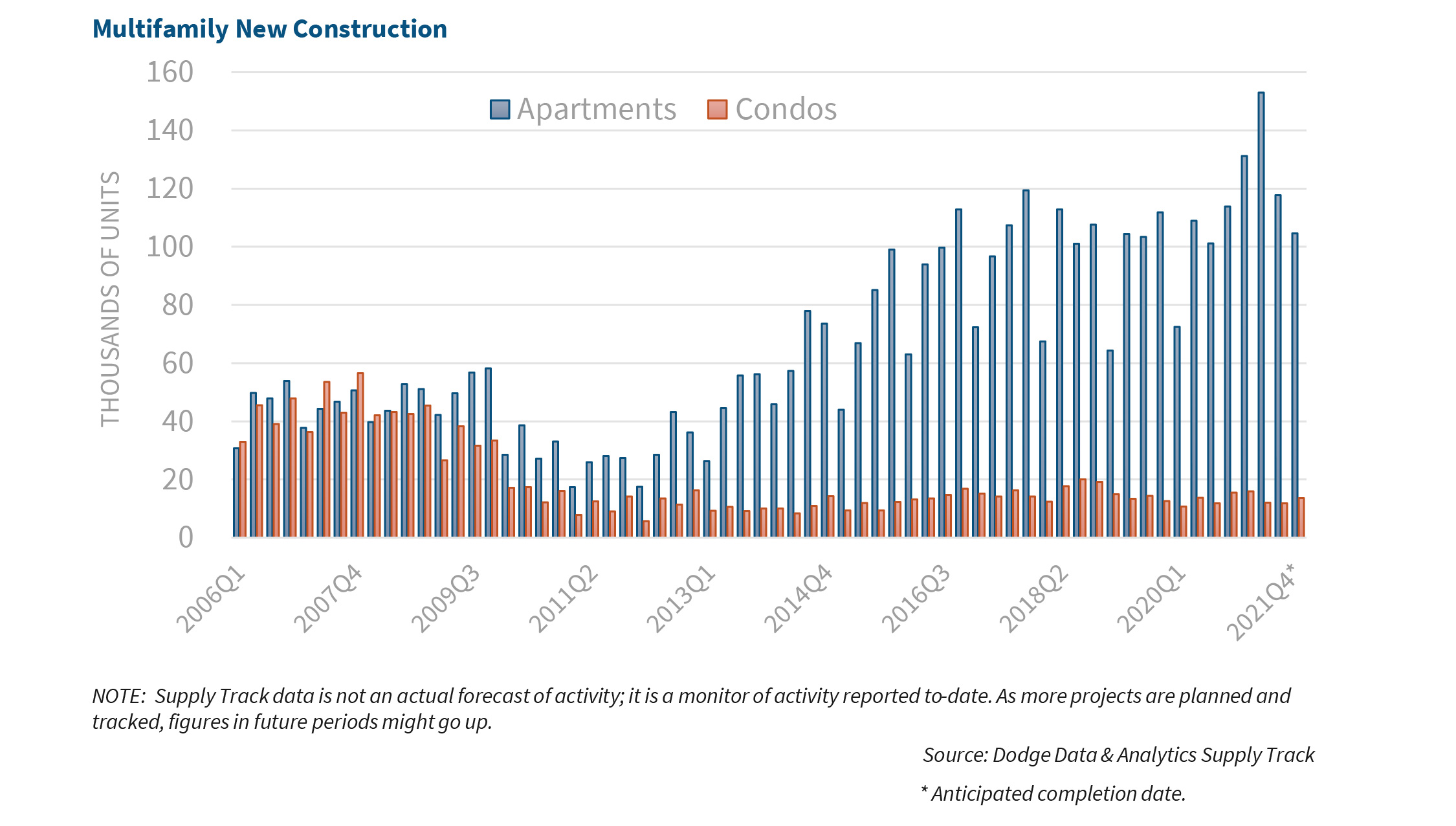

Multifamily New Supply Could Peak in 2021

According to estimates from Dodge Data & Analytics Supply Track, which distinguishes between multifamily properties consisting of either apartment or condominium units, more than 396,000 apartment units were completed in 2020, making it the most recent peak year for new deliveries. Although the number of units slated for completion in 2021 is a staggering 506,637, it seems that developers are uncertain that all of those units will actually be completed before year-end.

Indeed, according to the Associated General Contractors of America’s 2021 Construction Hiring and Business Outlook Report, “most contractors report it remains difficult to fill some or all open positions. Fifty-four percent of firms report difficulty finding qualified workers to hire, whether to expand headcount and replace departing staff. Many contractors expect, despite the pandemic-induced downturn, that it will remain difficult to find qualified workers during the coming 12 months. Forty-nine percent report it will either get harder, or will remain as hard, to find qualified workers, in 2021.” This is in addition to concerns contractors have regarding supply chain interruptions, increased competition, and overall fewer projects expected to be available in 2021.

Expect Weakening Before Improvement

At a national level, a supply/demand imbalance is expected this year, based on the amount of new multifamily units expected to come online. Even though some of these new units may not be completed by year-end, the economic recovery and the amount of expected job replacement and growth are unlikely to produce enough demand for all the new Class A units that are anticipated to deliver in 2021.

Year-over-year job growth is expected to be 5.5 percent by the end of 2021, according to Fannie Mae’s latest economic forecast, resulting in an estimated 7.9 million jobs. Unfortunately, annualized job losses were negative 6.2 percent in 2020, resulting in an estimated net loss of more than 9.3 million jobs. As a result, we believe it will take until 2022 at the earliest to replace the jobs that were lost in 2020, as well as to begin seeing any possible new demand – instead of mostly replacement demand – for multifamily rental housing.

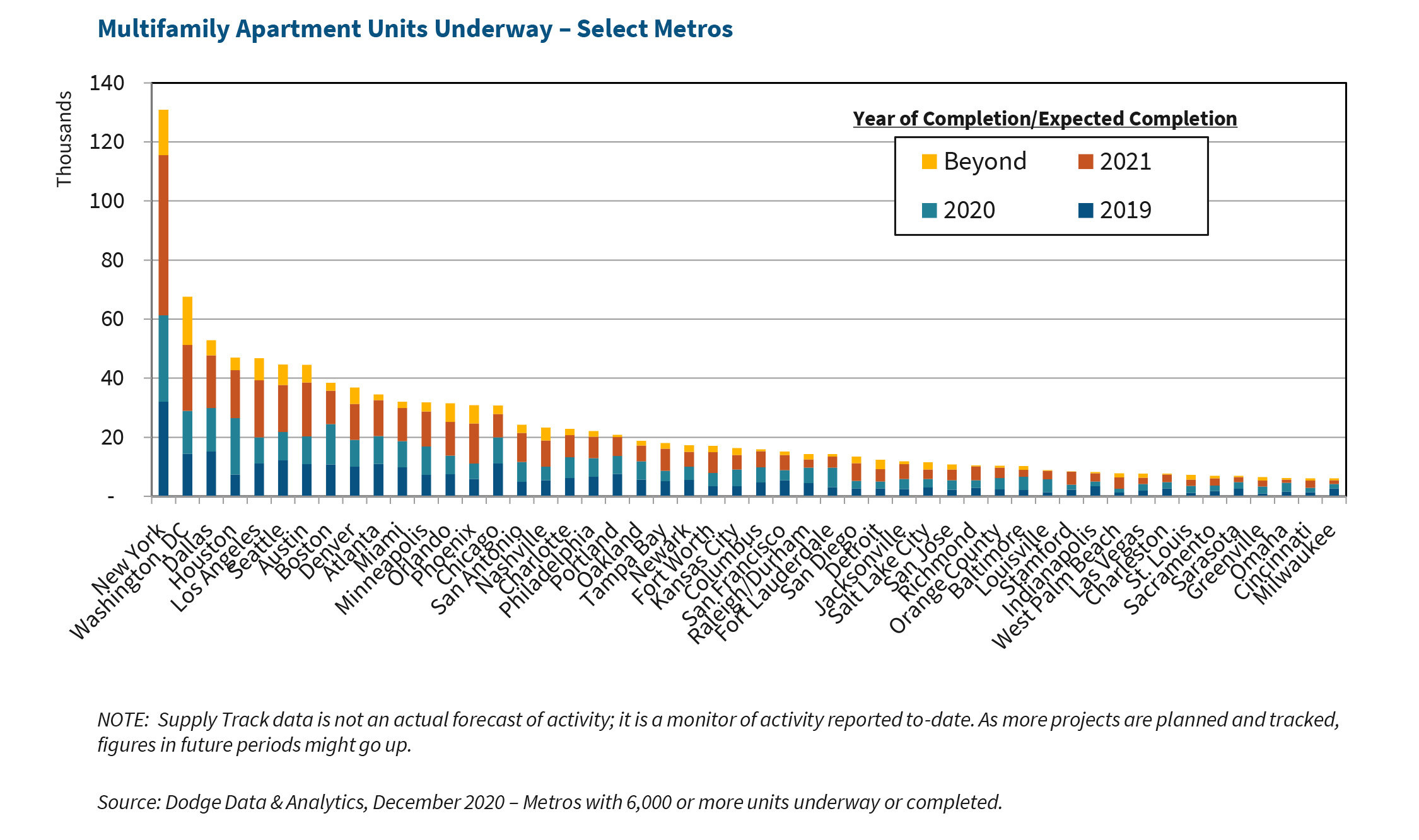

Much of the new multifamily supply consists of more expensive Class A units and is primarily concentrated in about 15 metros, as seen in the chart below. Many of these impacted submarkets are among the most expensive in the country and also bore the brunt of falling rents, rising vacancies, and increasing concessions throughout much of 2020.

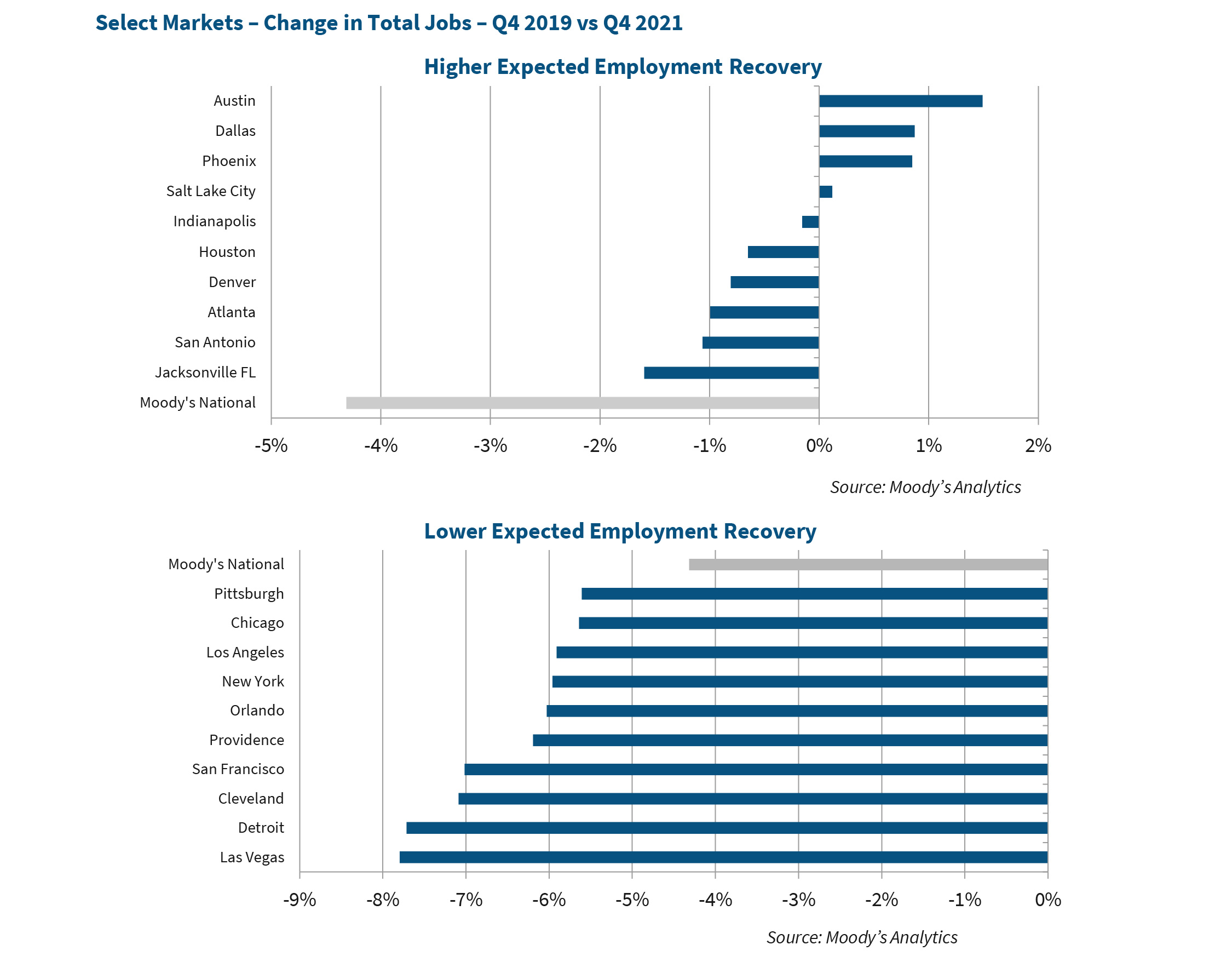

Employment Recovery Will Take Time in Many Places

As seen in the charts below, although we expect the improving economic conditions to continue throughout the year, the employment recovery will likely vary from metro to metro. Indeed, we expect that the employment recovery of many metros will remain negative in terms of where job growth had been pre-COVID, or as seen here, as of fourth quarter 2019. Metros with a significant amount of supply, such as Austin, Dallas, and Phoenix, are expected to see positive job growth by late 2021, according to Moody’s Analytics, which we expect will help boost demand, albeit modestly. However, many other metros with elevated levels of new supply, such as New York, Los Angeles, and Chicago, are expected to languish until at least 2022 before seeing any meaningful increase in job growth – and demand.

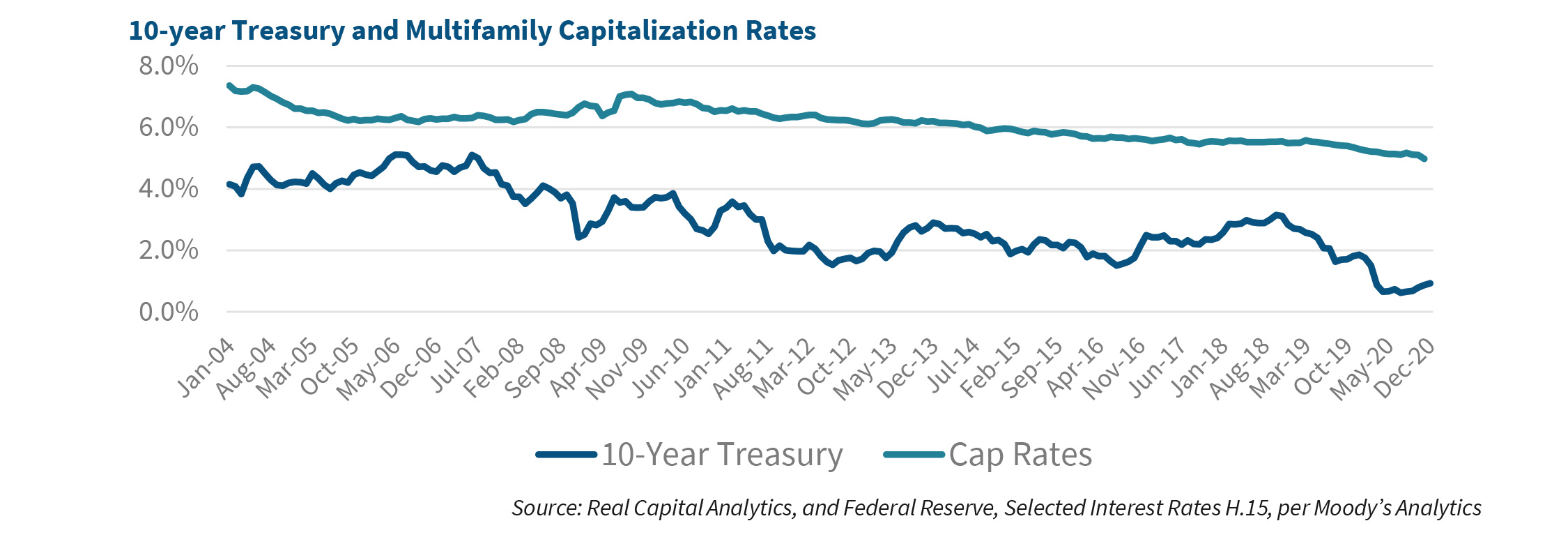

Multifamily Sector Still Attracting Investment

With interest rates remaining low over the past several months and increasing pressure on the performance of the hotel, retail, and to a lesser extent, office sectors during the COVID-19 pandemic, investors have remained steadfastly interested in the multifamily sector. As a result, there has been downward pressure on cap rates, especially during the second half of 2020, as seen in the chart below. Although multifamily cap rates started 2020 at approximately 5.3 percent, according to data from Real Capital Analytics, they are estimated to have ended the year at 4.9 percent, a new low.

Although we have previously cautioned that a decline in the 10-year Treasury yield would likely compress cap rates as well, it is interesting to note that cap rates have continued to decline despite recent increases in the yield for 10-year Treasurys. We currently anticipate that cap rates will remain low again in 2021 despite an expected increase in the 10-year; however, because the spread between the two remains wide, as illustrated in the chart below, we do not expect significant increases in multifamily property prices in 2021.

2021 Multifamily Outlook: Weathering the COVID-19 Storm

We maintain a positive but cautious outlook for the multifamily sector in 2021. We expect the multifamily sector to be impacted in the first half of 2021 from a rising national vacancy rate and declining rents, but, overall, we still expect the multifamily sector to perform well relative to other commercial real estate property types, most notably retail and hospitality.

Additionally, based on anticipated investor demand, increasing-but-still-low interest rates, and construction projects whose loans are expected to convert to permanent financing throughout the year, multifamily mortgage origination volume levels in 2021 are expected to be higher than in 2020. The Mortgage Bankers’ Association predicted that multifamily originations volume will be $288 billion in 2020 and $305 billion in 2021. Based on current trends, we believe that annual multifamily originations could easily surpass both estimates. For commercial real estate investors, if the economic recovery continues as expected, demographics and demand are a tailwind that should help keep multifamily as a favored asset class in 2021, leaving open the possibility for further cap rate compression, increased property sales, and, in turn, higher origination levels.

Kim Betancourt, CRE

Senior Director of Economics

Tim Komosa

Senior Manager

Multifamily Economics and Strategic Research

January 13, 2021

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Economic and Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.