The Seattle metro area was one of the best performing multifamily metros in the country prior to the COVID-19 pandemic. Much of the metro’s exponential growth over the past decade was a result of its well-established high- tech sector, as well as the resiliency of its manufacturing sector. The strength of the local job market, however, depends on a handful of large employers, including Amazon, Microsoft, and Boeing Co., of which the latter employs nearly 60,000 Seattle residents.

Boeing dealt with various setbacks over the past several years, and the severe reduction in air travel due to the pandemic has only exacerbated its troubles. Boeing has been reducing headcount since announcing last May that it would lay off 10,000 workers in the state of Washington, in addition to relocating some of its manufacturing jobs outside of the Seattle metro area.

The impact of Boeing’s workforce reduction on the Seattle metro’s multifamily sector is difficult to ascertain, especially since the advent of the pandemic in early 2020. Seattle’s multifamily rental market has been dealing with the headwinds of the economic shutdown and subsequent recovery, new multifamily supply, falling rents, and rising vacancy levels.

Seattle’s Demographics Support Multifamily Demand Long-Term

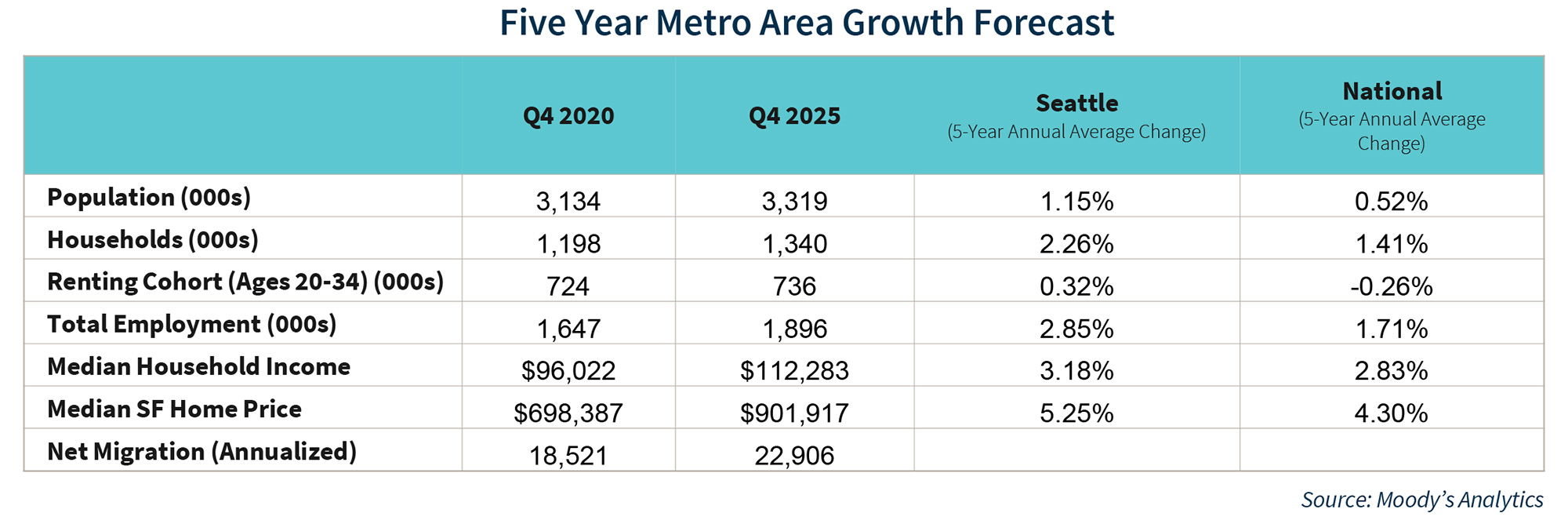

Due to the metro’s large high-tech presence, Seattle has a favorable demographic profile for the multifamily sector. According to Moody’s Analytics, the prime multifamily renter cohort (consisting of renters between the ages of 20 to 34) accounts for nearly a quarter of the metro’s population at 23 percent. Over the next five years, the prime renter cohort is expected to expand by 0.3 percent, compared to negative 0.3 percent nationally.

Seattle is expected to continue attracting Gen Z and Millennial residents due to the presence of well-paying high-tech jobs. In addition, over the next five years, Seattle’s overall population is expected to expand by 1.2 percent, compared to 0.5 percent nationally. The presence of Microsoft, Amazon, Google, and Boeing Co. –- despite its cutbacks –- is still expected to continue drawing new job seekers to the area, as there is steady demand for intellectual capital in the metro.

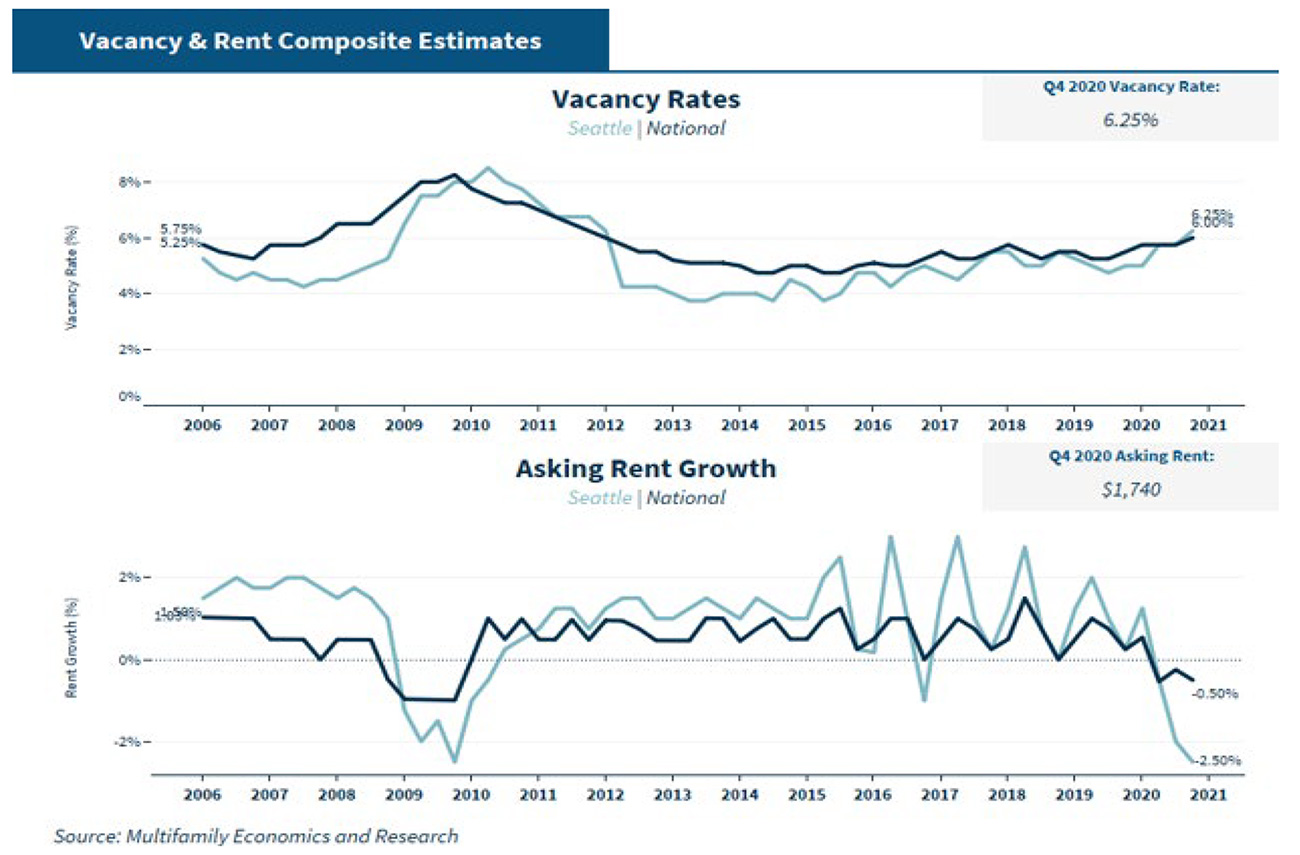

Even though the Seattle metro has a very strong demographic foundation, there are some causes for concern that have emerged as a result of the pandemic. Remote working was prevalent prior to the pandemic, due to the number of high-tech jobs, but it has expanded substantially over the past year. Seattle is an expensive city, and multifamily property owners have not escaped unscathed during the pandemic. Estimated rent growth in Seattle as of fourth quarter 2020 declined by 2.5 percent compared to negative 0.50 percent nationally. In addition, the estimated vacancy rate increased to 6.25 percent as of fourth quarter 2020, which is the highest estimated vacancy level in more than 10 years.

Many employers within the Seattle metro have said that they won’t bring employees back to the office until well into 2021 and perhaps even later. Despite the uncertainty looming in its commercial real estate sector, Seattle’s economy is expected to bounce back rather quickly. Moody’s Analytics forecasts that employment growth over the next five years will expand by 2.9 percent in the Seattle metro compared to 1.8 percent nationally.

Multifamily Development Still Churning

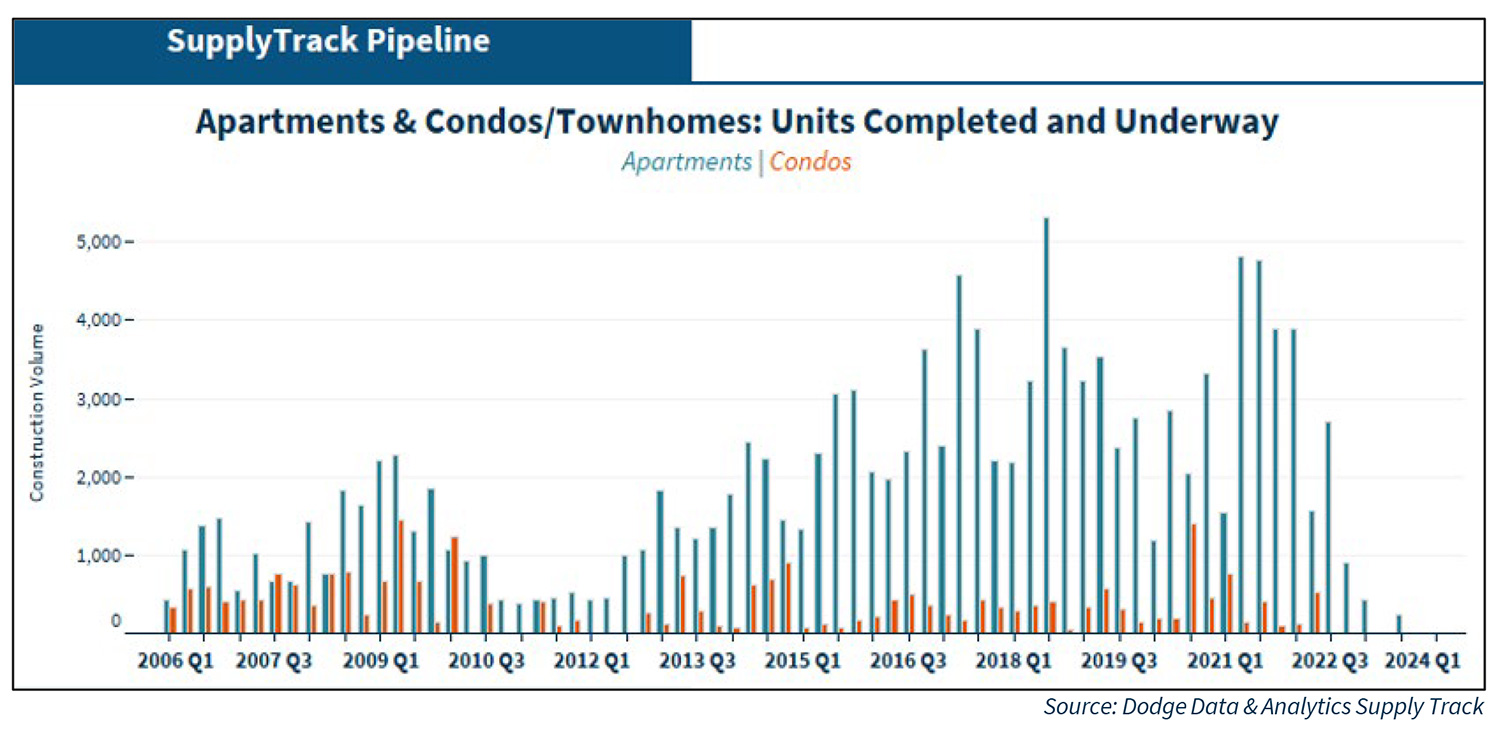

Multifamily development in the Seattle metro area has been elevated over the past several years. Since 2014, over 72,000 apartments have completed. Development really started to reach new levels during 2018 when more than 5,000 apartment units were completed in a single quarter. Since then, nearly 3,000 to 4,000 apartment units have been delivered to the metro each quarter. On the other hand, condo development has slowed tremendously since its peak levels during 2009. Even though condo development has slowed, it has not completely vanished from the supply pipeline as there are still nearly 4,000 condo units underway and scheduled to deliver by the end of 2022.

Even with all that multifamily supply over the past seven years, current construction has not been severely impacted by the pandemic. There are more than 20,000 units underway and scheduled to deliver throughout 2021 and into 2022. Furthermore, there are more than 71,000 units in the planning stages, as many developers continue to believe that the current pandemic will not change the long-term outlook for the metro.

Most of the new development has taken place in just two submarkets: Capitol Hill and Downtown. Together, both submarkets are scheduled to deliver approximately 7,300 units, or about 35 percent, of the total supply underway through 2022. It is not surprising that these submarkets are getting most of the attention from developers as both locations are located near most of the metro’s major employers, as well as local amenities.

Seattle has been very expensive for several years and, as a result, recent concessions have been generous. According to RealPage, a multifamily data vendor, concessions in the Seattle metro area for Q4 2020 were approximately negative 2.4 percent compared to negative 0.7 percent in Q4 2019. Furthermore, the discount on rents for Class A properties was about 10 days of free rent in Q4 2020 compared to just 3 days in Q4 2019.

Seattle’s Outlook Remains Bright

Despite its recent difficulties, Boeing remains one of the Seattle metro’s top employers, and the high-tech sector is expected to be the local economy’s driving force over the long term. Amazon, for example, has expanded in the metro area for several years now. Microsoft is the metro’s third-largest employer with more than 50,000 workers. Google also has a sizeable presence in the metro, with more than 5,700 employees.

We expect the multifamily sector’s performance in Seattle to rebound as the pandemic recedes and vaccinations become more widespread. The passing of the recent stimulus package should allow both renters and property owners some breathing room over the short term. Seattle has a population growth rate that is more than twice the national average, a rate that is expected to continue for the next five years. Furthermore, the growth rate of the prime renting cohort in Seattle is expected to expand much faster than the national rate, which should also help boost multifamily demand, bringing the metro a brighter outlook over the long term.

Francisco Nicco-Annan

Multifamily Economics and Research - Economist – Lead Associate

Rebecca Meeker

Economic and Strategic Research – Market Research – Senior Associate

April 5, 2021

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Economic and Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.