Fannie Mae’s National Housing Survey® asks respondents a series of questions intended to better understand housing sentiment, including questions regarding renting, homeownership, and both current and future expectations of the housing sector. The survey focuses on six groups of respondents: homeowners, single-family renters, multifamily renters, renters aged 18-34, and renters aged 35 and older. The most recent renter survey, conducted during the first quarter of 2020, yielded some interesting findings, including from renters aged 18-34, the prime renting cohort for the multifamily sector comprised of both Millennials and Generation-Z (Gen-Z).

Some of the trends identified in the survey differed from just a few years ago. One of the most interesting is that the prime renting cohort’s desire for eventual homeownership appears to be softening. Even though this group still believes that owning makes the most financial sense, there are several key reasons why their stance on homeownership appears to be waning: it is often cheaper to rent than to own a home; renting offers more flexibility in housing choices; and renting is less of a “hassle” than owning. Still, the majority of the prime renter cohort aspire to achieve homeownership at some point during their lifetime. Within the last few weeks a major economic shock occurred within the United States related to COVID-19, and the survey data referenced throughout this commentary was gathered prior to that shock.

Demographics of Survey Participants

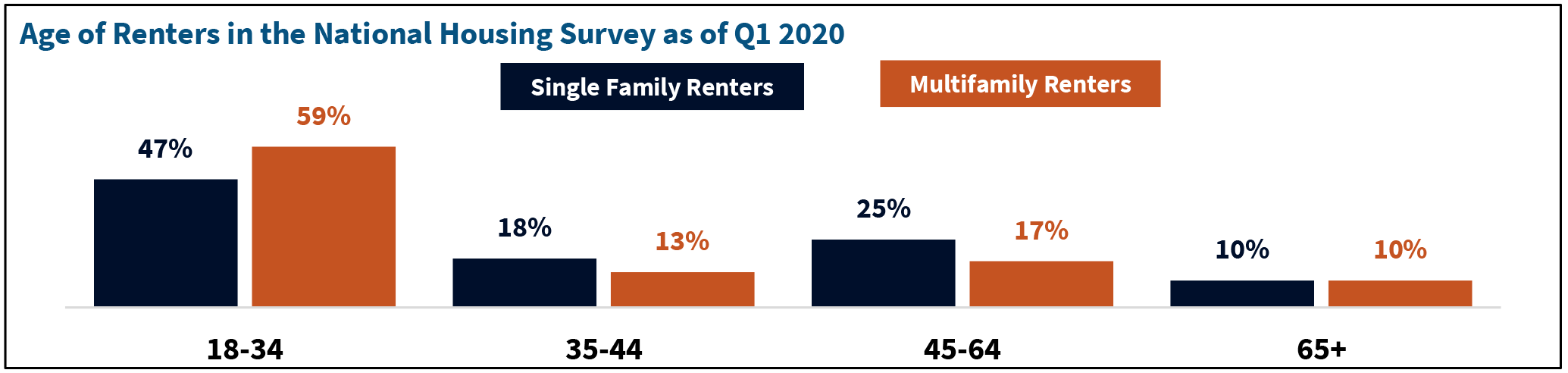

Of the respondents polled, approximately 59 percent were multifamily renters aged 18-34. That percentage is the highest among all multifamily renters polled to date. Furthermore, nearly one-third of those multifamily renters earn less than $25,000 per year, or about 28 percent. The next highest income bracket for multifamily renters was $50,000 to $100,000 per year; approximately 28 percent of respondents fell within this income range.

Regarding educational attainment, approximately 29 percent of multifamily renters had some college experience, while 27 percent of multifamily renters graduated from high school. One of the most telling demographic characteristics of the multifamily survey respondents was that approximately 61 percent were single. Having a high concentration of single multifamily renters corroborates our belief that most multifamily renters, especially those in the prime renting cohort, are multifamily renters for both financial and lifestyle purposes.

Homeownership Still Valued as a Financial Investment

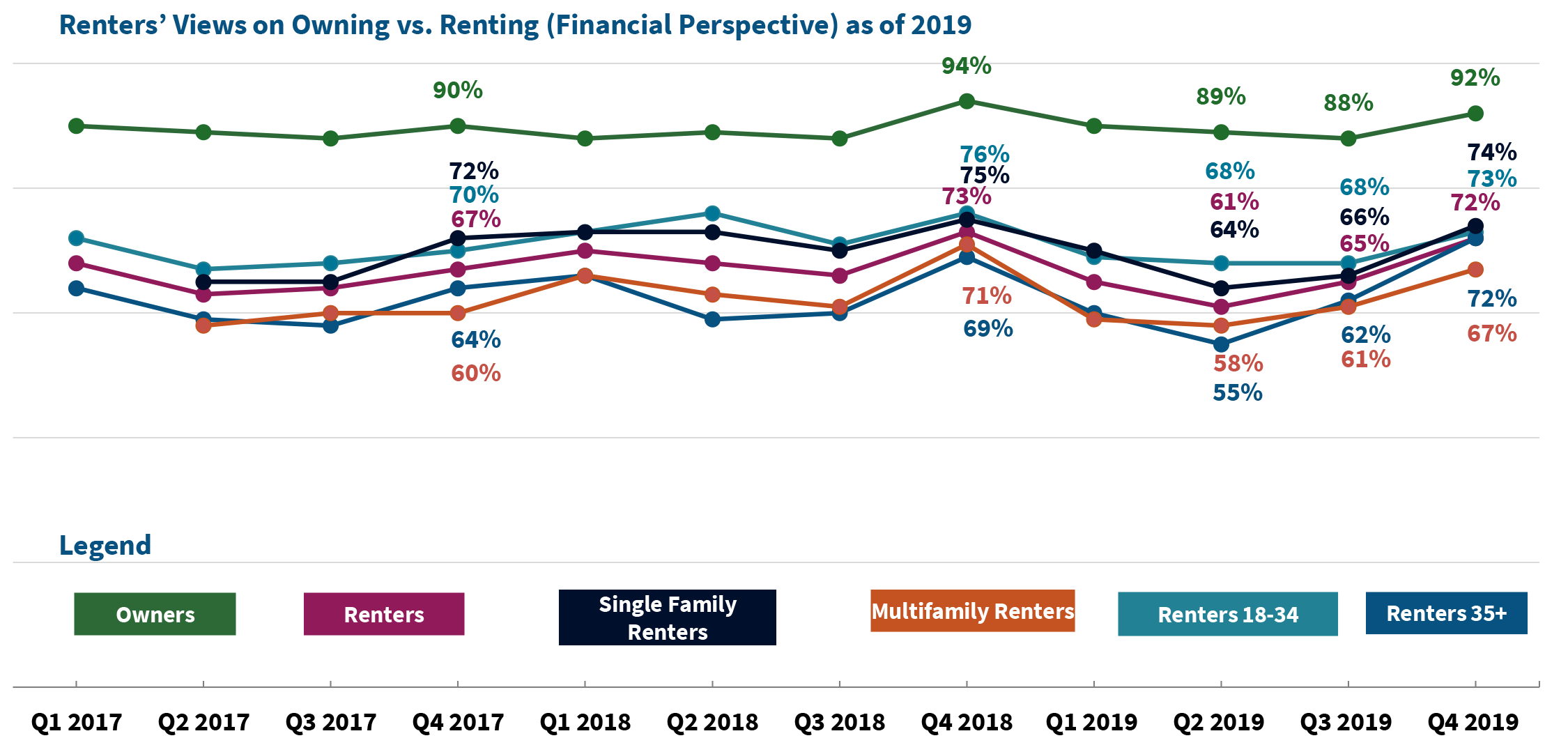

They survey also asked about renters’ impressions of homeownership. The questions were framed from both a lifestyle and a financial perspective, and the answers for each were slightly different.

From a financial perspective, approximately 73 percent of the prime renter cohort believe homeownership is more sensible than renting. However, from a lifestyle perspective, only 56 percent of the prime renter cohort believed homeownership is more sensible. The underlying data from the survey responses shows that the prime renter cohort appears to favor flexibility and location.

Not All Renters Experienced Rent Increases

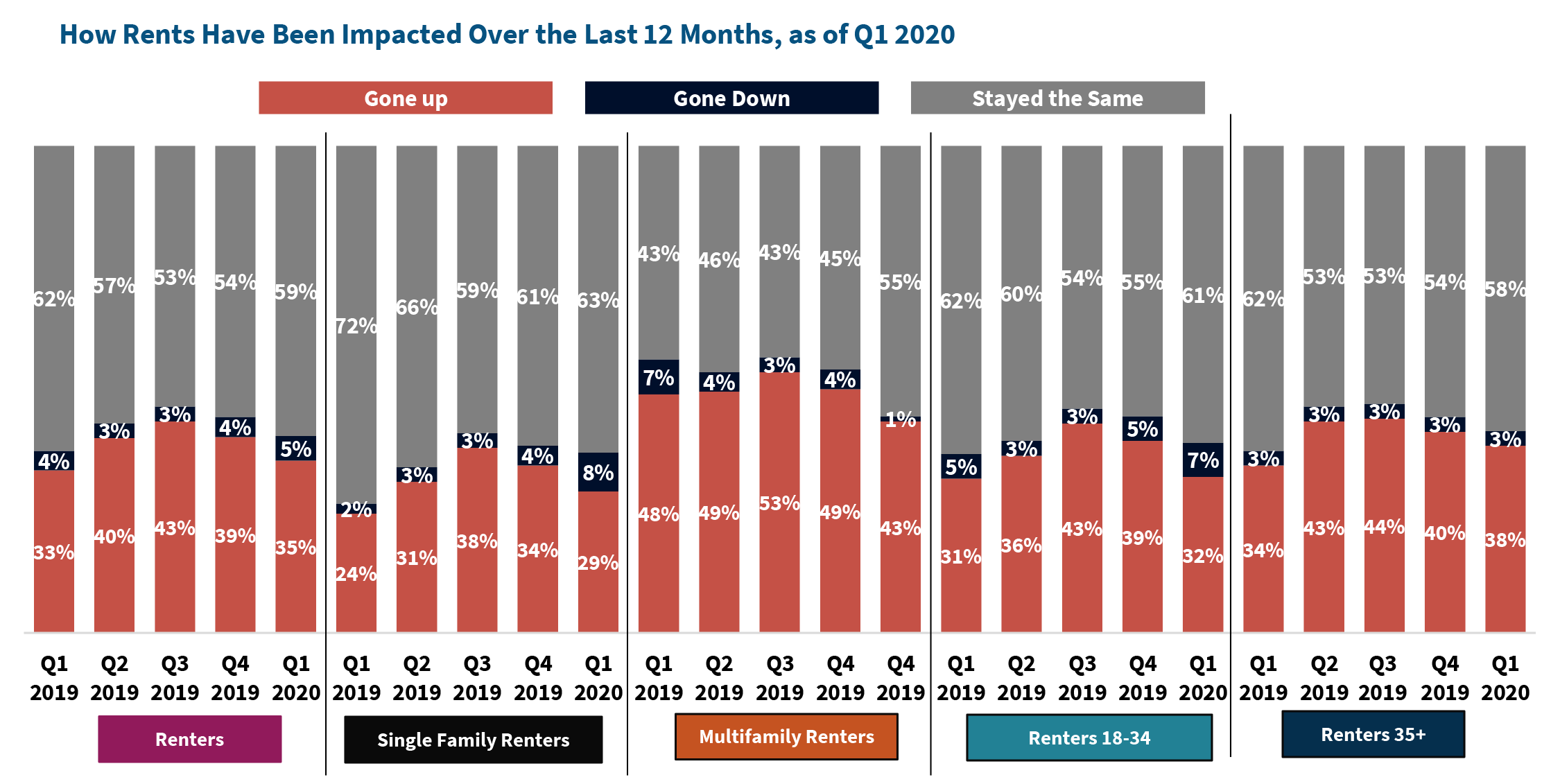

They survey also asked about rent levels over the past year. Of the prime renter cohort, 61 percent stated that their rent levels had mostly stayed the same. However, nearly 32 percent said their rent had increased. There are a myriad of reasons why rents can change over a given year, including local supply and demand drivers.

However, for those respondents whose rent level stayed the same, the result might be attributable to lease renewal timing. Historically, renters prefer not to move during the colder months of the year (Q4 and Q1) and, as a result, they could be reporting similar rents over a 12-month timespan. In other words, their rent remained unchanged since it was not time to renew their lease.

Renting as a Path to Homeownership

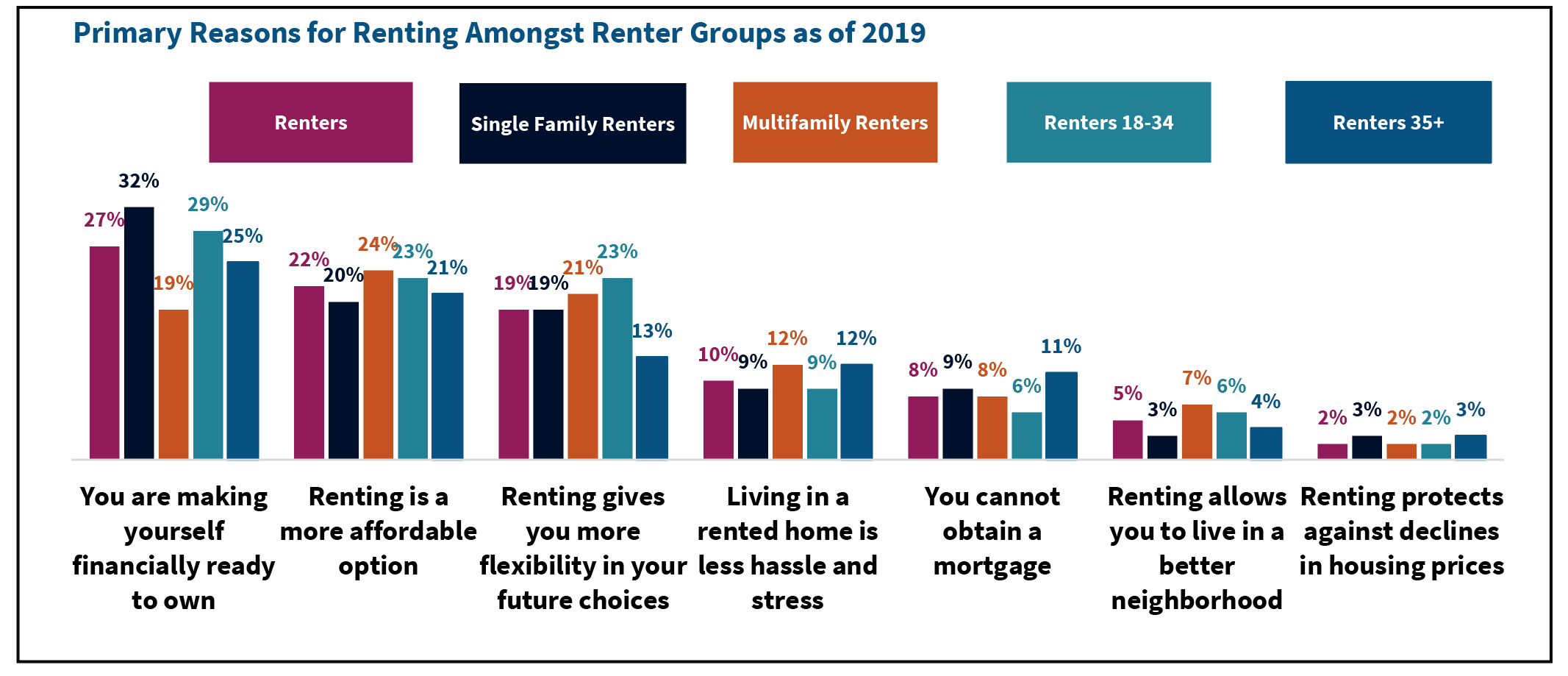

Unsurprisingly, another key finding is that there are a number of reasons why people rent, and they are not all due to financial constraints. For example, the primary reason among the prime renting cohort is that they’re preparing their finances to one day own the home they desire (and not necessarily that they can’t afford any home) – and renting allows them greater flexibility to do so.

Other Reasons for Renting

According to the survey, approximately 29 percent of prime renter cohort respondents said that they were preparing for eventual homeownership but had no definitive timeline in mind. Furthermore, approximately 23 percent of the same respondents indicated that renting is simply the more affordable option at this point in their lives. This response makes sense, since there are a number of metro areas across the country that have attracted new prime renter cohort-aged residents over the past decade, but local housing prices remain out of reach for many of them. These metros include some of the nation’s most expensive locations, including New York City, San Francisco, San Jose, and Seattle. And it is not just in these expensive, more coastal metros.

According to the National Association of Realtors, since 2017 single-family home prices have increased by approximately 10.4 percent ($248,800 in 2017 compared to $274,600 in 2019). It’s unsurprising that rising home prices would make renting far more attractive for those who aspire to own someday as they continue to save to buy a home.

Furthermore, the prime renter cohort respondents stated that they found it was difficult to save the money necessary for a down payment on a home. One of the more interesting findings was that 23 percent of the prime renter cohort respondents believed that renting provides more flexibility for future housing choices. Even though the prime renter cohort clearly aspires to own a home at some point in their lives, they also prioritize and desire the flexibility that renting offers them now and in the near future.

The survey also found that renter respondents had some obstacles that explained why some of them may be renting indefinitely, even though they aspire to own a home. Forty-four percent of the prime renter cohort respondents felt that the biggest obstacle to homeownership was having enough money available for either a downpayment or closing costs. Furthermore, approximately 50 percent of the prime renter cohort respondents feel as if they do not have the necessary credit score or credit history to obtain a mortgage.

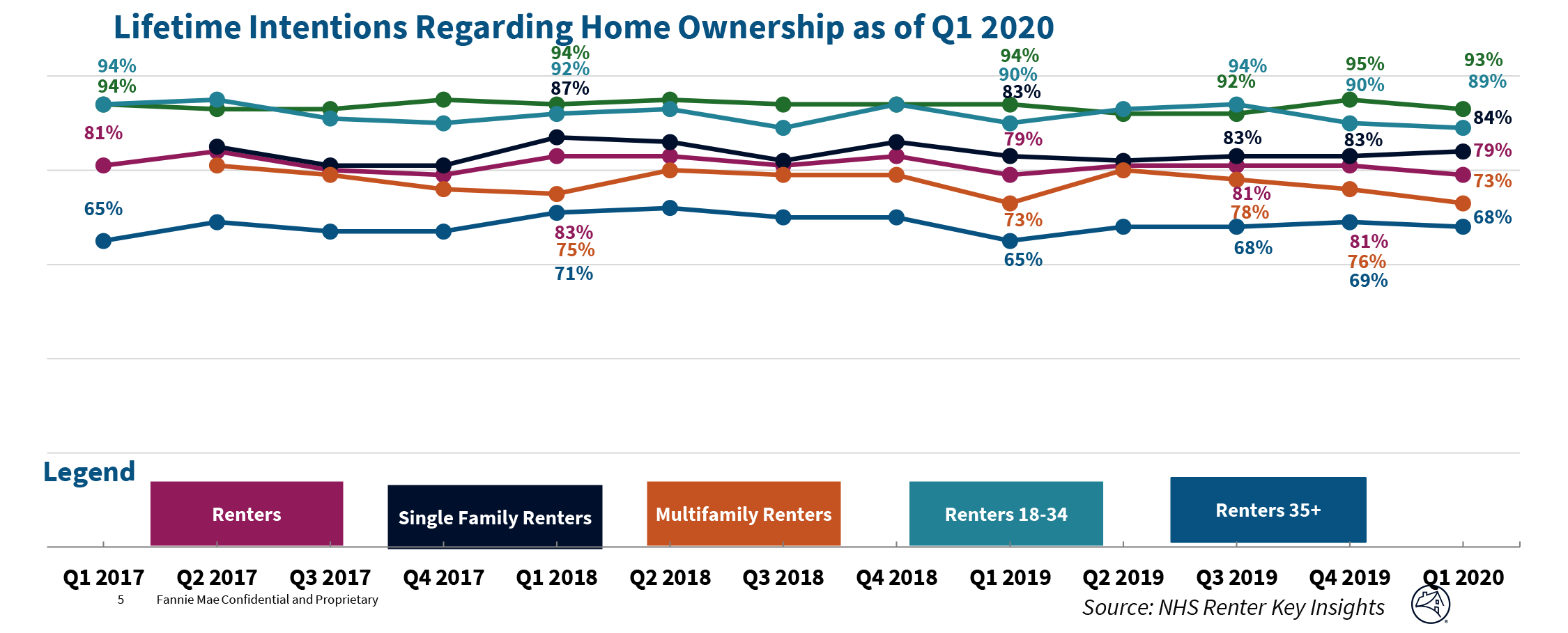

Homeownership is Still the Dream

Even though some of the results in the survey indicate that the prime renter cohort’s stance on eventual homeownership is softening, the dream of owning a home is still alive and well. The main trend that has changed recently is that the prime renter cohort seem to aspire to own a home at a later time in their lives than previous generations. One of the questions that was asked regarded lifetime homeownership aspirations. For the prime renter cohort, approximately 89 percent of the survey respondents stated that they intend to purchase a home in their lifetime, the highest of all the renter age groups surveyed.

Even though the softening of homeownership aspirations from the prime renter cohort may not be ideal for the single-family sector, it is likely good news for the multifamily sector. Rising single-family home prices nationwide is also a contributing factor to many renters putting off homeownership for a longer period.

The Millennial generation is currently the most populous age cohort; however, as Millennials age, their housing desires are expected to change. The new emerging adult-age cohort, Gen-Z, may have different housing needs and desires from Millennials. It will be interesting to see how Gen-Z shapes the future of housing – both rental and owned – as they compete with Millennials for housing over the coming decades.

Francisco Nicco-Annan

Economist

Steven Deggendorf

Director Market Research Insights

Sarah Shadad

Market Insights Researcher

Multifamily Economics and Research

April 14, 2020

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Multifamily Economics and Research Group (MRG) included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the MRG bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the MRG represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.