The spring 2021 semester provided a glimpse of what could potentially come for the student housing sector in fall 2021. Compared to both semesters in 2020, spring 2021 showed a sector that was recovering at a rapid pace. Now that fall has arrived, the turbulence experienced throughout 2020 for the sector is likely in the rearview mirror. Early returns for fundamentals in the sector are performing extremely well and even exceeding pre-pandemic highs.

Even though the fall 2020 school year (the first full semester of the pandemic) was not as disastrous as many student housing investors and developers anticipated, they were eager for a return to the pre-COVID days. Indeed, the student housing sector has normalized at a rate much faster than market participants expected. Student enrollment rates bear watching, however, as both declining enrollments and birth rates may present long-term challenges for the sector.

Supply Largely Uninterrupted, For Now

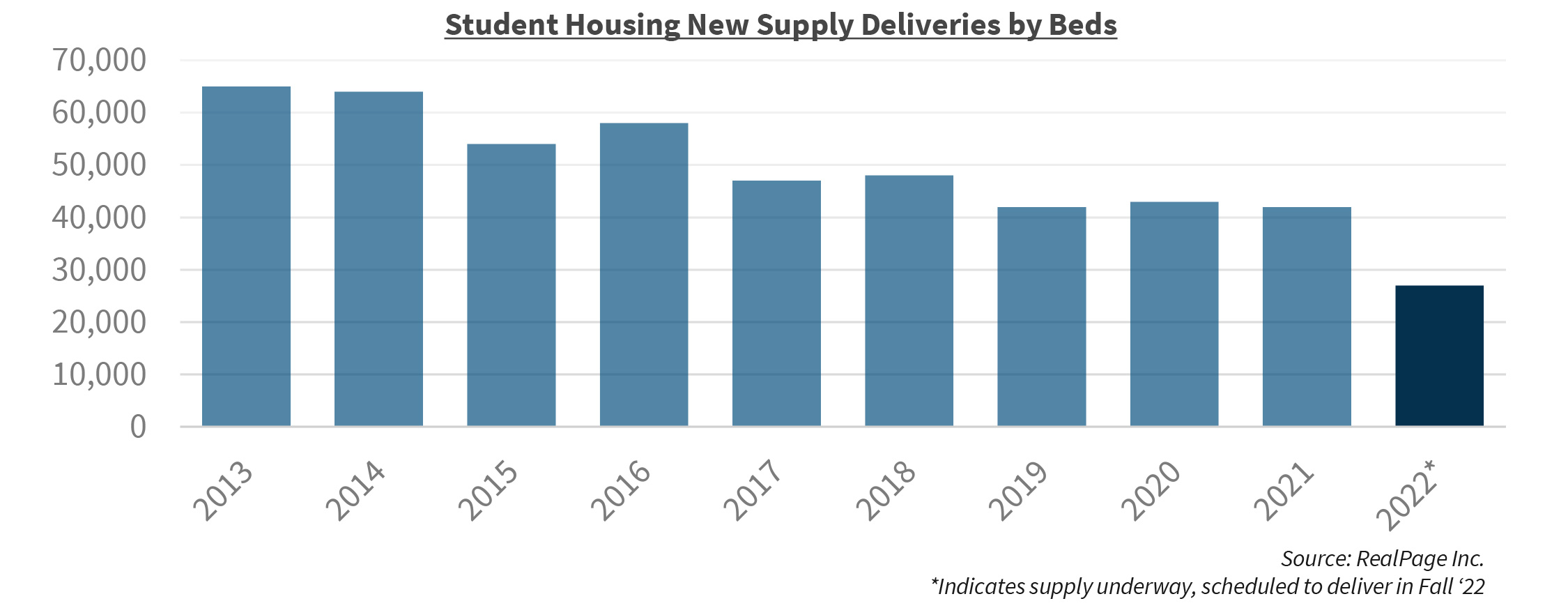

Supply has been one of the most prominent fundamentals of the student housing sector and one that catches the attention of all at the start of each new school year. For the last few school years, supply had mostly moderated and was put on the back burner relative to more pressing issues within the sector. During the height of the pandemic in 2020, construction was considered essential and was largely unhindered. With minimal disruptions during construction, there were approximately 42,000 new beds delivered in time for fall 2021, which was practically level with fall 2020’s levels of 44,000 new beds, according to data from RealPage, Inc.

Even though supply and deliveries were not disrupted in 2020 and in 2021, the impacts of supply chain disruptions are being felt in advance of the fall 2022 school year. Practically every industry around the world has been impacted by the supply chain shortages. Since the projects scheduled to deliver in 2020 and 2021 were already in progress and close to completion, deliveries for those school years was largely unimpacted. However, according to RealPage, Inc., as of October 2021, there are approximately 27,000 beds scheduled to deliver in time for the fall 2022 school year. Although supply numbers are subject to change until actual delivery, it appears that the next school year will feature among the lowest amount of new supply delivered to the sector in quite some time. According to research from real estate data vendor John Burns Real Estate Consulting, the supply chain disruptions for lumber and windows have led to construction projects being delayed by at least two months. It is possible that many of fall 2022’s deliveries may be pushed out to deliver in spring 2023 or even fall 2023 due to supply chain disruptions.

Student Housing Fundamentals Seeing Record Improvements

Many student housing participants posit that the sector is recession-proof and, based on its performance over the past two years, many are now saying that the sector also appears to also be pandemic-proof. Although that’s certainly open to discussion, the performance of fundamentals for fall 2021 suggest the sector’s perseverance. Since many universities required students to be vaccinated, especially those living on campus – nearly 1,000 schools according to The Chronicle of Higher Education – this mandate has allowed off-campus student housing to seemingly return to normal and even out-perform the sector’s pre-pandemic results.

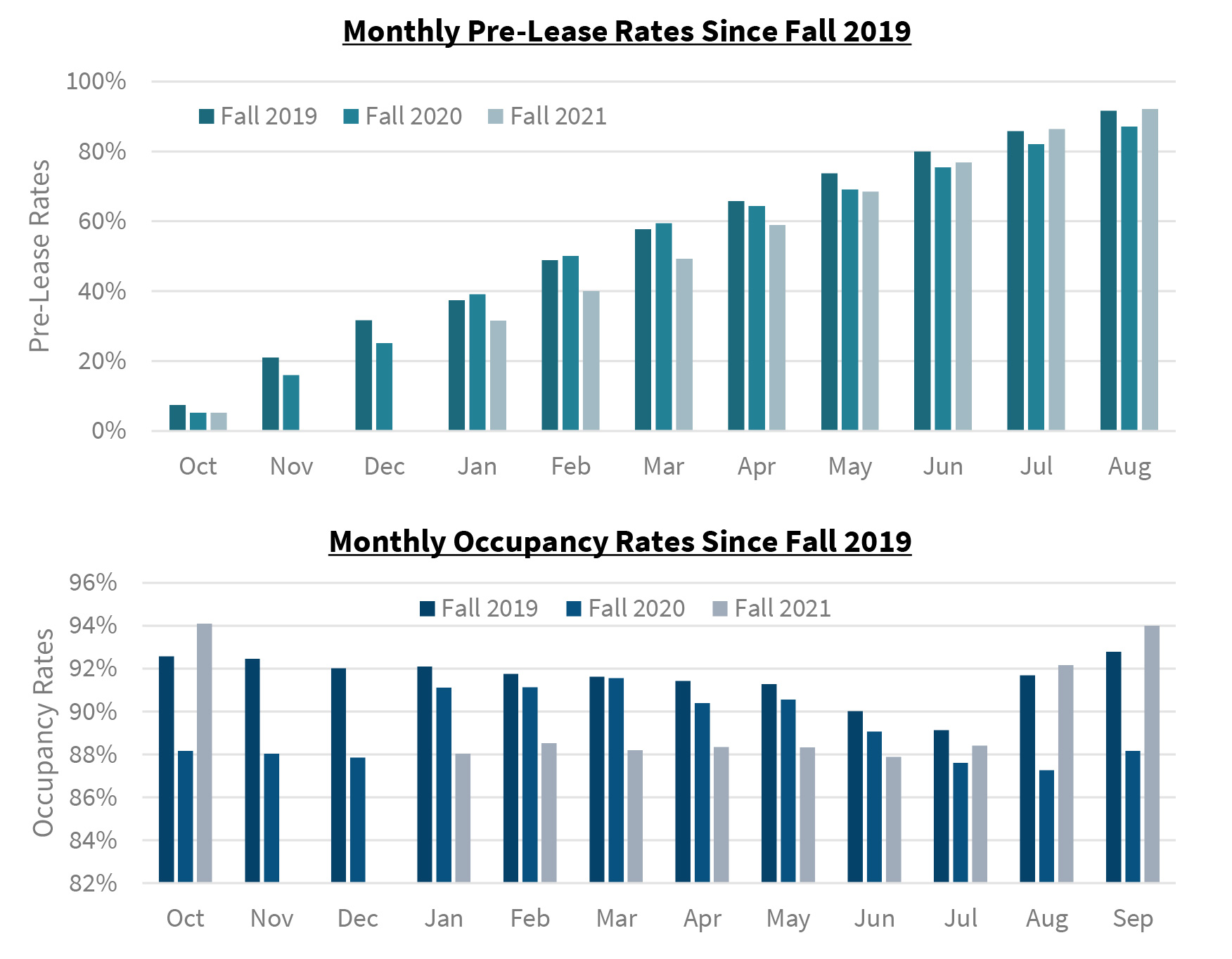

Occupancy levels were largely impacted by the virus in fall 2020 as remote-learning and declining enrollments played a significant part. As of September 2021, occupancy rates tracked by RealPage Inc. were approximately 94.1% compared to September 2020’s occupancy rate of 88.2% and September 2019’s rate of 92.8%. Occupancies are considered full at 90%. As a result of vaccination requirements, relaxed enrollment requirements, and pent-up demand, fall 2021 occupancy rates are at record-high levels.

Pre-leasing activity also improved by late summer, near the beginning of the actual school year. According to RealPage Inc., the final August 2021 pre-lease level was 92.2% compared to August 2020’s rate of 88.3% and 2019’s rate of 91.5%. It wasn’t until the late summer months of 2021 that pre-leasing activity gained steam; from October 2020 through June 2021, pre-leasing activity briefly lagged behind 2020’s levels as students waited to see what the plans would be for the upcoming school year.

Declining Population Coupled with Declining Enrollments

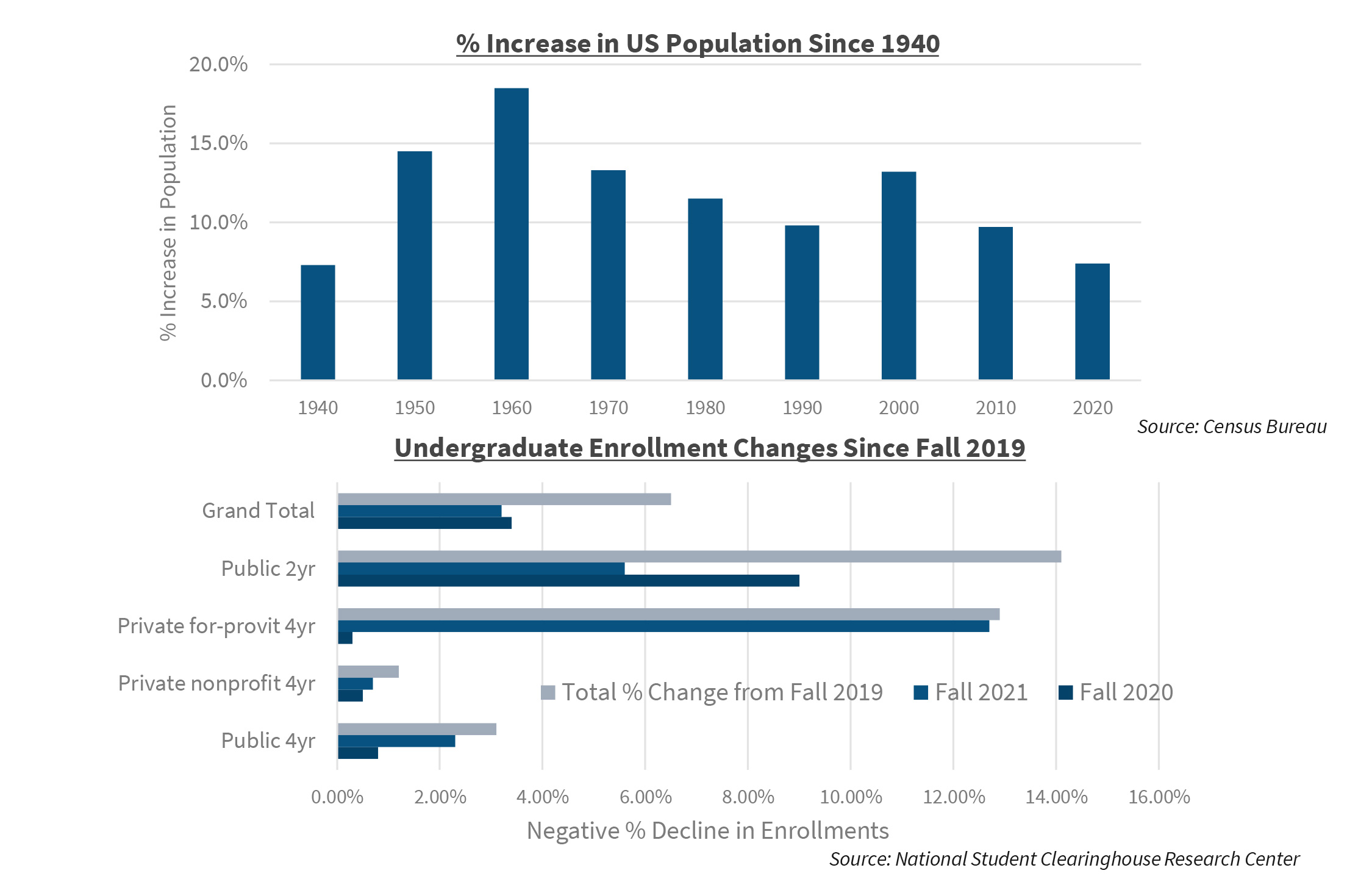

Although the student housing sector has benefited from tailwinds, headwinds consist of declining enrollment trends over the next several years. According to the National Student Clearinghouse, as of fall 2021, total undergraduate enrollment had declined by 3.2% year over year. Although this was a slight improvement over fall 2020, when enrollments decreased by 3.4%, this is now the eighth consecutive year in which overall undergraduate enrollments have declined.

Furthermore, international student enrollment has also been greatly impacted by the arrival of COVID-19. According to the Institute of International Education, during the school year that began in fall 2020, international student enrollment decreased by approximately 16% compared to the prior school year. Additionally, more than 40,000 international students who were accepted into US institutions deferred their fall 2020 enrollments as a result of travel restrictions, virus protocols and uncertainty due to COVID-19.

According to 2020 Census data, the US population grew at its slowest rate in nearly 80 years, with a population growth rate of 7.4% for the decade ended in 2020 compared to 9.7% for the decade ended in 2010 and 13.2% in 2000. Furthermore, the Center for Disease Control and Prevention reported that birthrates in the US declined by 4% in 2020, which was the sixth consecutive year of birthrate declines. Since the Millennial generation has transitioned into adulthood and has phased out of the primary age of attending college, the arrival of Generation Z (Gen Z) has brought potential headwinds to the student housing sector. Gen Z is less populous than the Millennial cohort and coupled with declining population growth, immigration trends, and birthrates, it appears that declining enrollments will continue over the long-term forecast. While fall 2021 returns have been positive for the student housing sector, there are many looming longer-term issues that the sector will need to address in the future.

Waiving Admissions Tests a Short-Term Fix?

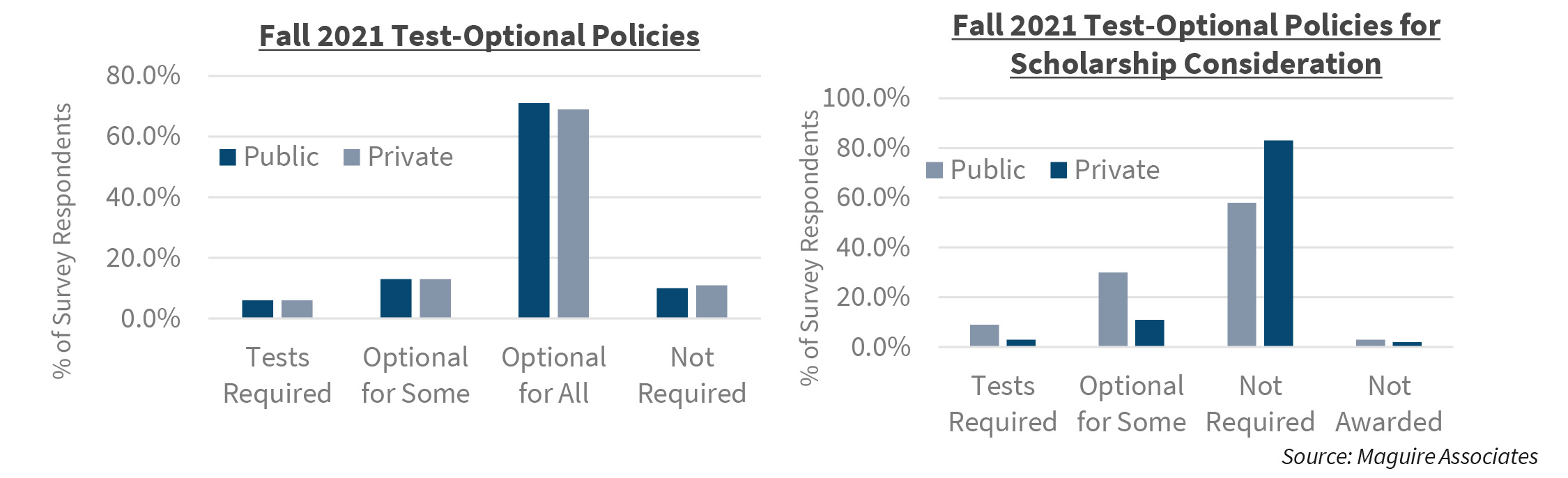

Although declining enrollments are not new to the student housing sector, it has been difficult to produce practical solutions that would help mitigate the annual enrollment declines. One solution that many colleges and universities adopted during the pandemic was to waive admissions tests (both SAT and ACT) requirements to entice more students to apply. Early returns from admissions offices around the country have produced positive results. According to The Los Angeles Times, the fall 2021 semester set a record high for college and university applications. Universities such as Colgate University, the University of California – Berkley, and the University of Pennsylvania saw their applications increase by 102%, 28%, and 34% respectively. Increasing the number of applications is a boon for colleges as it helps increase revenues for the university since college applications have a fixed cost. Furthermore, an increase in applications is also a boon (if it leads to increased enrollments) for off-campus student housing operators. At many colleges and universities, on-campus housing has a finite number of beds for freshmen and underclass students. If more institutions are accepting more students, students will need places to stay and that bodes well for boosting the occupancy rates for off-campus student housing properties where there are fewer requirements regarding who can live there.

Even though waiving testing requirements increased applications at both public and private intuitions, there is some nuance that accompanied the relaxed requirements. For the fall 2021 school year a survey was conducted by Maguire Associates, a market research group that provides enrollment data to colleges and universities. The survey centered around the testing policies for more than 250 public and private higher education institutions. The survey found that nearly 20% of both private and public institutions still required some form of testing, depending on a student’s field of study. When considering scholarships, that number doubled to nearly 40% of institutions requiring test scores depending on field of study. Overall, the survey revealed that test scores were mostly optional for both types of four-year institutions; however, it is unclear how long these protocols will stay in place. Furthermore, it is also unclear whether an increase in applications has led to an increase in enrollments, and institutions have not committed to waiving test scores beyond the fall 2023 school year.

Short-Term Boon, Long-Term Headwinds

The off-campus student housing sector has largely emerged from the pandemic and achieved performance levels that bested pre-pandemic highs. Both occupancies and pre-lease rates are nearly as high and full as they can be, which bodes well for the sector. Supply being delivered to universities has continued to moderate and is on track to be the lowest amount in more than a decade for the fall 2022 school year. Higher education institutions have also had to produce new ways to mitigate the declining enrollments that the sector has faced for the last several years. Although overall undergraduate enrollments still contracted in fall 2021, the rates of contraction were slightly improved compared to fall 2020. The slight improvement in enrollments suggests that schools waiving test requirements and accepting more applications may have had a slightly positive effect in the short term. However, potential headwinds include a dwindling applicant pool as the overall US population growth rate is at its lowest point in nearly 80 years and birthrates in the country have declined for the fourth consecutive year. Coupled with a large decrease in international enrollment, if creative solutions that maintain the current pace of enrollments don’t come about then the student housing sector will have to also adjust to the new reality.

Francisco Nicco-Annan

Lead Economist

Fannie Mae Multifamily Economics and Strategic Research

November 9, 2021

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Economic and Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.