Starts for new multifamily rental and condominium construction have remained robust since the end of 2014, with a minimum of 78,000 units started in each quarter, according to updated data from Dodge Data & Analytics. The number of new apartment rental units started during second quarter 2019 totaled approximately 95,100; this figure is up from 91,600 in the prior quarter, though down from the average of 105,300 units started in each of the last three quarters of 2018. An estimated 421,500 units were started during 2018; the vast majority remain in the multifamily rental category, while just 52,000 were condos. This trend continues to be true in 2019.

Census Bureau starts remain up

The Census Bureau’s estimated multifamily starts, which include condominiums, were up 12.6% year over year as of second quarter 2019, at an annualized rate of 411,000 units. Our Economic and Strategic Research Group forecasts that multifamily starts (2+ units) will remain steady in 2019 at about 373,000 units — down a slight 0.3% from 374,000 units in 2018 — but will then decline in 2020 to approximately 347,000 units. The overall level of multifamily construction starts continues to be well above the 1989-2008 historical average annual rate of 260,000 units started but remains well below the record 1 million units started in 1973 and 700,000-plus started in 1985.

Construction pipeline remains elevated

Dodge Data & Analytics’ pipeline data continues to show a robust level of new apartment rental units currently underway: More than 612,000 units are under construction as of October 2019 — up from 597,000 in January 2019 — as illustrated in the chart below. The number of condo units underway has remained generally steady, with approximately 60,000 units as of October 2019 — down slightly from approximately 61,000 in January 2019.

Major markets see major supply; national supply shortage continues

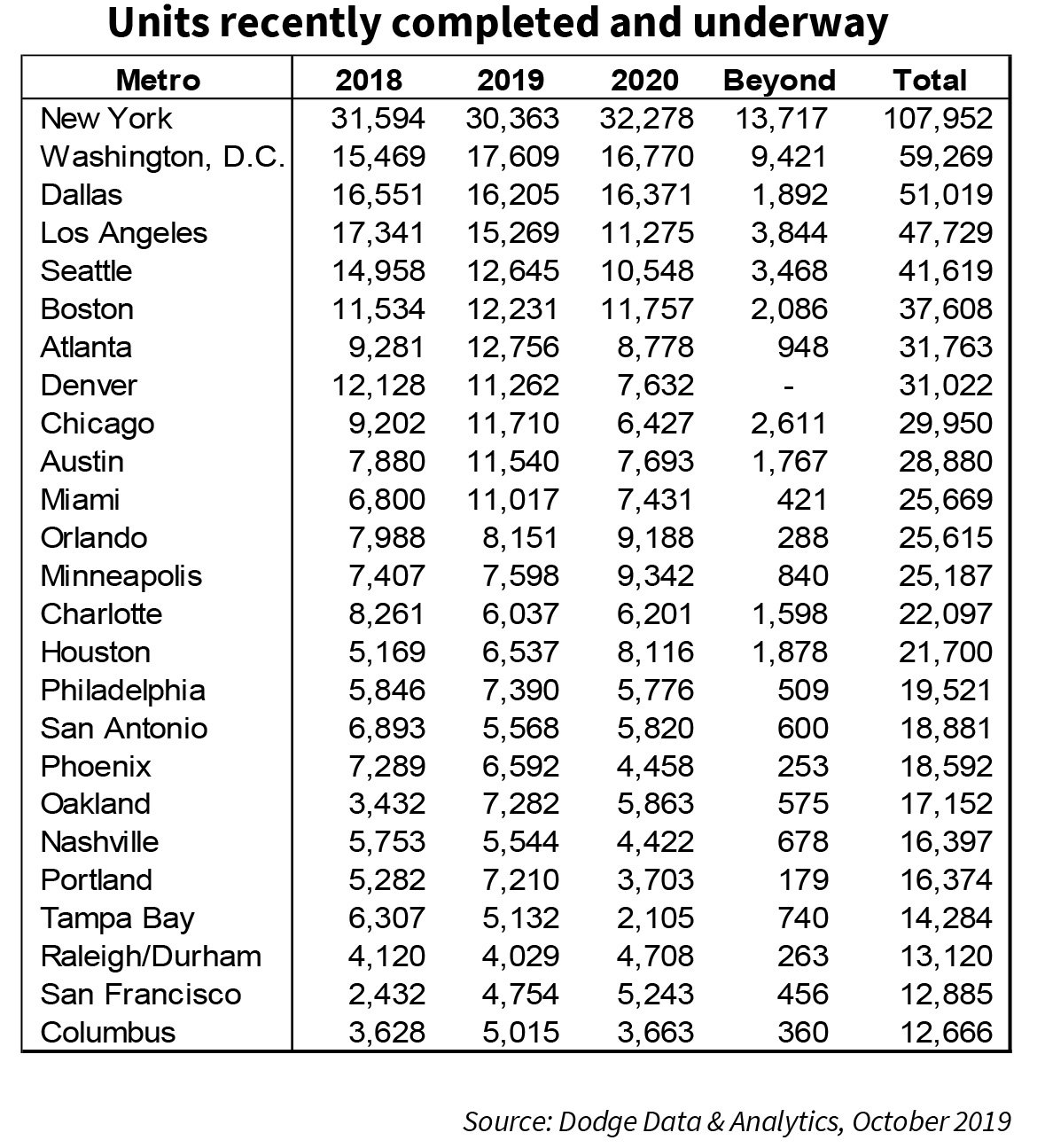

The metropolitan areas with the most active apartment development in the country continue to be New York, Washington, D.C., Dallas, Los Angeles, and Seattle — each with more than 40,000 units underway. Boston, Atlanta, and Denver follow with slightly fewer units underway. Rounding out the top 10 are Chicago and Austin.

While the short-term surge in supply in some of these metros might be ill-timed from a market-in-balance perspective, we expect nearly all of the multifamily rental housing being built today and over the next several years to be absorbed fairly quickly due to the demand created by these metros’ respective economic and demographic growth forecasts.

While we expect some of the markets in the table on the right will see some short-term deterioration as the robust supply is out-matched by somewhat moderated demand, on a national level, there continues to be a housing shortage for both multifamily and single-family properties. The level of housing construction since the end of the Great Recession, including the recent delivery surge of 2017 through 2019, has not been significant enough to satisfy the needs of a growing population and expanding economy.

According to Dodge Data & Analytics, the number of projects started across the country peaked in the second quarter of 2015 and has remained high since then, with only moderate volatility. A total of 936 projects were started during second quarter 2019 — up from 893 in the first quarter — as seen in the chart above. The average number of units also continues to be generally steady, with about 102 units per project.

Highly supplied metros likely to see easing

As has been the case since 2014, new supply coming online through and beyond 2020 is concentrated in several metros, some of which we believe are likely to experience softness in occupancies. Steady demand continues to be expected, but the vast majority of new development will likely be in the more luxurious segment of these markets, and competing properties might see amplified softness. Rising vacancy levels and reduced or negative rent growth could affect the overall metro trend in oversupplied metros. However, this slowdown is expected to be modest and brief. Once the supply surge subsides, we expect the strength of multifamily’s underlying fundamentals to continue— including stable job growth and strong demographic trends — resulting in increased demand and a stable apartment market.

Tim Komosa

Economist Manager

Kim Betancourt

Director of Economics

Multifamily Economics and Market Research

October 2019

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Multifamily Economics and Market Research Group (MRG) included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the MRG bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the MRG represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.