Investor Interest in Manufactured Housing Communities Remains Strong

The ongoing increase in multifamily asking rents over the past several years has prompted many renters to seek lower cost housing alternatives, including renting factory-built homes located in a Manufactured Housing Community (MHC). Although most MHCs rent sites to owners of manufactured homes so they can access electricity and other utilities, there are a number of these communities that also rent out manufactured housing units themselves. The combination of renewed renter and homeowner interest in MHCs has not been lost on some real estate investors. As a result, 2018 MHC volumes were higher than they’ve been at any point since the end of the Great Recession in June 2009.

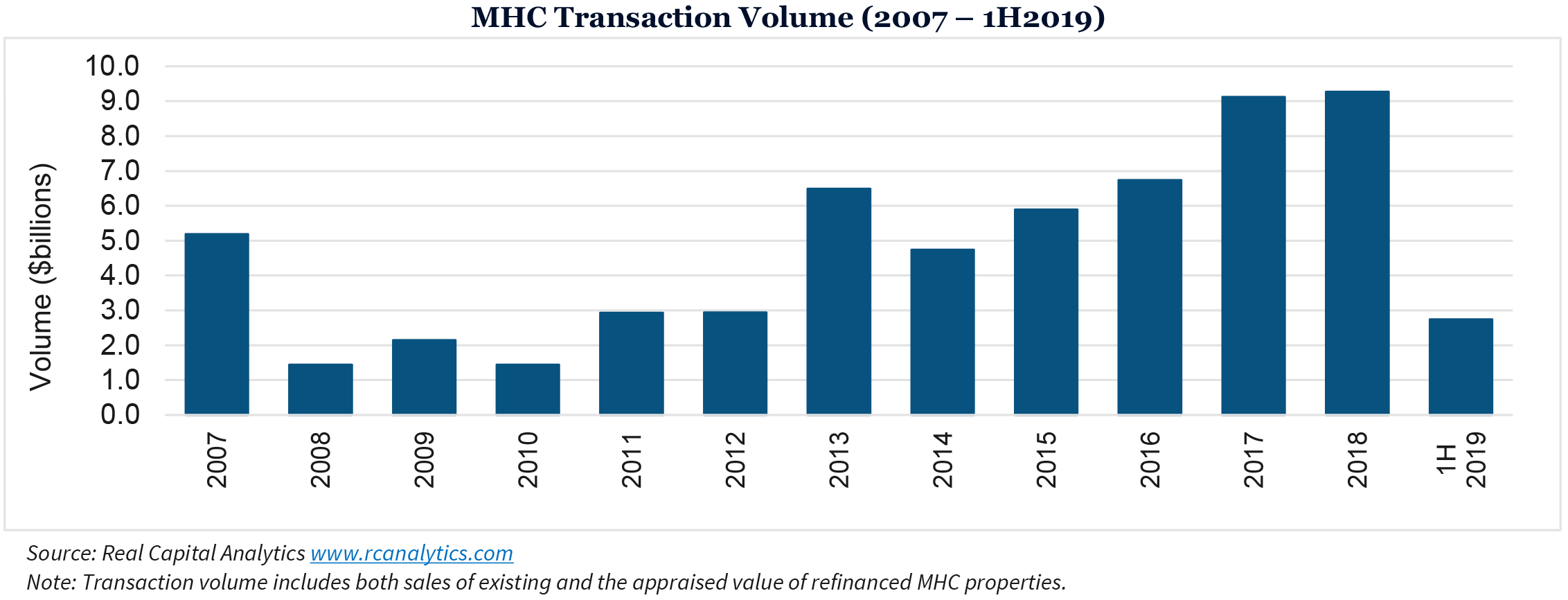

Transaction Volume Continues to Rise

Although not a comprehensive source of data for MHC property sales, Real Capital Analytics (RCA) provides a window into the MHC sector. As shown in the chart below, last year was another strong year for MHC. Transactions involving MHC properties totaled an estimated $9.3 billion in calendar year 2018, compared to an estimated $9.1 billion in 2017. RCA recorded just under $3.0 billion in transactions in the first half of 2019. Transaction volume may rise in the second half of 2019 as there is speculation that some owners of smaller MHCs will take advantage of ongoing investor interest and sell their properties to help fund retirement plans.

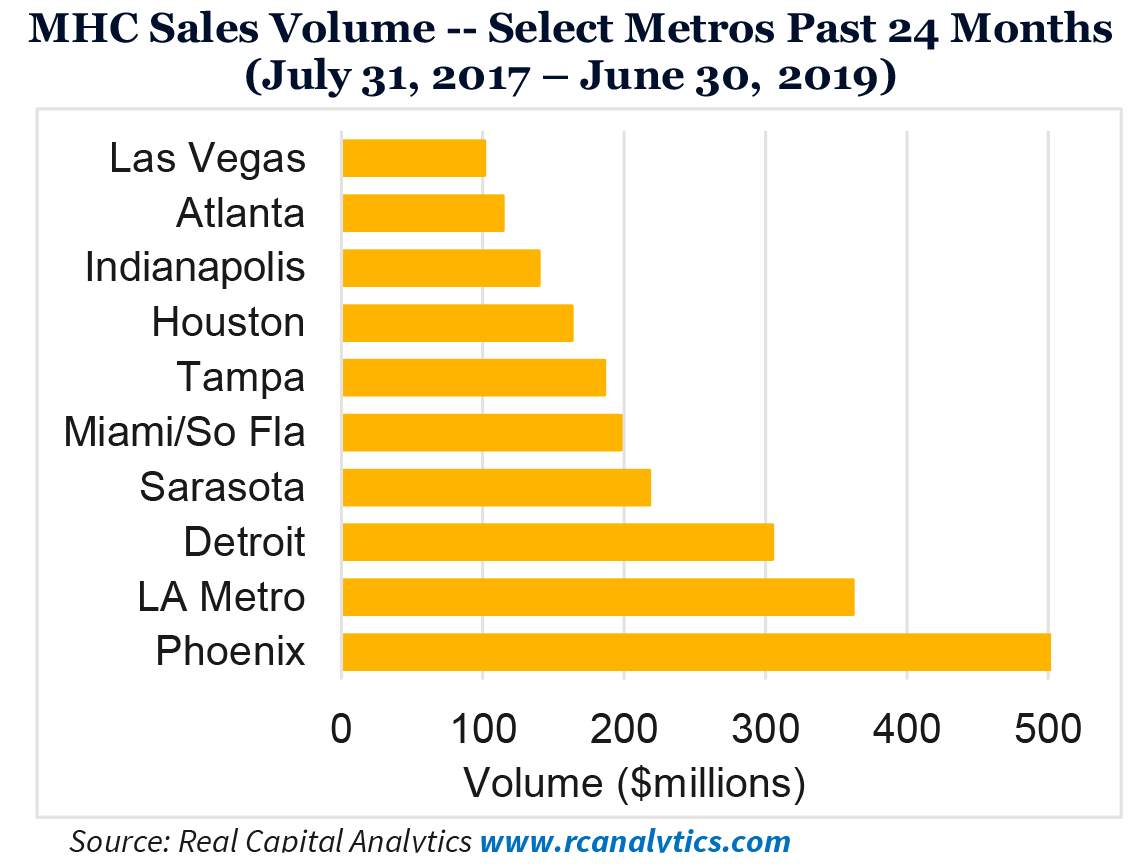

Phoenix Dominates Sales

The Phoenix metro area dominated transactions over the past 24 months with about $500 million in sales. This is largely due to the one-time sale of the Tricon Capital Group MHC portfolio of 14 properties for an estimated $172 million in June 2018 to Blackstone Real Estate Income Trust, Inc. (BREIT), an institutional investor.

Sarasota Also Active

Sarasota, which is a much smaller metro than Phoenix, appears to have had a lot of sales over the past two years. However, this is due to just a couple large transactions. In 2018, Cove Communities purchased the 968-unit Camelot Lakes and Camelot East MHC from the Ivy Foundation for

$165 million. In 2017, Northwestern Mutual purchased the 645 Gardens of Parrish from an individual owner, Edward Mihevic, Jr.

MHC Investing Goes Beyond REITs

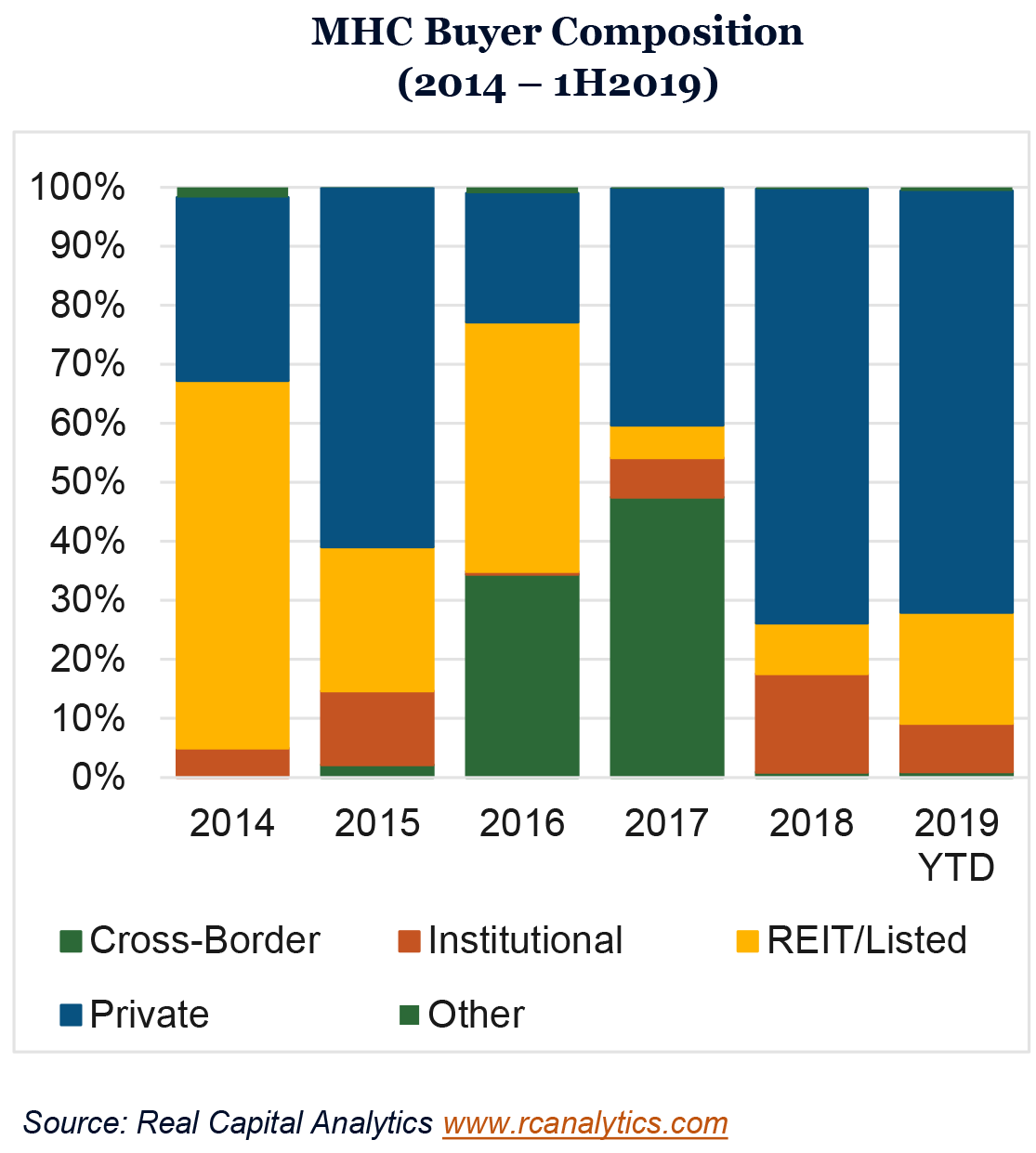

While publicly listed REITs have remained active in the MHC sector, private entities had the highest share of investment in MHCs through mid-2019. Private investors, which include privately-owned companies and real estate developers, represented just over 70 percent of MHC purchase volume through the end of June 2019, followed by public REITs with just under 20 percent. Institutional investors – which include insurance companies, equity funds, and sovereign wealth funds – came in third with just under 10 percent of purchase volume.

Drop Off in Global Investors

Global investment in U.S. MHC appears to have decreased in 2018 and going into 2019. However, the decline is likely not as dramatic as it appears. Global investment was particularly strong in 2017 primarily due to a single large portfolio transaction in which the Government of Singapore Investment Corporation (GIC), the sovereign wealth fund of Singapore and its affiliates, invested almost $1.5 billion to gain a majority interest in 178 MHC properties sold by Yes! Communities. Over the past five years, Canada remained the top global investor in MHC, investing about $2.2 billion to obtain just over 155 properties.

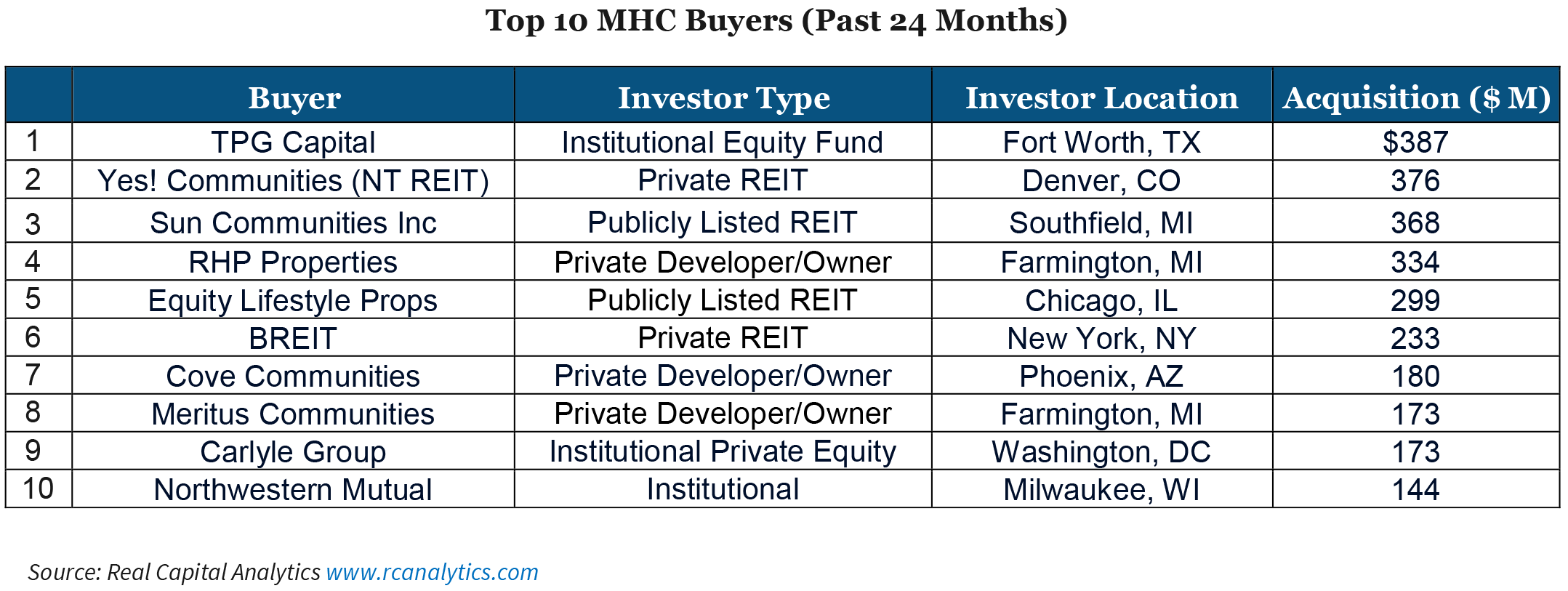

A Variety of Top MHC Investors

The top buyers have been evenly dispersed recently with regard to acquisition volume. TPG Capital, an institutional equity fund based in Fort Worth, was the top MHC investor over the past 24 months, investing almost $390 million on about 78 MHC properties. The second most active buyer was Yes! Communities, a non-publicly traded REIT located in Denver, investing just under $480 million on 30 properties. Rounding out the top three investors was publicly listed REIT Sun Communities Inc., one of the largest owner-operators of MHC properties, which invested almost $368 million on just 15 properties. Sun Communities bought larger communities in higher cost areas which was reflected in its average price per MHC of $25 million, compared to TPG Capital’s average price of just $5 million.

One relatively new company that has been very active over the past two years is Meritus Communities. Founded just six years ago, it has acquired over 50 properties and over 20,000 sites. While many are in Michigan, Meritus has been acquiring properties in other states, including Texas, Alabama, Ohio, and Indiana.

Few New MHC Properties Being Built

MHC properties are aging, with 68 percent of the stock having been built prior to 1980, according to MHC data vendor Datacomp/JLT. In fact, currently fewer than 10 new MHC properties appear to be under construction. The vast majority are in rural areas.

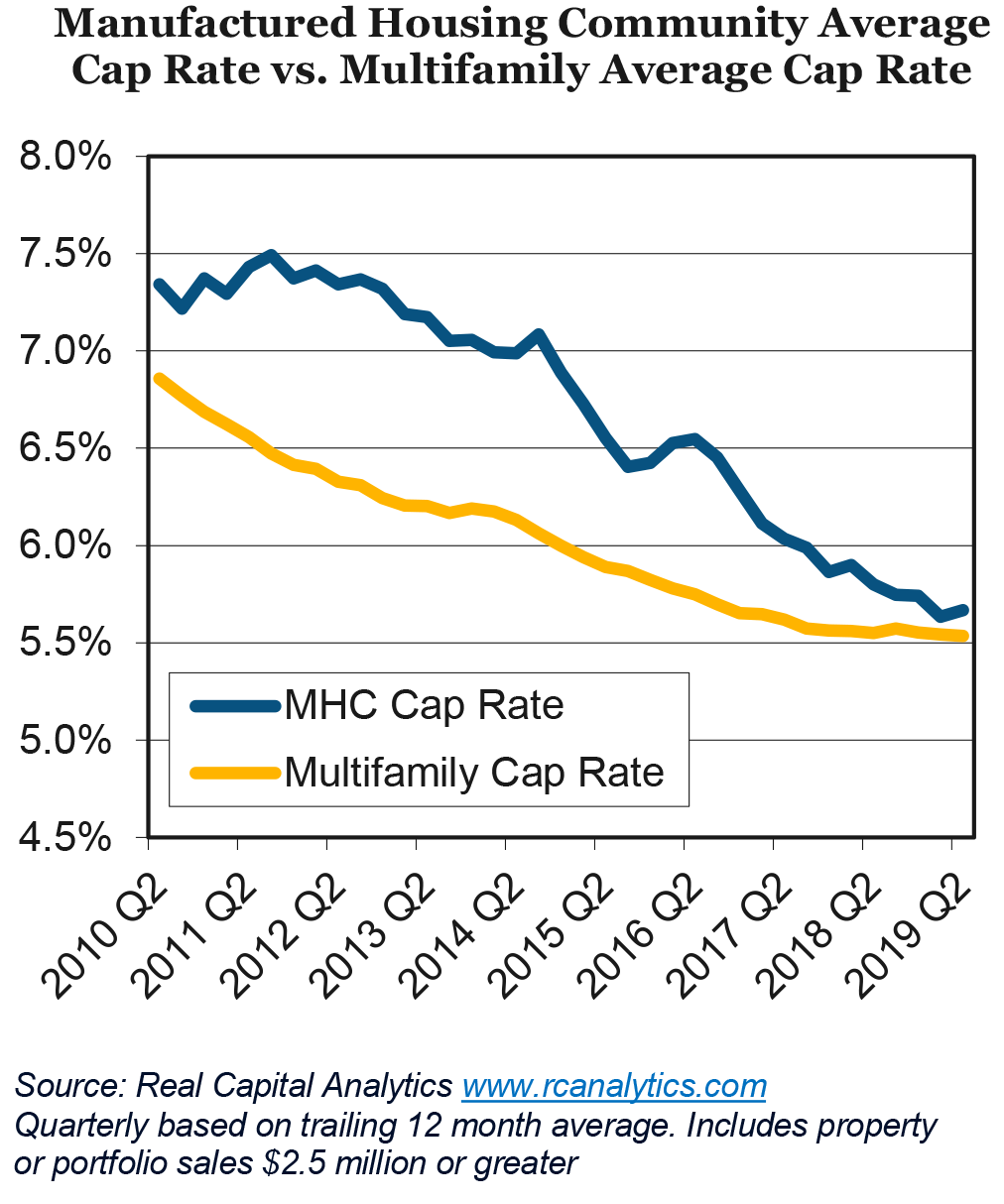

MHC Cap Rates Remain Low

With ongoing interest from a wide variety of investors, and few new communities being built, capitalization rates for institutional-quality MHCs have declined significantly in recent years. As of second quarter 2019, RCA estimates that MHC cap rates are 5.7 percent, slightly lower than the 5.8 percent cap rate a year ago in second quarter 2018.

There is quite a bit of variation in cap rates, however. Smaller MHCs tend to have much higher cap rates. For instance, the 71- unit Shady Oaks Mobile Home Park near Portland, ME, was underwritten with a 6.9 percent cap rate, according to RCA. Nevertheless, on average, cap rates have declined considerably since the recent peak of 7.5 percent for MHCs recorded in third quarter 2011.

Average Sales Price per Unit Continues to Increase

The average price per MHC site was about $60,000 as of second quarter 2019, according to RCA. While this is about 50 percent higher than the estimated $40,000 per site recorded as of fourth quarter 2007, it remains a fraction of the $157,000 average sales price per unit recorded for multifamily properties.

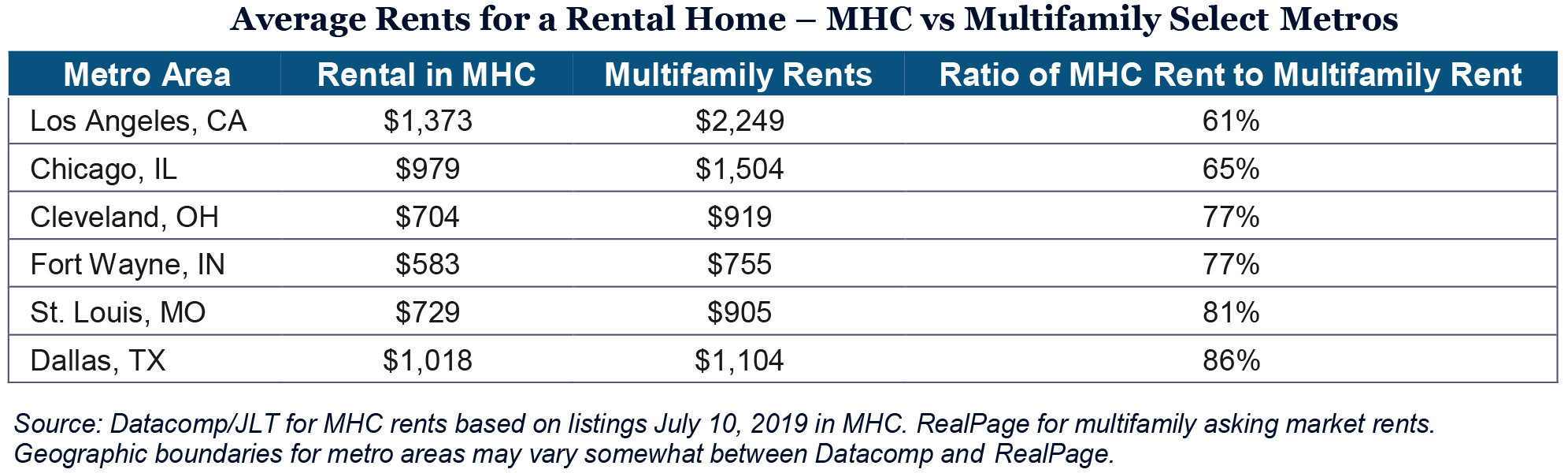

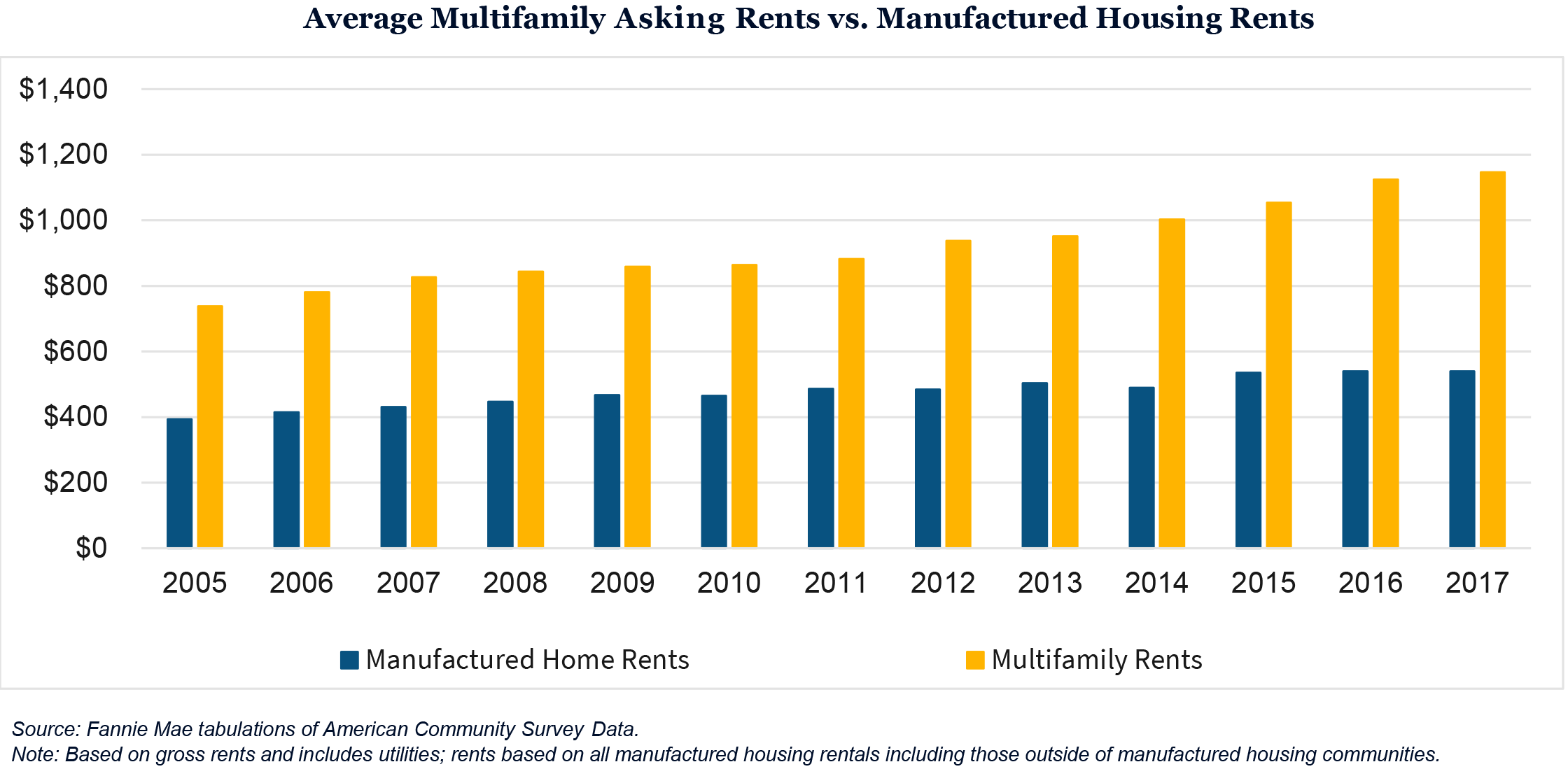

MHC Rents Are Generally More Affordable than Multifamily Rents

Despite the lack of new supply, rentals in MHC properties are generally less expensive than apartments. The average MHC rent nationwide has been about half that of a multifamily unit over the past decade. According to recent data from Datacomp/JLT, the average rent for a pre-owned manufactured home in the Fort Wayne metro area was just $583, approximately three-quarters of the average rent for a multifamily unit. However, the savings are even higher for an MHC located in a major metropolitan area. For instance, the average rent for an MHC unit in the Los Angeles metro is $1,373, just 61 percent of the metro’s average estimated rent for an apartment. Nationwide, the asking rents on all manufactured housing rentals, including those on individual plots of land, remain at about half of multifamily rents, making them often a more affordable option for many renters.

Fannie Mae Finances MHC

Fannie Mae’s Multifamily business provides financing options for MHCs where the borrower owns the MHC property along with the associated common amenities and infrastructure and leases the individual pad sites to the owners of the manufactured homes. Multifamily lends on the income generated from the pad rents. Tenants typically own their manufactured homes. However, up to 25 percent of homes may be rentals provided by the MHC owner. Fannie Mae’s MHC financing activity is excluded from the Federal Housing Finance Agency (FHFA)-imposed multifamily annual maximum cap on lending volume for the GSEs. In 2018, Fannie Mae financed $2.9 billion in MHCs, which represented an increase of 56 percent from the $1.9 billion in multifamily MHC loans financed in 2017.

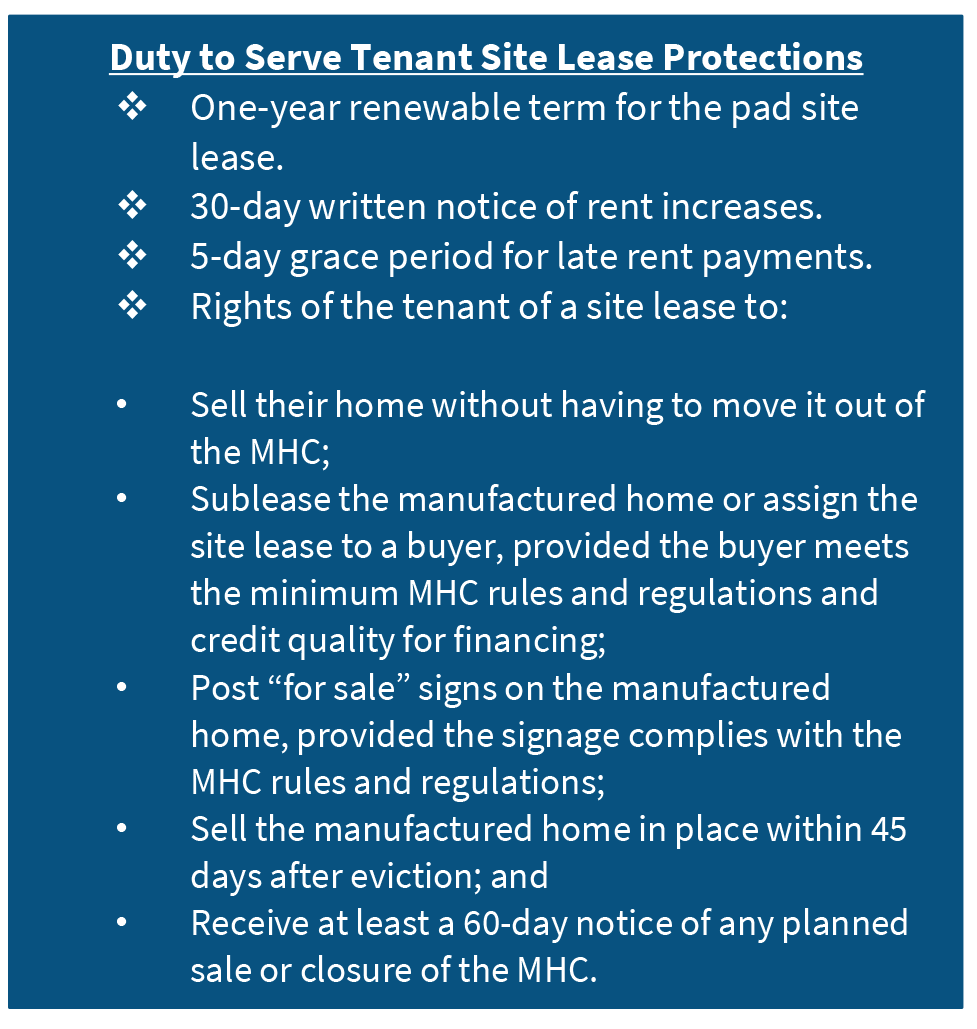

Duty to Serve Encourages Tenant Site Lease Protections

In many states, MHC residents do not have the same tenant protections afforded to tenants living in other multifamily properties. There is no national standard, and in fact no state or local jurisdiction currently requires all of the tenant protections mandated by FHFA under the Duty to Serve (DTS) program for tenants in MHC.

Fannie Mae offers pricing discounts for borrowers who institute these Tenant Site Lease Protections on at least 25 percent of pad sites and higher discounts for protections on at least 5o percent of sites.

In 2019, Fannie Mae financed Harmony Pointe MHC through a $4.75 million loan closed through Berkadia Commercial Mortgage LLC. Harmony Pointe is an age-restricted MHC in West Carrollton, OH with 124 pads and one apartment. The borrower worked with tenants to convert leases on at least 50 percent of the sites. Residents signed an addendum to their lease that included the DTS requirements for site lease protections. This transaction was notable because Ohio is a state with very few MHC tenant protections.

Fannie Mae’s MHC Portfolio Continues to Perform Well

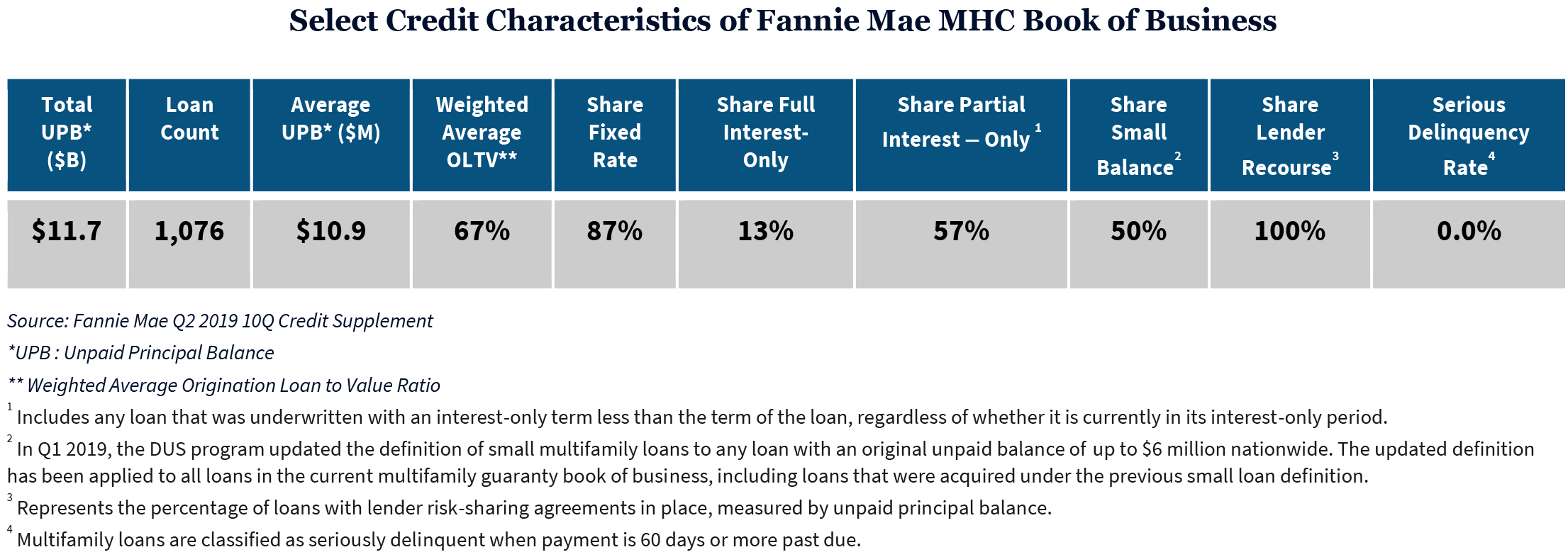

As of second quarter 2019, Fannie Mae had just over 1,000 loans on MHCs with a total unpaid principal balance (UPB) of over $11 billion. The loans were performing well with no serious delinquencies, as of second quarter 2019. While the average UPB was $10.9 million, approximately half of the loans had an original unpaid balance of $6 million or less at origination, indicating most transactions involved smaller properties.

Continued Investor Interest Expected for MHC

According to third-party MHC data vendor Datacomp/JLT, there are about 38,000 existing MHC properties and only a handful of new communities are being built or expanded. With rents for manufactured homes typically more affordable than those for traditional multifamily units, there is no shortage of demand by a wide variety of renters, whether they are lower income households or retirees living on fixed incomes. An expectation of strong demand for affordable rental housing, continuing low interest rates, and a dearth of new supply supports continued strong fundamentals in the MHC sector. As a result, investor interest is expected to remain strong in this segment of the multifamily market over the next 18 months at least.

Tatyana (Tanya) Zahalak

Senior Economist

Multifamily Economics and Market Research

August 2019

Opinions, analyses, estimates, forecasts and other views of Fannie Mae's Multifamily Economics and Market Research Group (MRG) included in these materials should not be construed as indicating Fannie Mae's business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the MRG bases its opinions, analyses, estimates, forecasts and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts and other views published by the MRG represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.