National multifamily market fundamentals, which include factors such as vacancy rates and rents, have been negatively impacted throughout second quarter 2020 by the COVID-19 pandemic, which began impacting most local economies in mid-to-late March 2020. The softening of multifamily demand due to increasing unemployment and economic uncertainty has resulted in a weakening of occupancy and rental growth over the past three months.

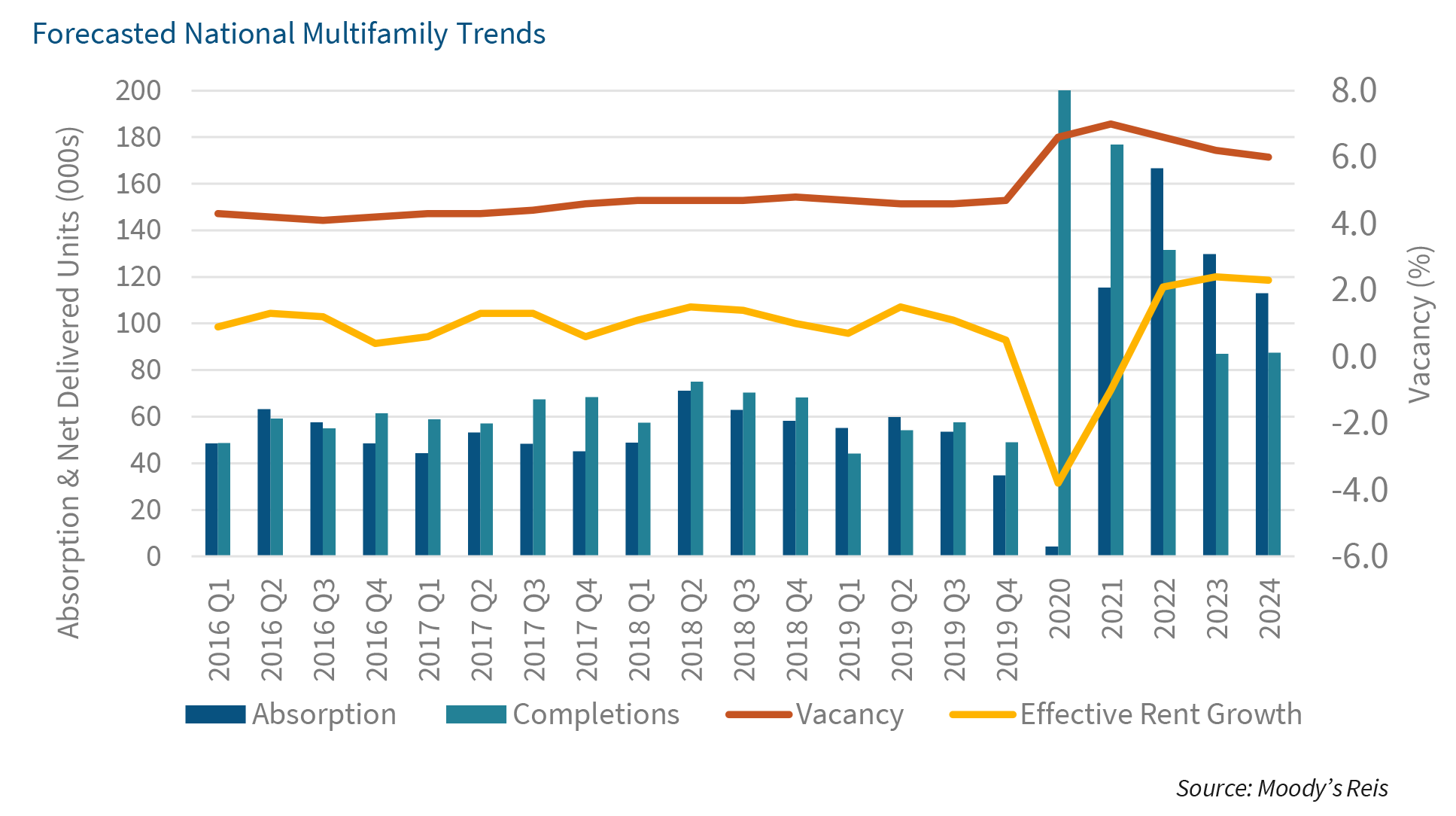

We expect the multifamily sector to be negatively impacted in 2020 from rising vacancy rates, as well as declining or negative rent growth, due to the economic dislocation resulting from the COVID-19 pandemic, as illustrated in the chart below.

Multifamily Vacancy Expected to Remain Elevated

The national multifamily vacancy rate is expected to rise in 2020 despite the recent stay-at-home orders that were put in place in many metros over the past few months. Completions are expected to outpace demand, as illustrated in the chart above. The decline in multifamily demand is likely primarily due to negative job growth and future employment uncertainty, thereby dampening new rental household formations just as completions are expected to peak this year. As a result, we anticipate that the U.S. multifamily vacancy rate could rise to an estimated range of between 6.0 percent and 6.25 percent by year-end 2020, from the current estimated 5.75 percent.

Rent Growth Expected to Decline

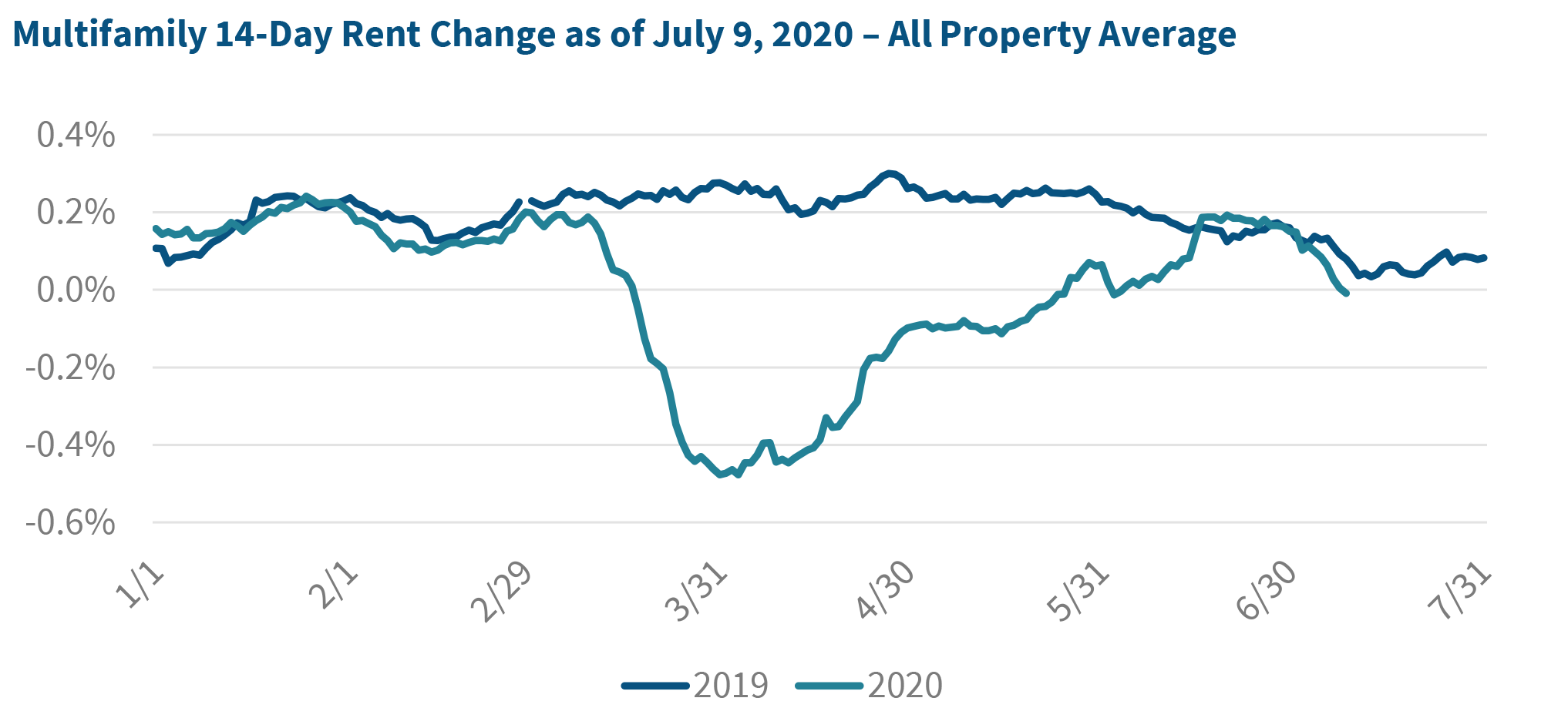

Rent growth was positive in first quarter 2020 and is estimated to have been 0.5 percent quarter over quarter. However, since then, trends appear to indicate a curtailment in rent growth, as seen below.

Rent growth was likely negative in second quarter 2020, at an estimated negative 0.25 percent, taking back part of the increase from a quarter earlier. We expect that the negative rent growth trend will continue into the second half of the year, resulting in an estimated 1.0 percent to 1.5 percent decline in rents for 2020.

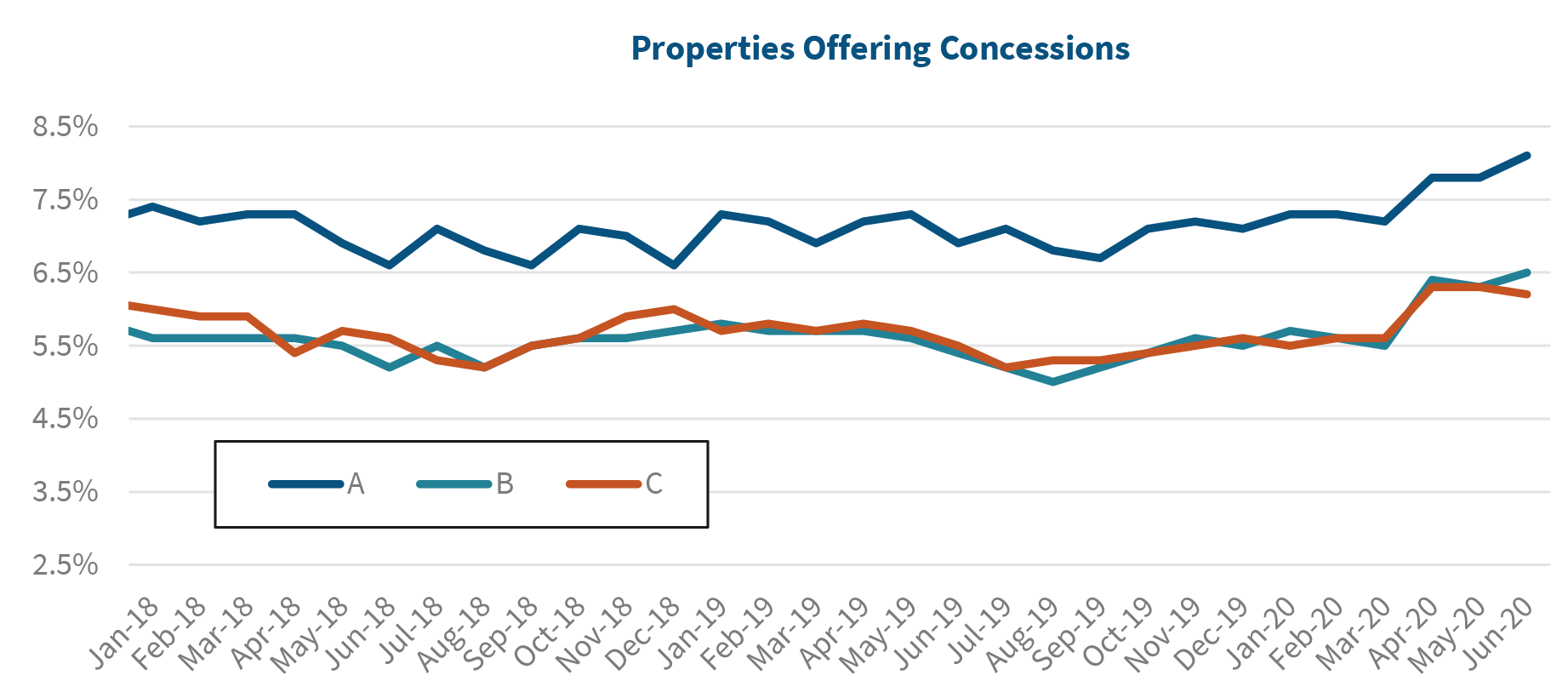

Concessions Up but Stabilizing

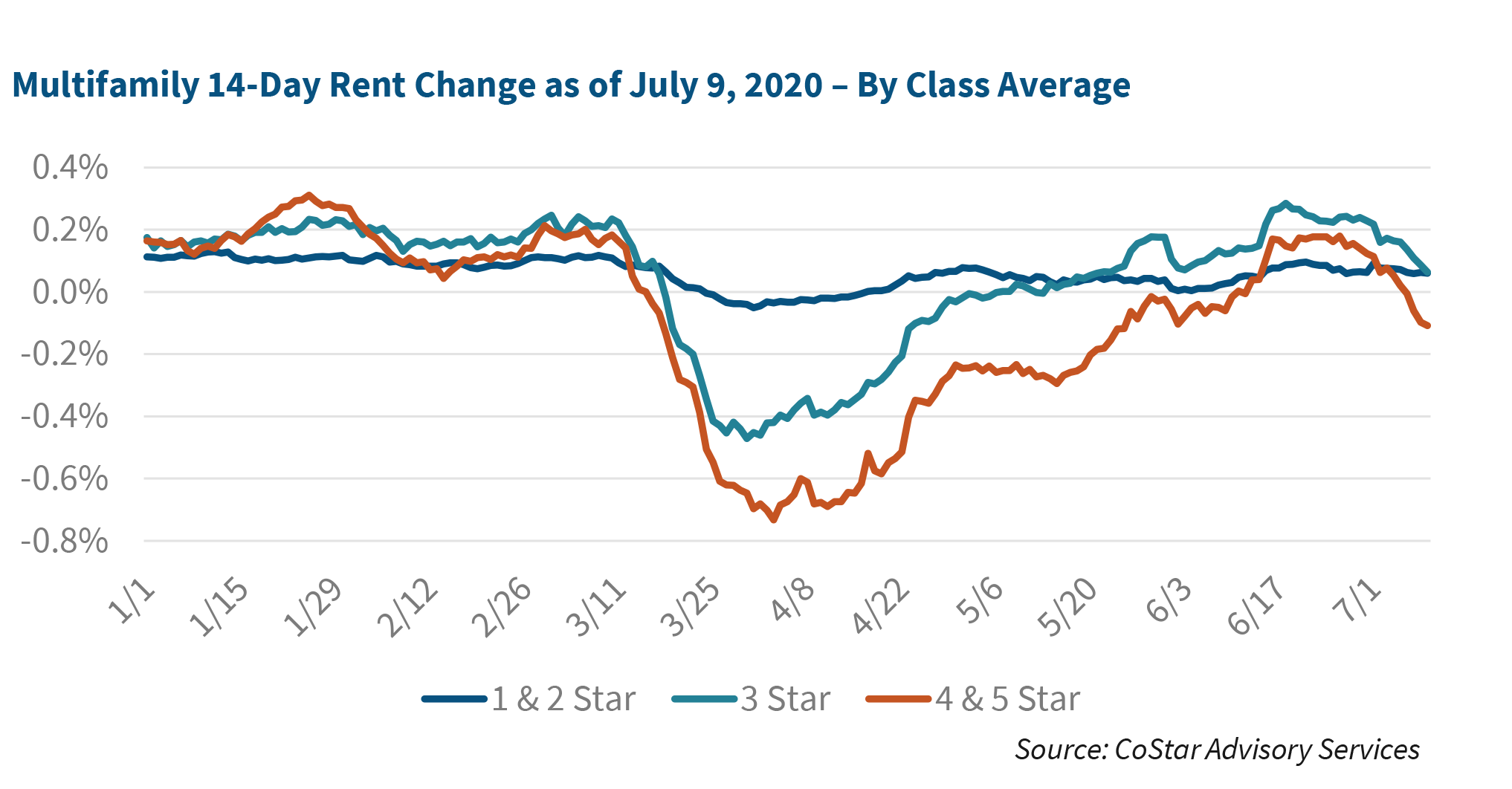

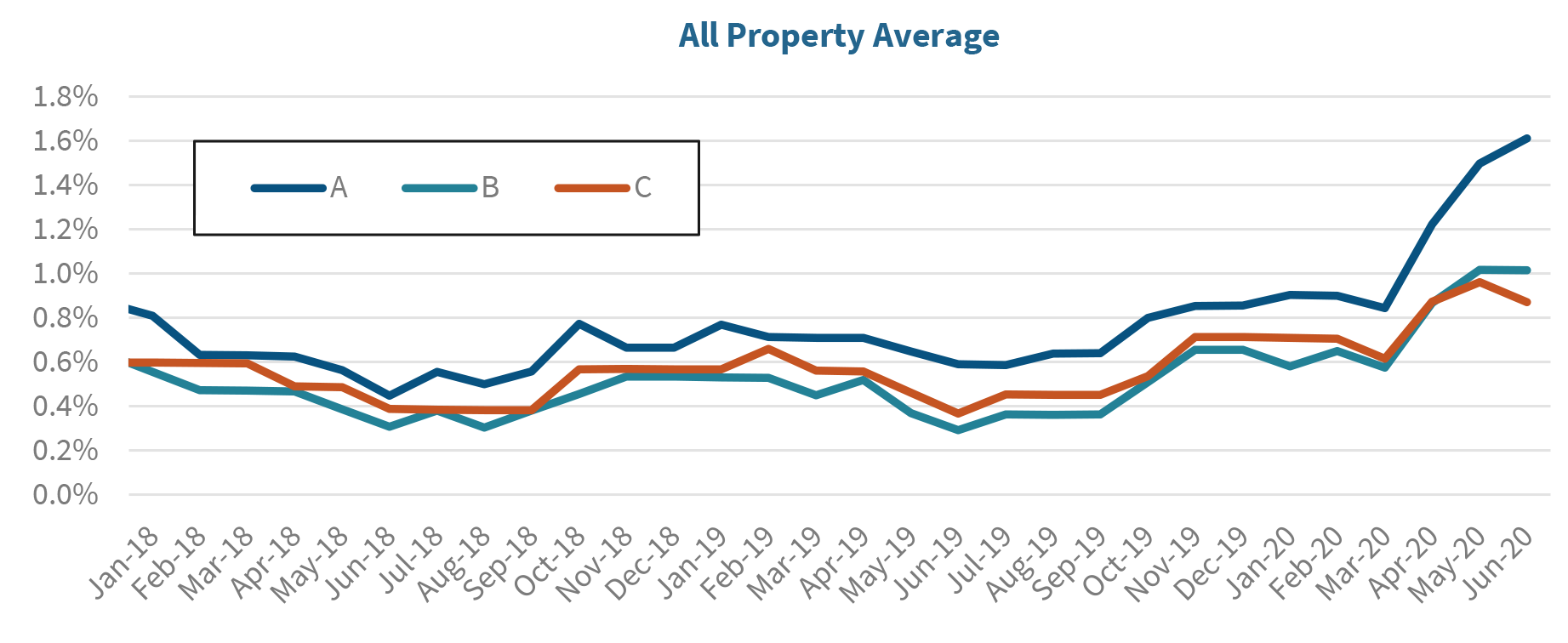

Although rent growth trends appear to differ by class, as seen in the charts on the previous page, national multifamily concessions for all property classes have risen over the past few months, as seen in the charts below. As of second quarter 2020, 25.5 percent of all multifamily units are offering concessions, according to data from RealPage, Inc., with the average concession rate at 4.1 percent.

Class A concession levels remain higher than for class B and C units, indicating that property owners are likely offering more generous concessions upfront for newer class A units due to increasing competition from new completions. For those class A units offering concessions, the average concession rate as of June 2020 was 8.1 percent, or nearly a month’s free rent. And it was slightly more than three weeks of free rent for those properties offering concessions on class B and C units, at 6.5 percent and 6.2 percent, respectively, reflecting the ongoing demand for more affordable multifamily rental units.

National Concession Rates by Class

Negative Net Absorption Expected to Be Short Lived

Demand for multifamily rental units has slowed and could result in negative net absorption for the second half of 2020. Net absorption is estimated to have totaled about 317,000 units last year, according to data from CoStar Advisory Services, Inc., which was down compared to 2018’s estimated 366,000 units absorbed. Net absorption for the first half of 2020 is estimated at 118,000 units, according to CoStar, but is expected to turn negative for the second half of the year, at an estimated negative 34,000 units. Despite the precipitous decline during the third and fourth quarters, the total year’s net absorption is expected to remain positive, but at just 84,000 units, according to CoStar.

New Executed Leases on the Rise

Although new multifamily leasing activity plunged at the end of March, the trend has reversed itself and has been on the upswing since the beginning of April. As seen in the chart below, based on leasing data from RealPage, new leases have increased week-over-week since April 4 and were at a year-over-year increase rate of just above 10% during the first week of July. In contrast, lease renewals peaked in April at a nearly 30 percent year-over-year increase, but recently that trend has moderated and fallen into negative territory over the past few weeks. This trend suggests that multifamily tenants are increasingly becoming more mobile and appear to be taking advantage of the lifting of stay-at-home orders over the past few weeks to move into new units.

Interestingly, lease renewals are stickier for class B and C units as opposed to class A units. According to data from RealPage, year-over-year lease renewals for class A units as of June 2020 were at 48.4 percent. But for class B units the renewal rate was higher, at 54.1 percent, and even slightly higher for class C units, at 58.2 percent.

Year-over-Year Change in Multifamily Executed Lease Signings

Multifamily Investors Remain Interested

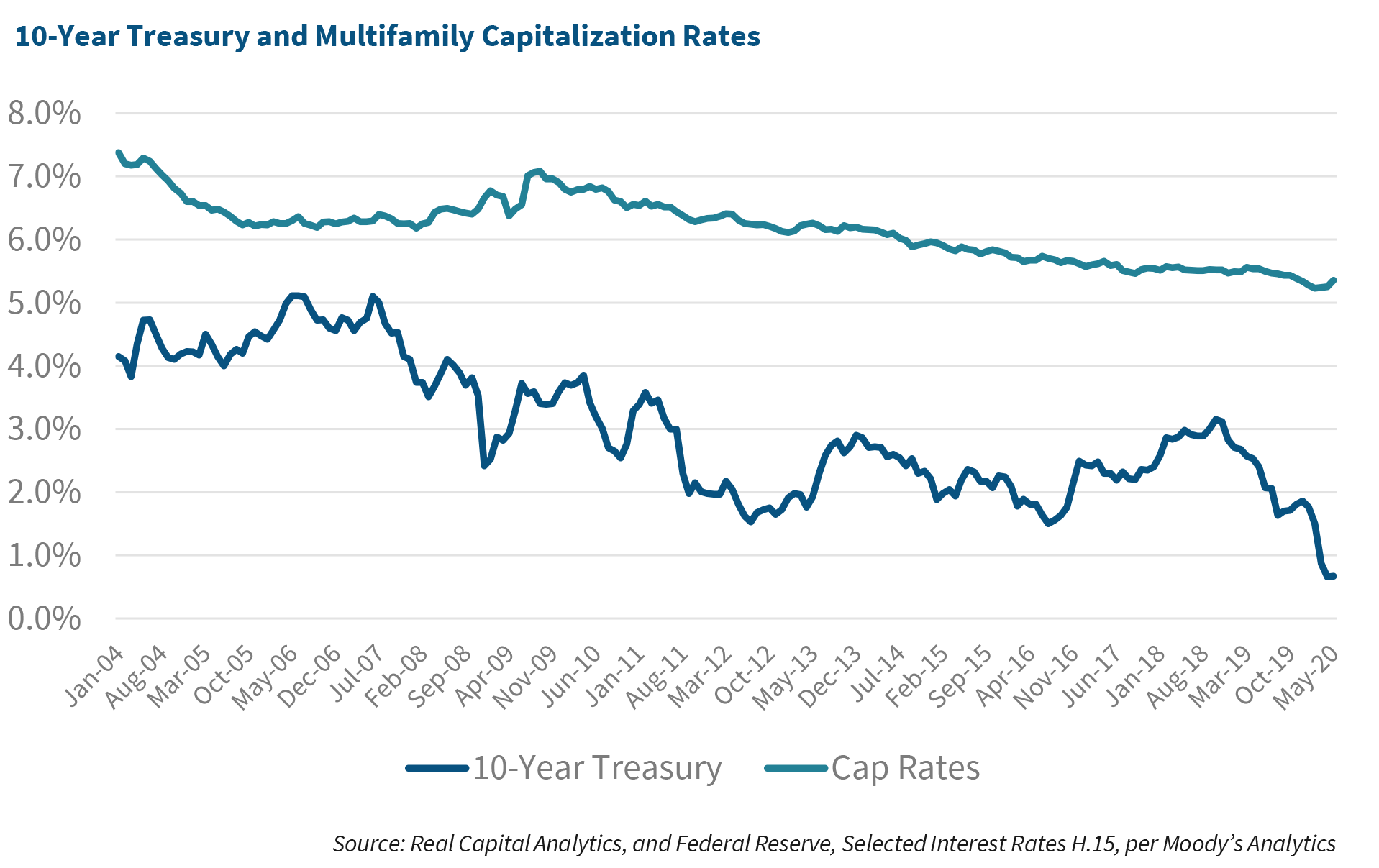

Multifamily sales are expected to see a significant decline from last year’s $186 billion. As an example, in 2009, multifamily property sales declined 60 percent year over year. Year to date through May 2020, multifamily property sales totaled only about $47 billion compared to $67 billion for the same time period last year, according to data from Real Capital Analytics. Based on recent transaction trends, multifamily property sales could total less than $150 billion in 2020.

Despite expecting a significant pullback in sales, we are not anticipating a significant spike in multifamily capitalization rates this year. It seems unlikely that sellers will go ahead and sell into a slowing market if they are not forced to sell. According to data from Real Capital Analytics, cap rates through May 2020 remained stable, ending the month at 5.4 percent. As a result, we expect cap rates to remain fairly stable for the rest of year, perhaps rising to 6.0 percent or higher if the economic recession continues late into the year. By comparison, multifamily cap rates last peaked at 7.0 percent in 2010.

Nevertheless, investors appear to remain interested in multifamily, and there are still reports of investors reaching out to brokers looking for potential “motivated seller” deals.

2020 Multifamily Mid-Year Outlook: Expected Turbulence Ahead

Our outlook for the multifamily sector in 2020 has taken on a more moderated stance. We expect the multifamily sector to be impacted in 2020 and possibly into early 2021 from rising vacancy rates and declining and negative rent growth, but overall we expect the sector to weather the storm better than other commercial real estate property types, most notably retail and hospitality.

Multifamily rent collections have held up well for professionally managed properties, according to data from the National Multi-Housing Council’s rent tracker, but there may be dark clouds on the horizon. With the $600 weekly unemployment insurance benefit expansion set to expire at the end of July, there are concerns that rent collections could be negatively impacted starting in September. Furthermore, if additional outbreaks continue and local economies endure rounds of additional shutdowns, multifamily fundamentals, as well as property values and cap rates, could remain stressed well into 2021.

On an optimistic note, there are recent reports that Congress is working to extend economic aid to the general public soon. One possibility is another one-time stimulus payment. The other is a modified version of an extension of the enhanced unemployment insurance benefits, but possibly at a lower dollar amount than the current level. A continuation of these type of transfer payments would likely assist many renter households in making their rental payments over the coming months. And that could be enough of a lift to get the multifamily sector through the worst of the economic recession this year relatively unscathed.

Kim Betancourt

Director of Economics

Tim Komosa

Economist Manager

Multifamily Economics and Research

July 2020

Opinions, analyses, estimates, forecasts, and other views of Fannie Mae’s Economic and Strategic Research (ESR) Group included in these materials should not be construed as indicating Fannie Mae’s business prospects or expected results, are based on a number of assumptions, and are subject to change without notice. How this information affects Fannie Mae will depend on many factors. Although the ESR Group bases its opinions, analyses, estimates, forecasts, and other views on information it considers reliable, it does not guarantee that the information provided in these materials is accurate, current, or suitable for any particular purpose. Changesin the assumptions or the information underlying these views could produce materially different results. The analyses, opinions, estimates, forecasts, and other views published by the ESR Group represent the views of that group as of the date indicated and do not necessarily represent the views of Fannie Mae or its management.