While there has been some easing in occupancy among Age-Restricted Multifamily Affordable Housing subsidized with Low-Income Housing Tax Credits (LIHTC), the affordable segment has fared much better than the closest comparable market rate segment: the Seniors Housing Majority Independent Living (IL) segment. According to recent data from the National Investment Center for Seniors Housing & Care (NIC), occupancy rates at Majority IL properties have fallen an estimated 2.6% since the start of 2020. By contrast, CoStar estimates that the average occupancy rate across Age- Restricted Affordable Housing subsidized with LIHTC and subject to rent restrictions has fallen by just under half of a percent over the same time period. The steady nature of this type of rent-restricted housing for seniors likely reflects the fact that, even in a pandemic, low-income seniors have fewer options for housing. As a result, this segment’s fundamentals are not expected to soften significantly in the coming months.

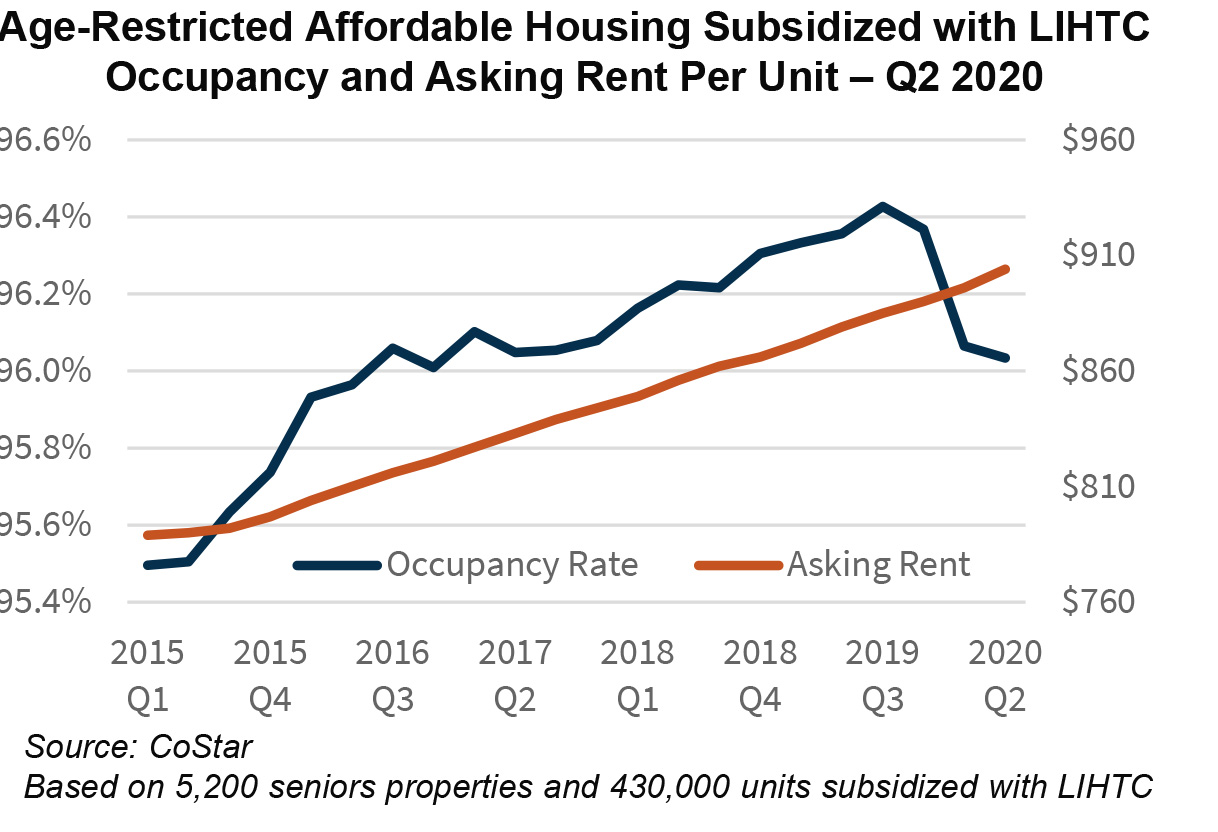

Occupancy Trends

According to Moody’s Analytics REIS, the average occupancy rate for Age-Restricted Affordable Housing subsidized with LIHTC was 98.4% as of the end of Q2 2020, remaining unchanged from Q1. However, CoStar showed slight softening of occupancy in Q2 2020, with the average rate falling slightly to 96.0% from 96.1% as of Q1 2020 and 96.4% as of 4Q 2019. Even so, the decline in occupancy is relatively minor compared to Seniors Housing Majority IL, where the average occupancy rate declined by 2.4% in Q2 2020 alone, to a low 87.4%.

Asking Rent Trends

CoStar data shows that rents continued to grow in Q2 2020 for Age-Restricted Affordable Housing subsidized with LIHTC. CoStar showed that the average asking rent grew to $904 in Q2 2020 compared to $896 in Q1 2020. Over the past five years, CoStar data shows that rents have grown an average of 2.5% on average annually for this property type.

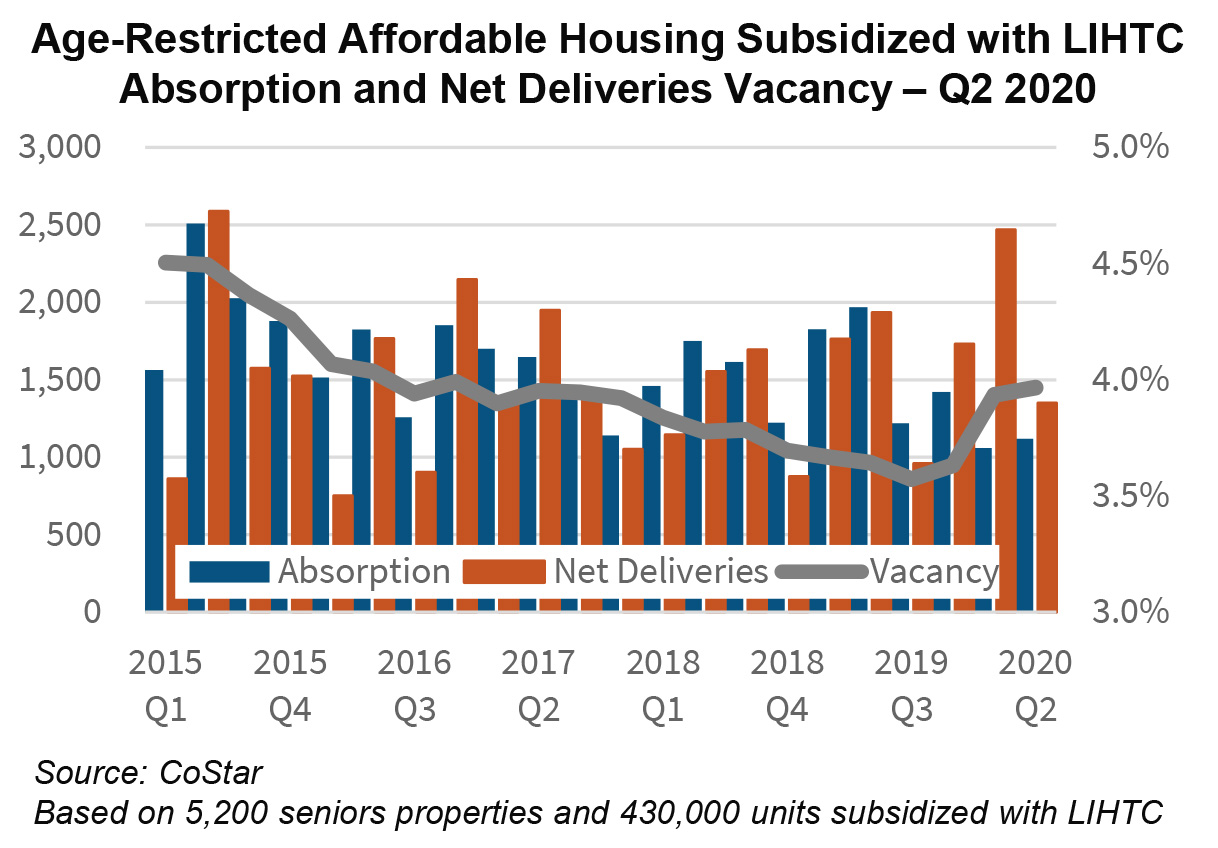

Absorption Trends

Deliveries outpaced absorption only slightly in Q2 2020 after strongly outpacing absorption in Q1. Deliveries of new Age- Restricted Affordable Housing units subsidized with LIHTC declined to just under 1,350 units in Q2 2019 compared to just under 2,500 in Q1 2020. By contrast, demand for these rent-restricted units affordable to seniors remained at about 1,100 units in both Q2 and Q1 2020.

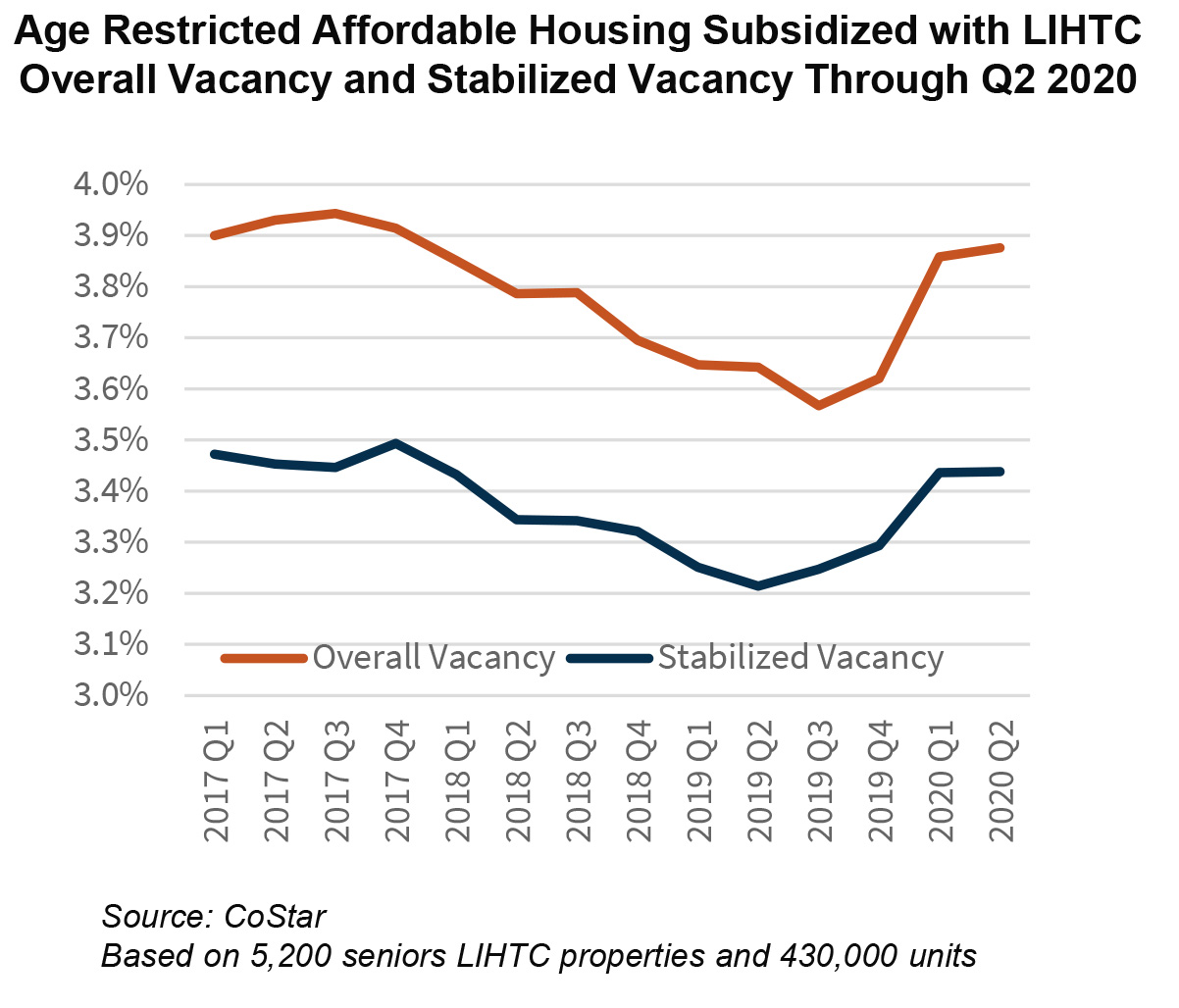

New Properties are Still Leasing Up

Affordable apartments are in great demand. In fact, 51.6% of units at new Age-Restricted Affordable Housing properties subsidized with LIHTC were pre-leased as of Q2 2020. In addition, through Q2, the pandemic does not appear to have had a significant effect on the lease-up for new apartment properties in this segment. As shown on the previous page, there was an ill-timed spike in new supply in Q1 2020. Even so, this caused the overall vacancy rate, which includes apartment properties leasing up, to rise by just 0.25% in Q1 2020 to about 3.9%, where it remained in Q2 2020. However, as shown on the adjacent chart, even with the slight increase since Q4 2019, the overall vacancy rate for apartments remains within 0.4% of the stabilized apartment vacancy rate, which excludes properties in a lease-up period.

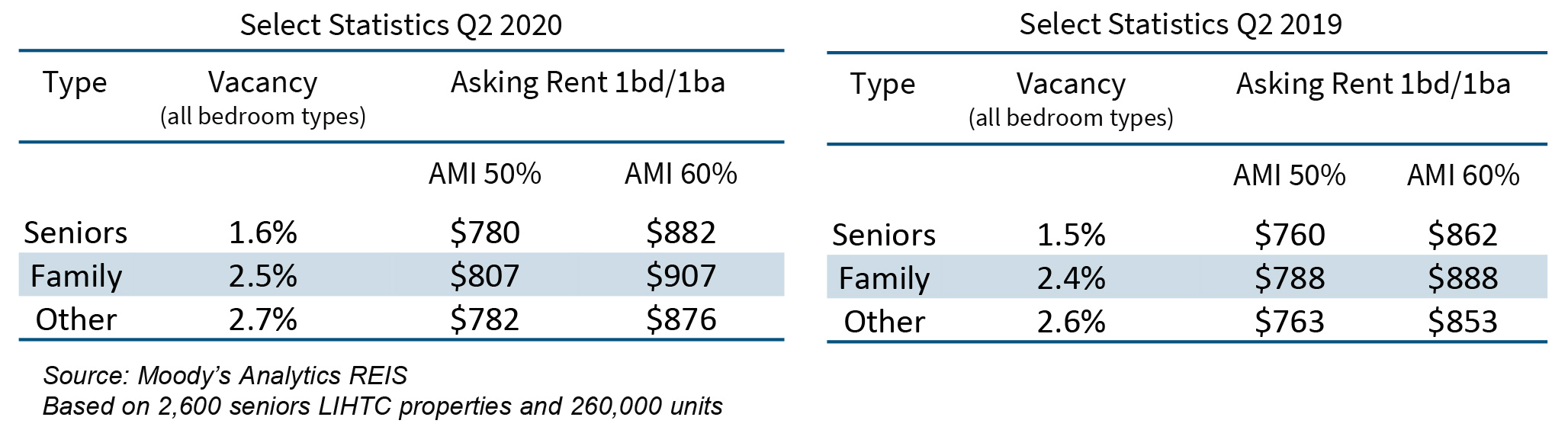

Moody’s Analytics REIS Data Shows Similar Trends

While provided in a different format, data from Moody’s Analytics REIS also shows similar trends for Age-Restricted Affordable Housing subsidized with LIHTC. The average vacancy rate across all seniors properties grew by just 0.1% year over year as of Q2 2020 to just 1.6%. Even so, the average vacancy rate for this segment remained almost 1% below the average vacancy rate for family-type multifamily affordable housing subsidized with LIHTC.

In addition, the average asking rent affordable to a senior household earning 60% of the area median income (AMI) for its location for a 1-bedroom/1-bathroom unit grew by about 2.3%, year over year, to $882 per month as of Q2 2020, as shown in the tables below.

Some Age-Restricted Affordable Housing Subsidized with LIHTC Has an Additional Cushion

Some Age-Restricted Affordable Housing properties are subsidized with LIHTC alone and may experience some volatility over the coming months. However, according to recent survey data from the National Council of State Housing Finance Agencies, just over one-quarter of multifamily units subsidized with LIHTC, including seniors properties, are also subsidized with Project-Based Section 8 contracts. This ensures that a renter household spends no more than 30% of household income on rent and utilities. In addition, seniors generally have a steady source of income such as social security. We believe this, coupled with the lack of affordable options for low-income seniors, indicates that Age-Restricted Affordable Housing properties subsidized with LIHTC should remain relatively stable over the coming months despite the pandemic.

Tanya Zahalak

Senior Multifamily Economist

Multifamily Economics and Research

August 2020

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Multifamily Economics and Research Group (MRG) included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the MRG bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changes in the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the MRG represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.